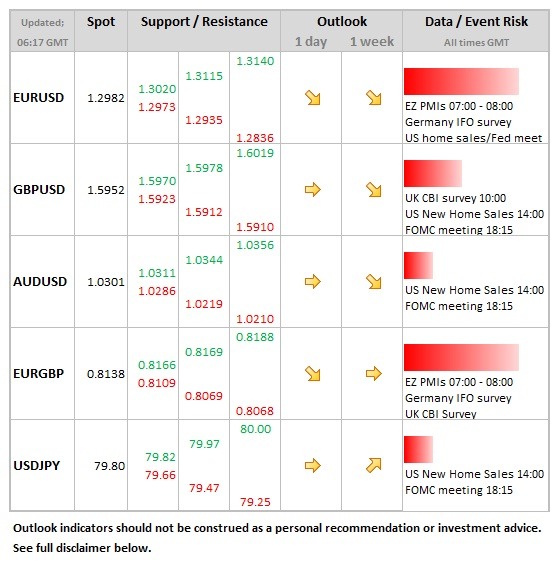

- USD: Little risk from FOMC decision, with focus on any changes to statement, but will be minor. Home sales fell 0.3% MoM in Aug, with 3.2% recovery seen in Sept, but USD more sensitive to labour market data so no major risks unless very weak and details housing recovery perception.

- EUR: Both the preliminary PMI data for the main countries, and the German Ifo data, bring strong event-risk to EUR/USD and others as key for shaping growth expectations going forward. ECB president is also speaking this afternoon in front of the German parliament.

Idea of the Day

We’ve written before about Spain wanting the best of both worlds – the comfort of an ECB bond-buying program/EU credit line waiting in the wings, but not having to use it. But, if you give politicians room for manoeuvre, they will use it to their advantage. This is what the Spanish PM is doing. If his position becomes stronger politically (as it did over the weekend with regional elections), the government feels in a better position to hold-off from asking for aid. But relying on a temporary line of credit yet to be opened up is not the way to solve a credit crisis. Markets took this view on board yesterday (stocks down, dollar up, peripheral bond yields up) and the more cautious sentiment could well come and go before Spain does eventually succumb.

Latest FX News

- USD: FHFA measure of house prices increased 0.7% in August. Prices have been increasing for seven months now. Housing looks to be over worst, but still has long way to go.

- GBP: BoE Governor King last night said the Bank was ready to inject more money into the economy should the “recent more positive signs” on the economy fade. Sterling unmoved, but suggests further QE (current tranche expires early Nov.) conditional on data worsening, at least in his view.

- AUD: Stronger than expected bounce-back in CPI for Q3, up to 2.0%, from 1.2%. Both housing and electricity costs were firmer. Now less clear whether RBA will cut rates next month.

- CAD: The only currency to gain vs. the dollar on Tues. after the Bank of Canada maintained its bias towards tightening rates. EUR/CAD hit hard, but holding above 200d MA.

- CNY: HSBC manufacturing PMI recovered to 49.1 in Oct, from 47.9 in the previous month.