- Non-Farm Payroll Report gave S&P500 Price A Considerable Boost

- Covid19 fears still affecting the markets

- Will high inflation be a worry in the weeks and months ahead?

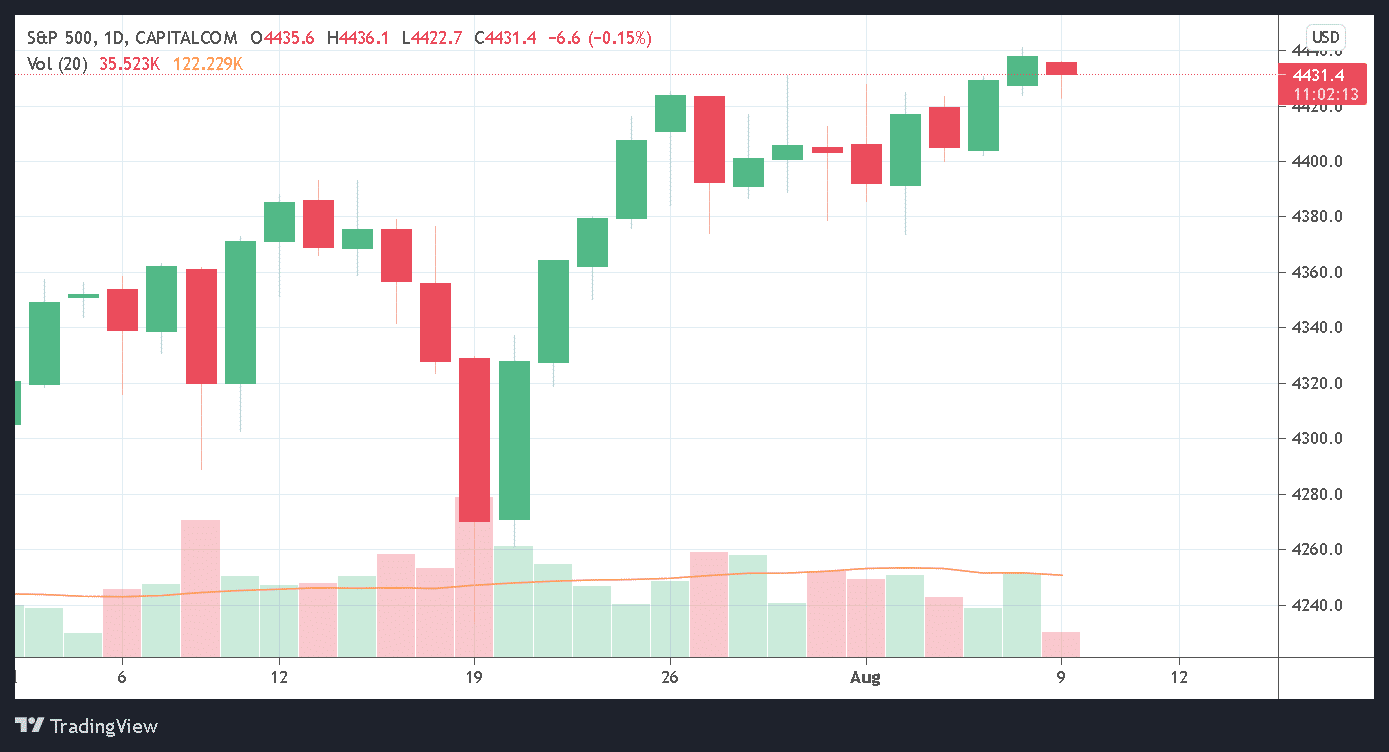

The S&P500 price started off the week at a slight decline of around 8 points or a 0.14% drop. The index ended the week on a high as expected after the highly positive Non-Farm Payroll report which saw much more jobs added than had been forecast. This is a clear sign that the economy is re-opening at a furious pace notwithstanding the Covid19 fears still prevalent in the US.

Another issue that should be affecting the long-term forecasts for the S&P500 price is the high inflation. In its Thursday 5 August decision, the Bank of England upped its inflation forecasts for the end of the year. The situation is not dissimilar in the US with the FED continually warning on high inflation figures. At present, investors seem to have largely shrugged off these concerns.

If you’re interested in trading forex, then you should be having a look at this How To Trade Forex Beginner’s Guide.

Short Term Prediction For S&P500 Price: Still Appears Bullish Despite Coronavirus Concerns

The S&P500 price closed off the week at a fresh record high of 4439 which represents a gain of over 1% over the week. The bullish close was no doubt fuelled by the Non-Farm Payroll results which exceeded expectations by a considerable margin.

This week seems to be relatively quiet as far as announcements go so there shouldn’t be much short-term movement in the S&P500 price. Perhaps another push for the 4500 mark may be made although the uncertain Coronavirus situation seems to continue weighing in on investor confidence.

A relatively quiet week ahead is expected for the S&P500 price with today’s movement in slightly negative territory which could be an indicator of what is expected. The 4500 mark should still be achievable by end of August though.

If you want to begin trading Forex take a look at these Top Forex Brokers.

Long-Term Prediction for SPX500: Still Very Bullish But Covid and High Inflation Remain on the table

Although there have been positive indicators in the recent opening up of the US economy, there are still concerns regarding the Covid19 situation and persistently high inflation. The Fed has also indicated that it will soon begin to taper off economic stimulus related to the pandemic but no clear timeline has been set.

A conservative long-term prediction for the S&P500 price would be a continued bullish streak with some retracements along the way. The 4500-4600 level should be reached by the end of August while the 5000 mark is a theoretical possibility not too far down the line.

It remains to be seen how the Coronavirus concerns, especially with the recent resurgence of the ‘pandemic of the unvaccinated’ in Florida and Texas, will affect this bull run in the markets.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.