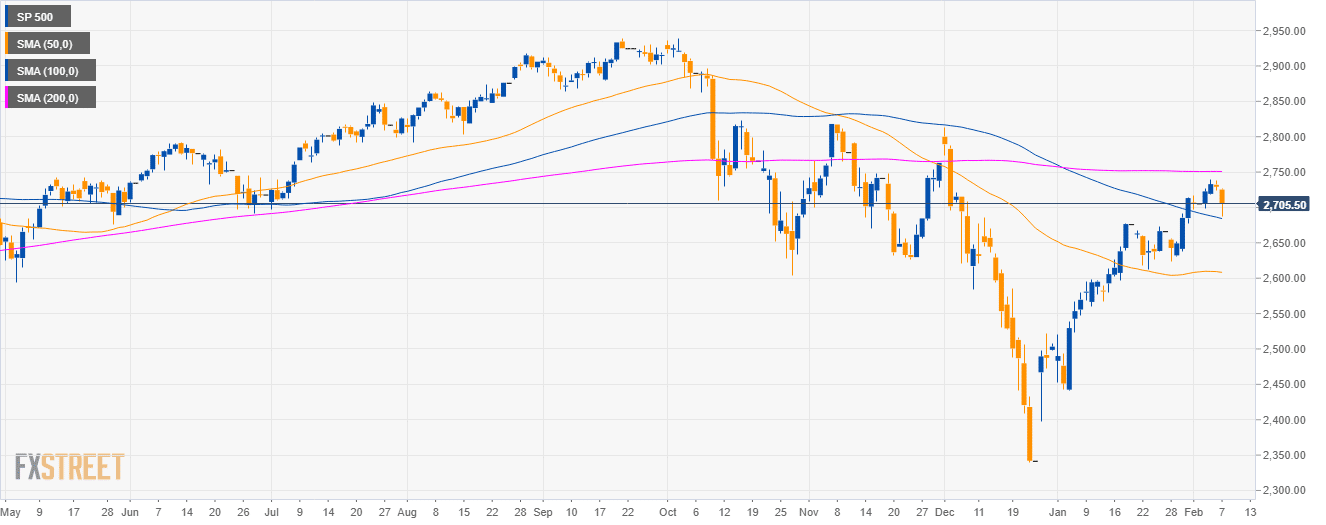

S&P500 daily chart

- The S&P500 Index is having a strong bullish reversal after a deep pullback below the 200-day simple moving average (DSMA).

- Bears challenged the 100 DSMA.

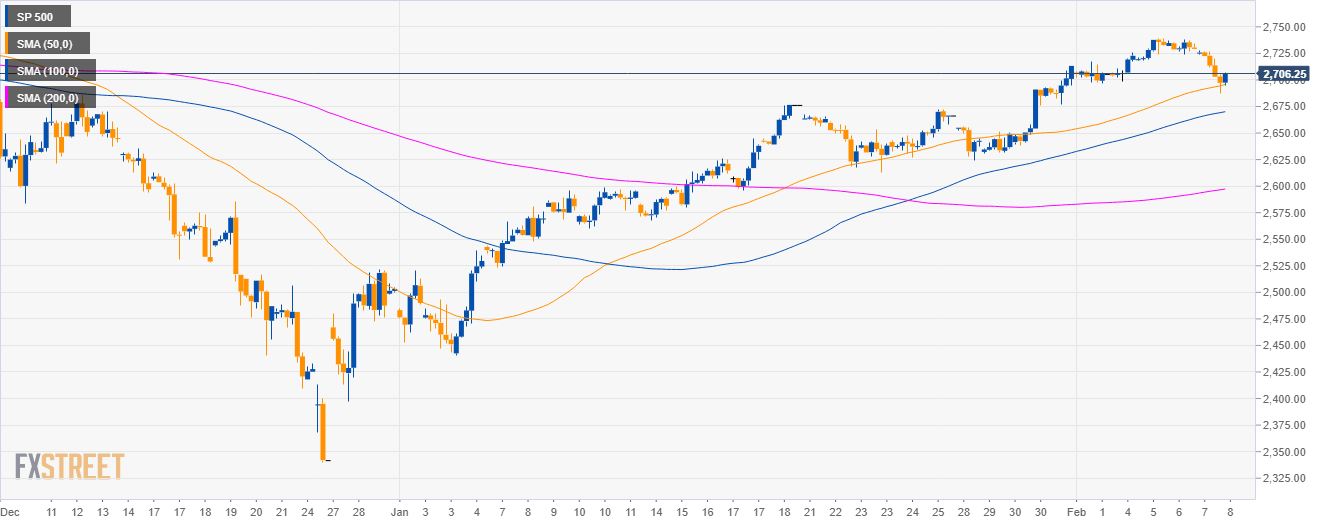

S&P500 4-hour chart

- The market found some support near the 2,700 figure and the 50 SMA.

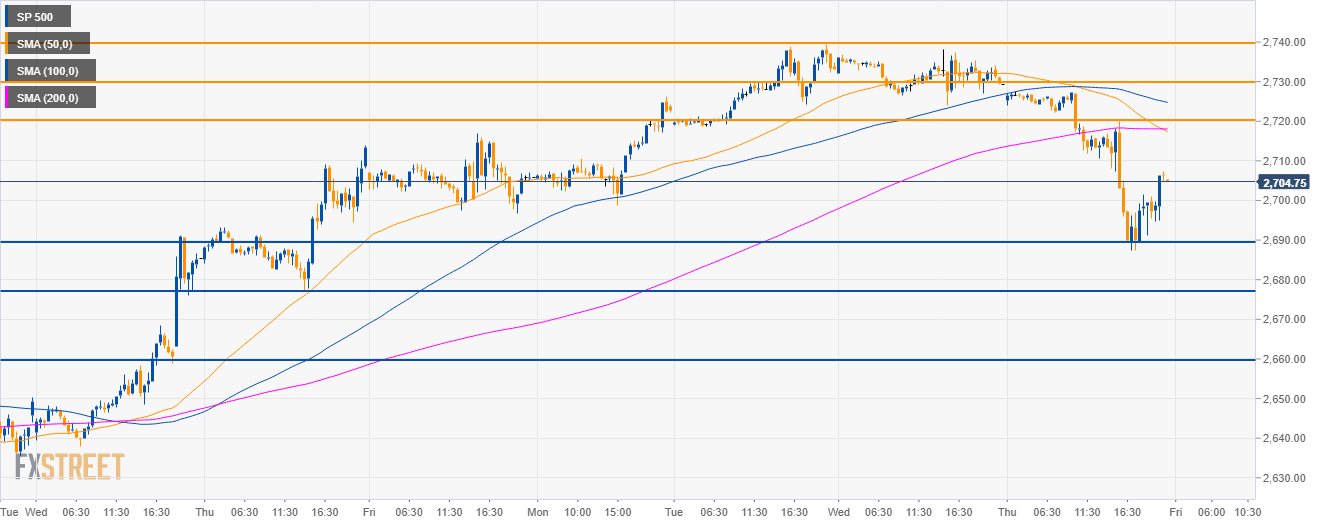

S&P500 30-minute chart

- The S&P500 is trading below the main SMAs suggesting bearish momentum.

- However, as the market found support at 2,690.00 level, bulls can drive the market to 2,720.00 and 2,730.00 in the short-term.

- To the downside, support is seen at 2,690.00, 2,680.00 and 2,660.00 levels.

Additional key levels

SP 500

Overview:

Today Last Price: 2706.25

Today Daily change: -23.00 points

Today Daily change %: -0.84%

Today Daily Open: 2729.25

Trends:

Daily SMA20: 2670.18

Daily SMA50: 2609.37

Daily SMA100: 2686.33

Daily SMA200: 2750.95

Levels:

Previous Daily High: 2738

Previous Daily Low: 2724

Previous Weekly High: 2717

Previous Weekly Low: 2623.75

Previous Monthly High: 2714

Previous Monthly Low: 2441

Daily Fibonacci 38.2%: 2729.35

Daily Fibonacci 61.8%: 2732.65

Daily Pivot Point S1: 2722.83

Daily Pivot Point S2: 2716.42

Daily Pivot Point S3: 2708.83

Daily Pivot Point R1: 2736.83

Daily Pivot Point R2: 2744.42

Daily Pivot Point R3: 2750.83