- Wall Street’s main indexes opened mixed on Friday.

- S&P 500 Energy Index is down more than 2%.

- Tech shares help Nasdaq Composite trade in the positive territory.

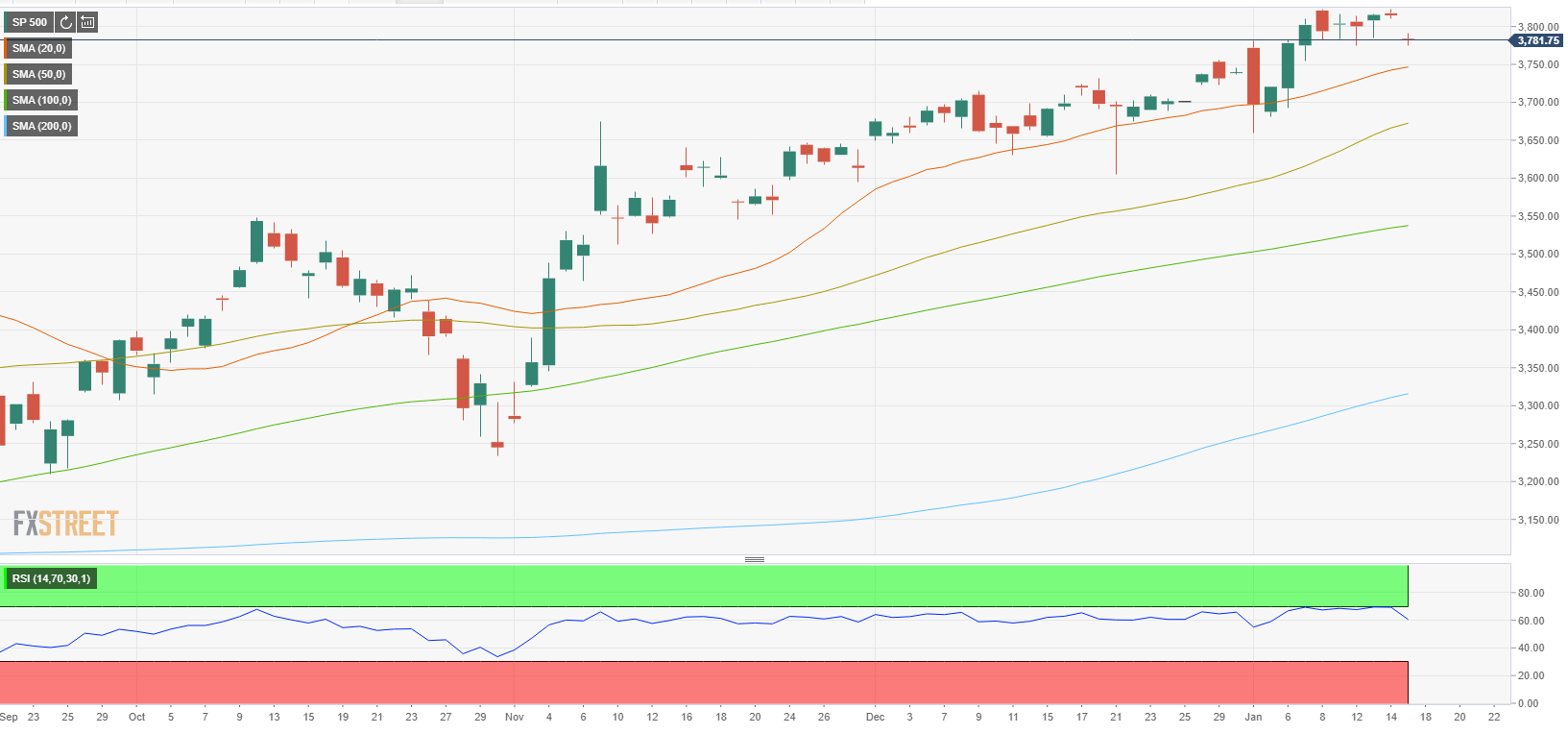

Major equity indexes in the US started the last day of the week mixed as investors assess President-elect Joe Biden’s coronavirus relief plan and the latest macroeconomic data releases from the US. As of writing, the Dow Jones Industrial Average was down 0.65% on the day at 30,788, the S&P 500 was losing 0.33% at 3,782 and the Nasdaq Composite was up 0.2% at 12,924.

Late on Thursday, Biden announced that the recovery plan will be worth around $1.9 trillion and include $2,000 direct payments to Americans.

On Friday, the US Census Bureau reported that Retail Sales in December declined by 0.7%. On a positive note, the Federal Reserve’s monthly publication revealed that Industrial Production expanded by 1.6%.

Among the 11 major S&P 500 sectors, the Energy Index is losing 2.4% pressured by a more-than-1% decline in crude oil prices. On the other hand, the Communication Services and the Technology indexes both trade in the positive territory, helping the tech-heavy Nasdaq Composite edge higher.