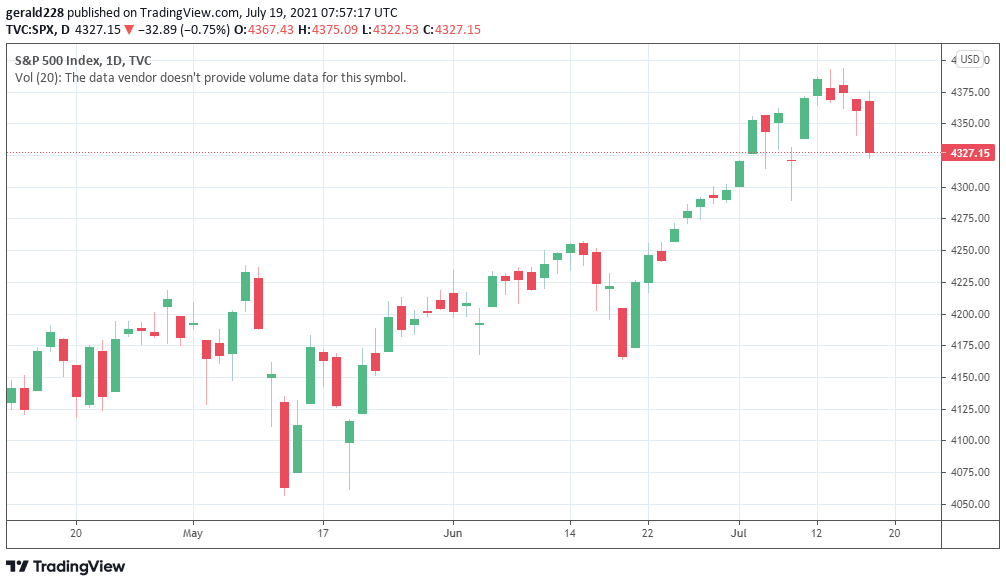

After having almost reached the critical $4400 level, the S&P500 price descended heavily on Friday and is expected to continue being bearish. The high inflation data has consistently tagged onto the index and as fears of rising Covid19 cases and other threats to reopening materialize, investor sentiment has turned bearish.

Of course, this could be a temporary blip, but a strong 0.75% drop on Friday could be the indication of further bleeding this week. Job openings remain at record highs but employers are struggling to find workers to fill them. This could be another drag on the S&P500 price. If you still haven’t started trading in stocks, it would be a good idea to take a look at the Top Forex Brokers.

Short Term Forecast For The S&P500 Price: A Grim Week Ahead

After reaching the $4388 level on July 12, the S&P500 price declined for four straight consecutive sessions to settle at the $4327 mark. Although FED Chair, Jerome Powell was measured in his remarks on inflation, this did little to calm investors’ jitters as the decline in stocks was sharp.

The S&P price could be seeing some further declines in the next few days before it resumes its upward trend. President Bide was scathing about anti-vaccine misinformation on social media as the number of cases amongst unvaccinated Americans continues to rise.

This could throw reopening plans into turmoil and stock prices with it.

Positive news from the retain side has failed to ignite investor interest however. Retail sales were up by around 0.8% in June when compared to May but investors continue to be worried about rising inflation.

Consumers are feeling the pinch as real estate prices continue to rise. Cars and other durable goods are also on the increase. There has also been a considerable decrease in the University of Michigan’s consumer sentiment index. This fell to 80.8 in the first half of July when compared to June’s 85.5.

Long Term Forecast For S&P: Still Bullish Although Less Than First Half of Year

The S&P500 price is still expected to be bullish over the rest of the year. Of course, the economic recovery is a crucial part of this and if there is another resurgence in Covid cases as well as hospitalizations, this could continue to drag on the economy. Economic growth is expected to continue, although at a slower pace in 2022.

After three weeks of solid gains, all major markets are in a slight correction period. This could mean further falls as profit taking takes place. Overall the long term picture still seems positive for the S&P500 price.

Looking to trade forex now? Invest at eToro!

[su_buttonurl=”https://www.forexcrunch.com/visit/etoroforexnews” style=”3d” background=”#1d44bb” size=”8″ center=”yes” radius=”0″]Trade Forex Now![/su_button]67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.