- Wall Street’s main indexes opened higher on Wednesday.

- Investors don’t seem to be paying attention to mixed US data.

- All major sectors of the S&P 500 trade in the green.

Major equity indexes in the US opened higher in light pre-holiday session as risk flows continue to dominate the financial markets. Despite the mixed macroeconomic data releases from the US, the CBOE Volatility Index (VIX), Wall Street’s fear gauge, is down more than 3% to reflect the upbeat market mood.

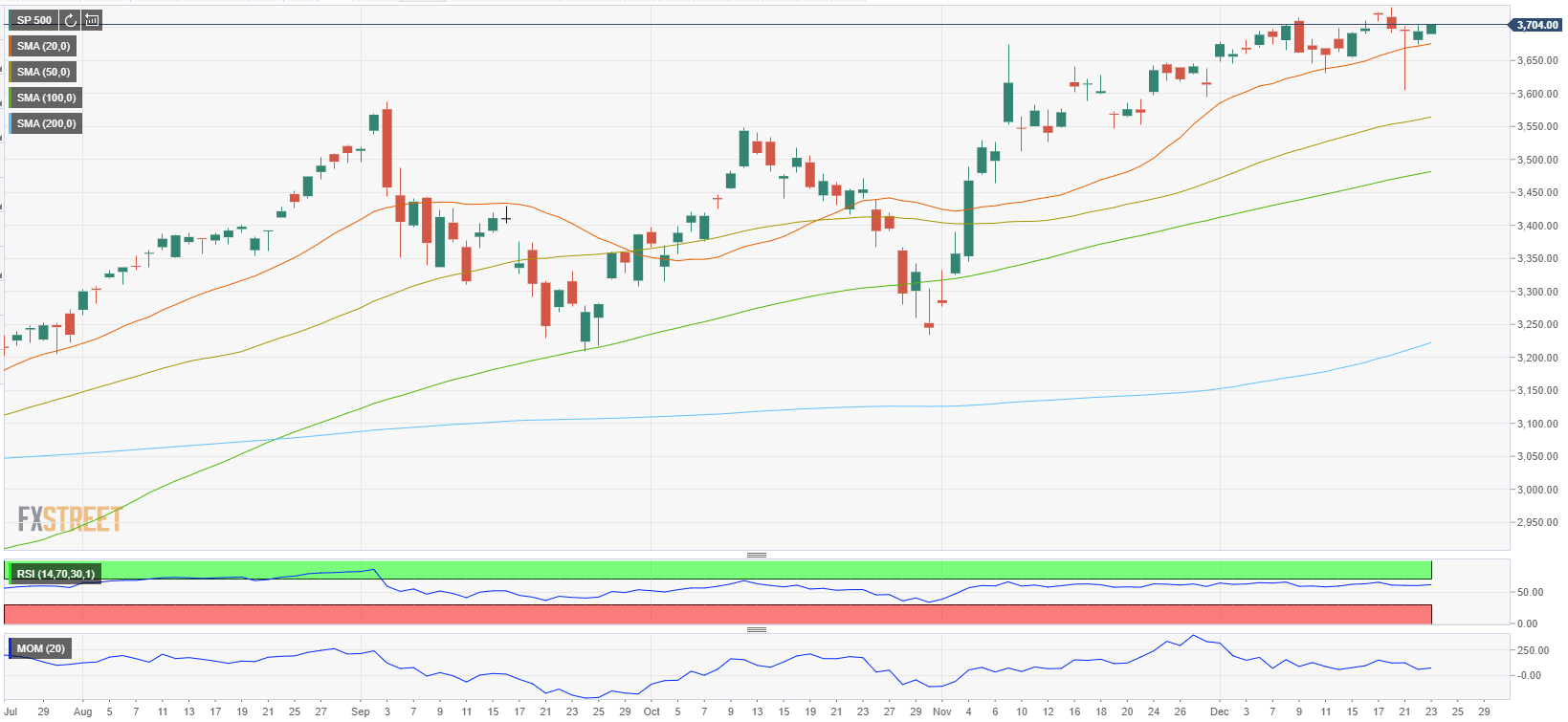

As of writing, the Dow Jones Industrial Average was up 0.56% on the day at 30,184, the S&P 500 was gaining 0.38% at 3,702 and the Nasdaq was virtually unchanged at 12,804.

Earlier in the day, the data from the US showed that the weekly Initial Jobless Claims declined by 89,000 to 803,000 last week and Durable Goodes Orders increased by 0.9% in November to beat the market expectation for an increase of 0.6%. On a negative note, the US Bureau of Economic Analysis’ publication showed that Personal Spending and Personal Income declined by 0.4% and 1.1%, respectively, in November.

Meanwhile, reports suggesting that the EU and the UK are closing in on a Brexit deal seems to be providing an additional boost to market sentiment.

All 11 major S&P 500 sectors trade in the positive territory after the opening bell with the Energy Index leading the rally with a gain of 1.6%.

S&P 500 chart (daily)