The pound was pounded by Carney but then recovered quite nicely. However, doom and gloom returns. CIBC describes the next potential moves:

Here is their view, courtesy of eFXnews:

Although sterling has been less correlated with global growth fears in the past than many other currencies, the UK’s large current account deficit and uncertainty over the country’s place within the EU have made it more susceptible to the recent risk-off sentiment.

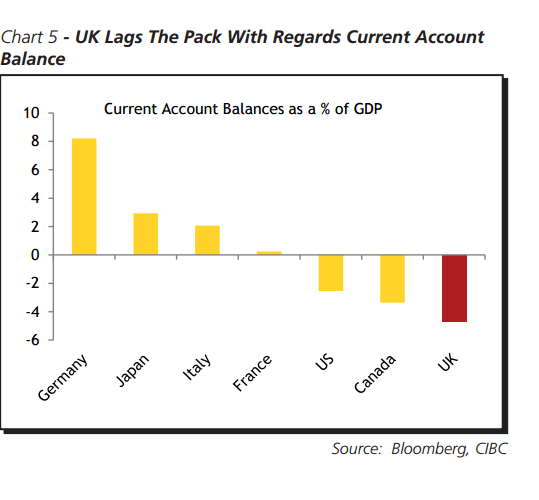

After the EU leaders’ summit on February 18-19, the run to a referendum on the UK’s membership should begin. Given the campaigning and legislation required, we would expect the vote to occur by the end of June. And with the decision likely to be a very close call, much like the 55-45% vote in the Scottish referendum, uncertainty will remain a headwind for sterling through the first half of the year. Given that backdrop, investment flows into the UK may be delayed which reduces demand for the currency. Given its large current account deficit (Chart 5), that has made the currency one of the worst performing majors year-todate against the USD.

However better days are expected for the currency in the second half of the year. While growth is still more uneven than we would like (driven largely by consumer spending), GDP appears to be advancing at a reasonably solid pace which should be good enough to see the unemployment rate continue to decline.

A continuation of that trend of solid growth and falling unemployment combined with a reacceleration in wage growth will have markets re-pricing the probability of a BoE rate hike before the end of the year. While we admit that a hike may not come as early as we were expecting, the market has now priced out any hikes. And even if Governor Carney sounds reasonably dovish, he could well be outvoted before the end of the year.

As a result, expect sterling to remain under pressure in the near term, but then recover to 1.56 by the end of the year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.