- Wall Street’s main indexes trade in the positive territory.

- Major brokers restrict trading in volatile stocks on Thursday.

- Upbeat US data seems to be helping market sentiment improve.

Major equity indexes in the US started the day decisively higher after suffering heavy losses on Wednesday. Upbeat macroeconomic data releases from the US and brokers’ decision to restrict trading in highly speculative and volatile stocks allowed risk flows to dominate the markets on Thursday. At the moment, the CBOE Volatility Index (VIX), Wall Street’s fear gauge, is down 18.8% on a daily basis.

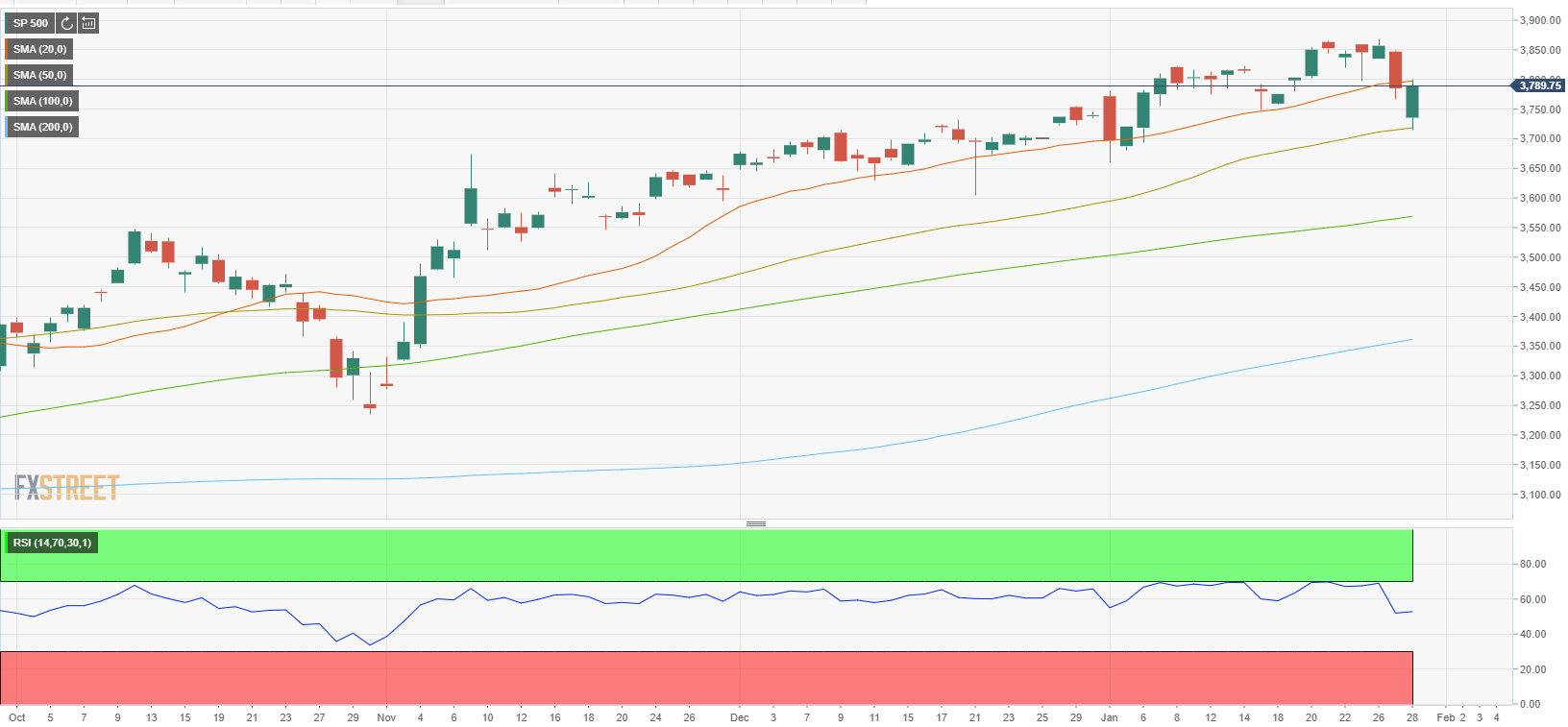

As of writing, the Dow Jones Industrial Average was up 0.7% on the day at 30,516, the S&P 500 was rising 0.66% at 3,775 and the Nasdaq Composite was gaining 0.32% at 13,152.

Earlier in the day, Robinhood and Interactive Brokers both announced that they will be raising margin requirements for certain stocks, including GME, AMC, EXPR and BB, while restricting trading in those stocks to the position closing only.

Meanwhile, the data published by the US Bureau of Economic Analysis revealed that the Real Gross Domestic Product (GDP) in the fourth quarter grew 4% as expected. Additionally, the US Department of Labor reported that Initial Jobless Claims declined by 67,000 to 847,000 last week.

Among the 11 major S&P 500 sectors, the Energy Index is up 2.15% as the biggest percentage gainer after the opening bell. On the other hand, the Consumer Discretionary Index is the only major sector in the negative territory, losing 0.15%.

S&P 500 chart (daily)