- Wall Street’s main indexes started the day modestly higher.

- Disappointing Retail Sales report weighs on market sentiment.

- Defensive sectors in the positive territory on Wednesday.

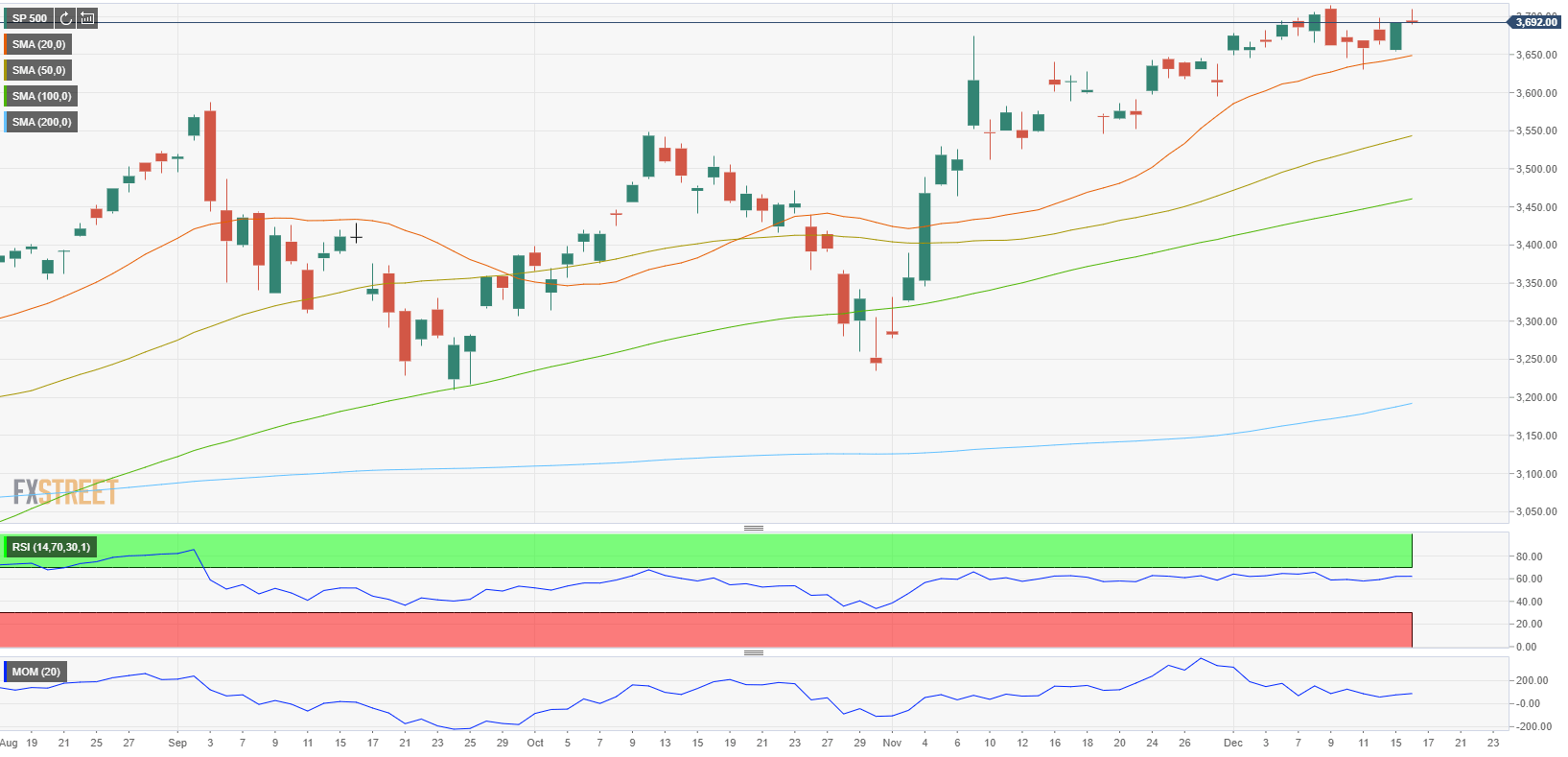

Major equity indexes in the US started the day slightly higher on Wednesday as investors await fresh developments surrounding US stimulus talks and assess the latest data from the US. As of writing, the Dow Jones Industrial Average was virtually unchanged on the day at 30,175, the S&P 500 was posting small gains at 3,698 and the Nasdaq Composite was up 0.04% at 12,601.

Earlier in the day, the data published by the US Census Bureau revealed that Retail Sales in November fell by 1.1% on a monthly basis. This reading came in worse than analysts’ estimate for a decline of 0.3% and weighed on the market sentiment.

Among the major S&P 500 sectors, the defensive Utilities Index and the Real Estate Index both gain around 0.6% to confirm the cautious market mood. On the other hand, the Energy Index is down 1% as the biggest decliner in the early trade.

Later in the session, the FOMC will release its Monetary Policy Statement and Economic Projections.