- S&P500 price appears to be heading for a bearish few days

- Situation in Afghanistan still to sink in for global financial markets

- Inflation and huge rise in Covid19 cases in Texas and Florida continues to hamper recovery.

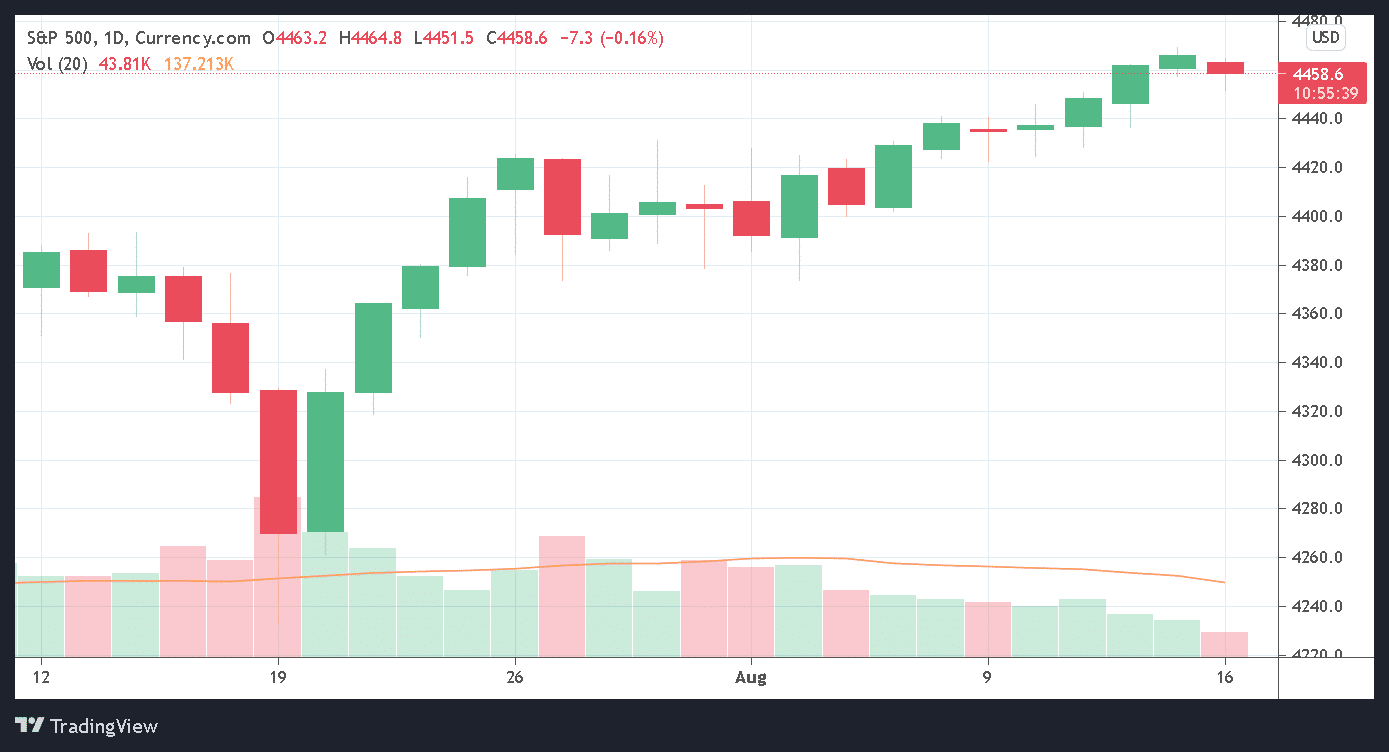

The S&P 500 price appears to be heading for a bearish few days after having reached new All Time Highs last week. The SPX500 rose to 4465 on Friday but is back to the 4459 level this morning as the instability regarding the Afghanistan situation begins to bite.

Although high inflation and a considerable rise in Covid19 cases in various Southern states continues to hamper economic recovery, the S&P price is undoubtedly going to feel the effects of the Taliban takeover of Afghanistan. With China already making moves on the diplomatic front, this international instability will undoubtedly have investors in jitters.

If you haven’t yet started trading forex then have a look at this Beginner’s Guide To Forex Trading.

Short Term Prediction For S&P 500 Price: A period of bearish pressure?

As the international situation continues to deteriorate, investor sentiment is undoubtedly slightly troubled. As the domestic situation in the US also turns slightly opaque, we could be in for a few bearish days for the SPX 500.

The S&P 500 price was at an all-time high on Friday as investors digested weaker than expected economic data. With the preliminary consumer sentiment index down to 70.2 in early August from 81.2 in July, there are also signs that the economic recovery may be slowing. The University of Michigan also reported that losses were spread across several different demographic subgroups and regions.

On the plus side, the stock market may be rather hesitant to make moves as a rapid deterioration in consumer sentiment may also halt the Fed’s projected tapering off of economic benefits. Wednesday’s FOMC meeting will also be looked at quite closely. US Retail Sales data will also be an interesting development later on this week.

The S&P 500 price is expected to trade sideways this week with very little price movement and a tight trading range. If you haven’t started trading forex yet, have a look at these Top Forex Brokers.

Long Term Prediction For SPX500: Still Bullish Over The Long Haul

With Chinese retail sales and industrial production figures coming in at less than affected, Asian Pacific investors will be looking for bargains. The measures taken to curb the Delta variant in China and the floods in Henan province are also factors to be taken into account.

Investors also continue to be concerned with Beijing’s recent crackdown on a number of private sectors but easing of POBC expectations has also grown. Asia Pacific investors may be looking to US stocks to bolster their holdings.

Over a long-term basis, the S&P 500 price managed to breach the key resistance level of 4290 with the path to higher prices now seemingly assured. The overall bullish trend remains there with the Ascending Channel continuing to dominate. The next resistance is to be found at the 4650 level with some pullbacks along the way where support can be found.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.