- S&P 500 looks overdue for a pullback, according to key options market metric.

- The anti-risk Japanese yen would draw bids if stocks drop.

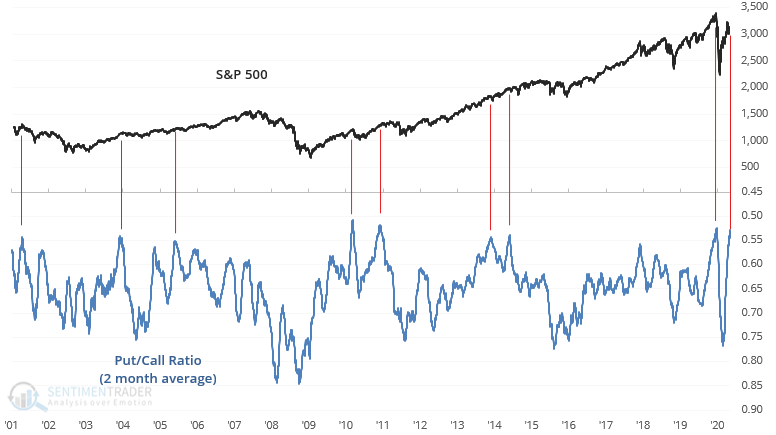

The two-month average of S&P 500’s put-call ratio has jumped to insanely high levels, which in the past, have led to pullbacks and corrections in the stock market, according to sentiment trader and strategist Troy Bombardia,

The put-call ratio refers to the proportion of all the put options or bearish bets and all the call options or bullish bets purchased on any given day, The metric is widely used to gauge investor sentiment.

As of Monday, the S&P 500’s put-call ratio was 0.56. “The last time this happened was before stocks crashed in February 2020,” Bombardia tweeted.

If the historical data related to the put-call ratio is a guide, the JPY crosses may be trading close to topping out. A stock market correction, if any, will likely strengthen the bid tone around the anti-risk Japanese yen, pushing JPY crosses lower.

At press time, USD/JPY is trading largely unchanged on the day at 107.34.