- Stellar’s partnership with TransferTo will open it up to over 70 countries as a cross-border money transfer provider.

- Technical indicators show the presence of buying power for the short-term.

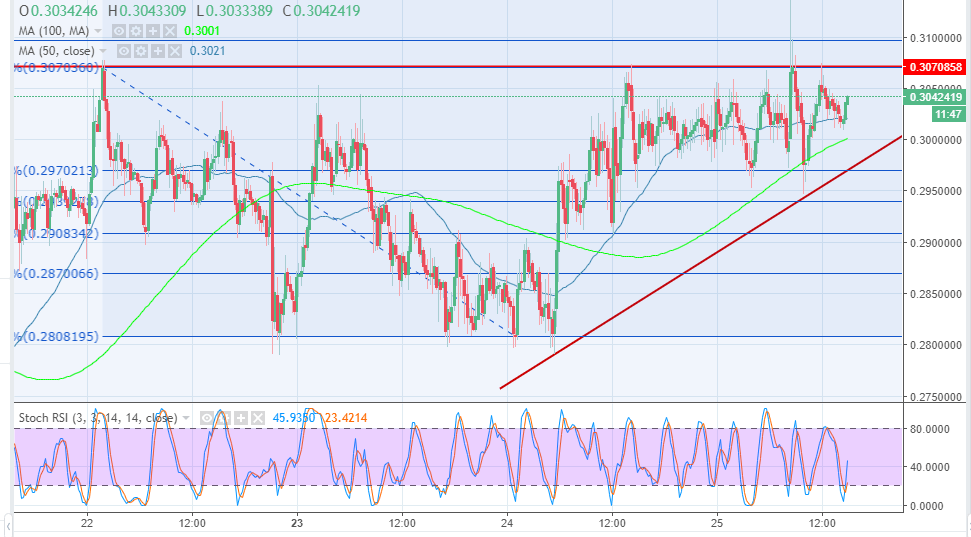

Stellar price is trading a classic rising wedge pattern, while the upside movements have been capped below $0.31 since June 19. The price has recovered from the dip that tested the support at $0.28 yesterday. The recovery trend has struggled after breaking above the 61.8% Fib retracement level with the last swing high of $0.3096 and a swing low of $02808 resistance unable to maintain the trend above $0.300.

In other news, Stellar Organization has announced a partnership that will see it take on cross-border money transfer. The partnership is with TransferTo; a company that focuses on cross-border transfer services. The network has its presence in over 70 countries around the world. This partnership has expanded Stellar’s dominance as well as the XLM token as a payment cryptocurrency. The announcement made by TransferTo states:

“TransferTo is excited to announce that it is partnering with Stellar.org to further enhance the way in which money is transferred across borders. Under this collaboration, financial institutions and partners of both Stellar.org and TransferTo will benefit from the combined network coverage, and be able to leverage new technologies to send and receive money more efficiently to more than 70 countries.”

The announcement also went ahead to explain the benefits that this collaboration accords both networks:

“TransferTo operates a cross-border mobile payments network for emerging markets, which interconnects financial institutions and digital financial service providers globally. Like the TransferTo network, Stellar also provides the benefits of real-time, secure, and low-cost transfers. By integrating with Stellar, TransferTo will enable a more seamless and efficient settlement method between its network partners.”

This is a groundbreaking partnership for Stellar, besides Lisa Nestor, Director of Partnerships at Stellar said that the vastly experienced TransferTo will allow the network to drive financial inclusion for the societies that lack banking services.

Stellar price analysis

Stellar price is embracing the 50 SMA support while edging higher against the bearish pressure in the market. It will face resistance at $0.3050, although the key resistance is at $0.310. XLM/USD must breakout out of the rising wedge pattern resistance; a move that will see it curve a trajectory path upwards. Technical indicators show that the bullish power is still present. On the flipside, the 100 SMA will offer support at $0.30 above the 61.8% support (former resistance).

XLM/USD 15′ chart