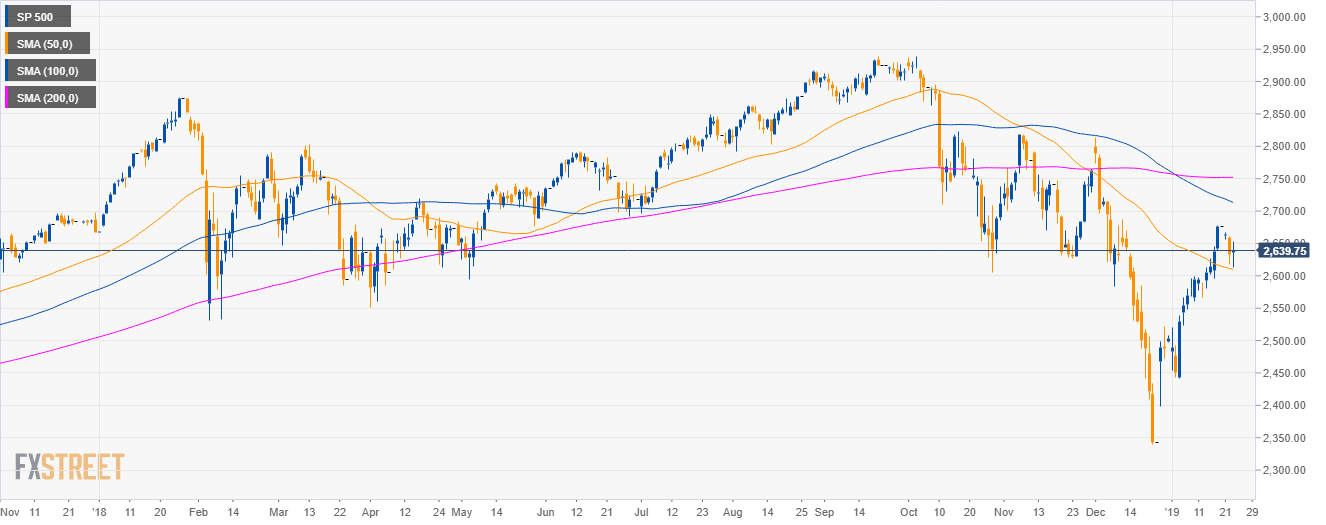

S&P500 daily chart

- The S&P500 Index is having a deep pullback below the 100 and 200-day simple moving averages (SMAs).

- Bulls have momentarily retaken the 50 SMA.

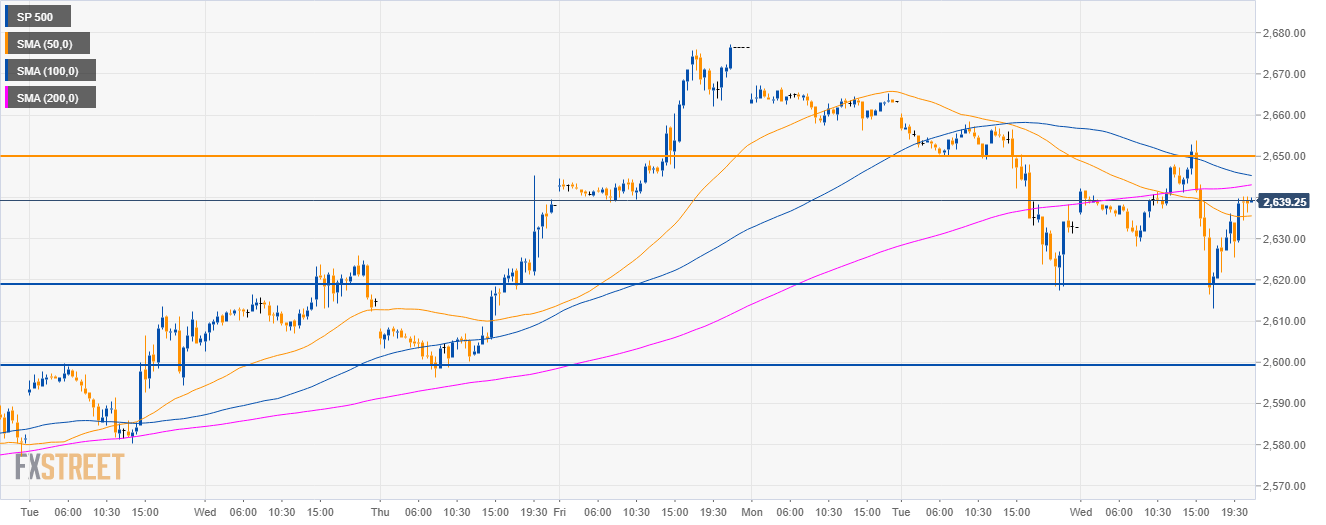

S&P500 4-hour chart

- The S&P500 is evolving the main SMAs suggesting bullish momentum in the medium-term.

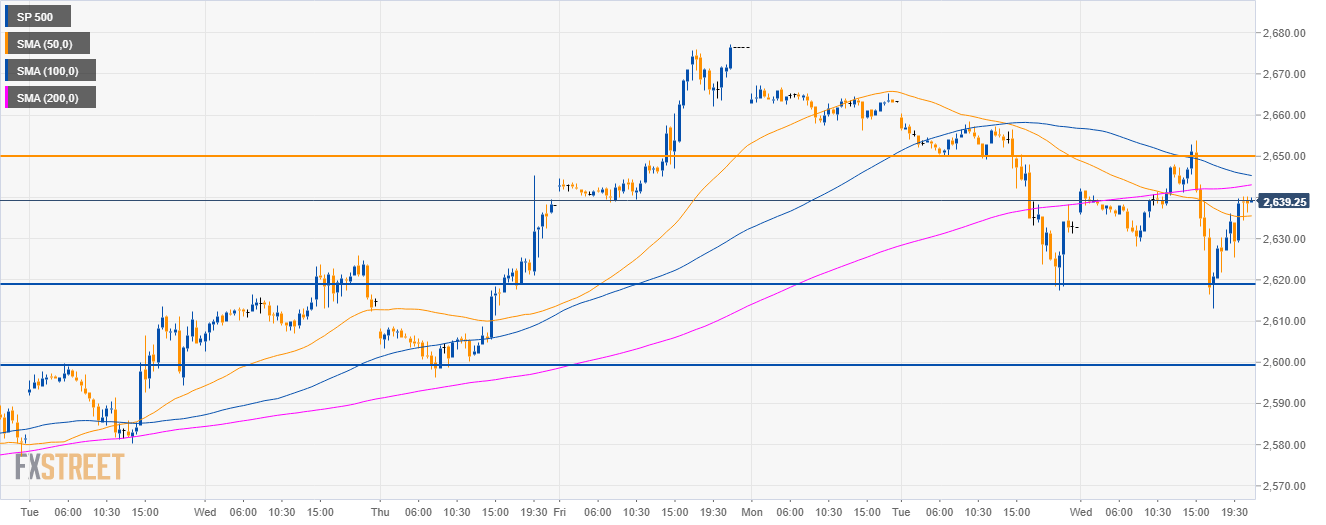

S&P500 30-minute chart

- The S&P500 broke below the 2,650.00 level and the 200 SMA suggesting bearish momentum in the near-term.

- A decline below the 2,620.00 support can lead to the 2,600.00 figure to the downside.

- The 2,650.00 level is resistance.

Additional key levels

SP 500

Overview:

Today Last Price: 2638.5

Today Daily change: 5.75 points

Today Daily change %: 0.22%

Today Daily Open: 2632.75

Trends:

Daily SMA20: 2563.76

Daily SMA50: 2611.31

Daily SMA100: 2715.91

Daily SMA200: 2752.02

Levels:

Previous Daily High: 2660.5

Previous Daily Low: 2617.5

Previous Weekly High: 2677.25

Previous Weekly Low: 2567.25

Previous Monthly High: 2813.5

Previous Monthly Low: 2340.25

Daily Fibonacci 38.2%: 2633.93

Daily Fibonacci 61.8%: 2644.07

Daily Pivot Point S1: 2613.33

Daily Pivot Point S2: 2593.92

Daily Pivot Point S3: 2570.33

Daily Pivot Point R1: 2656.33

Daily Pivot Point R2: 2679.92

Daily Pivot Point R3: 2699.33