The sentiment in the markets is still bearish on EUR/USD despite teh recent falls and ahead of the expected decision on QE from the ECB.

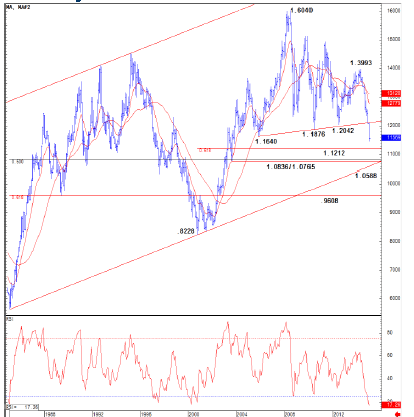

What levels should be watched? The team at Credit Suisse answers and provides a chart:

Here is their view, courtesy of eFXnews:

EUR/USD still trading in retreat hovering around a new cycles lows, maintaining multi-year top below the 1.2042 low of 2012, notes Credit Suisse.

“We look for 1.1650 to ideally cap to keep the immediate risk lower with support placed at 1.1512 initially, below which should see a move back to 1.1460/46.Beneath here should see a test of 1.1381, the November 2003 low, ahead of the 61.8% retracement of the entire 2000/08 rise at 1.1212 next,” CS projects.

“Near-term resistance shows at 1.1607. Above 1.1650 can see a recovery back to 1.1728/43, where we would expect fresh sellers. A break can see 1.1794, potentially 1.1841,” CS adds.

Longer-term, CS’ core target though remains at a cluster of supports at 1.0836/1.0765, which includes the 50% retracement of the entire uptrend from 1985.

“An overshoot to multi-year trend support at 1.0588 should be allowed for, but we would expect this to hold at first,” CS argues.

“Bigger picture though, we see scope for parity,” CS projects.

CS runs a limit order to sell EUR/USD at 1.1650 targeting 1.1215.

&For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.