The Swiss franc enjoyed a period of independence: EUR/CHF got away from the 1.20 line that the SNB fiercely defends, and weakened on its own. This sent USD/CHF higher.

The worries about the Cypriot precedents could strengthen the former safe haven franc, send EUR/CHF towards 1.20 and make USD/CHF a mirror of EUR/USD once again.

* This article is part of the February 2013 monthly forex report. You can download the full report by joining the newsletter in the form below.

The 1.20 floor under EUR/CHF is in place for over a year and half. The main justification for the floor is fighting deflation. On this front, Switzerland saw a refreshing change in February: prices rose by 0.3%, contrary to expectations for a drop of the same scale, which was seen in January.

This one time change wasn’t enough to change the mind of the SNB: in the quarterly rate decision, policymakers reiterated the previous stance of “unlimited amounts of foreign exchange” to defend the franc.

The levels of foreign currency reserves remained stable during this time, but a deeper crisis in Europe could cause the reserves to swell up.

Here are the main events to watch during April:

- April 5th 7:00: Foreign Currency Reserves

- 9th 5:45 Unemployment rate

- 9th 7:15 CPI and retail sales

- 16th 7:15 PPI

- 17th 9:00 ZEW Economic Expectations

- 23rd 6:00 Trade balance

- 30th 6:00 UBS Consumption indicator

- 30th 7:00 KOF Economic Barometer

- May 1st 7:30 SVME PMI

- 3rd 7:15 Retail sales

Despite the peg to the euro, USD/CHF remains technically interesting.

And if the situation in the euro-zone worsens quickly, the 1.20 floor could break. Nothing lasts forever, even if the SNB had exceptional success so far.

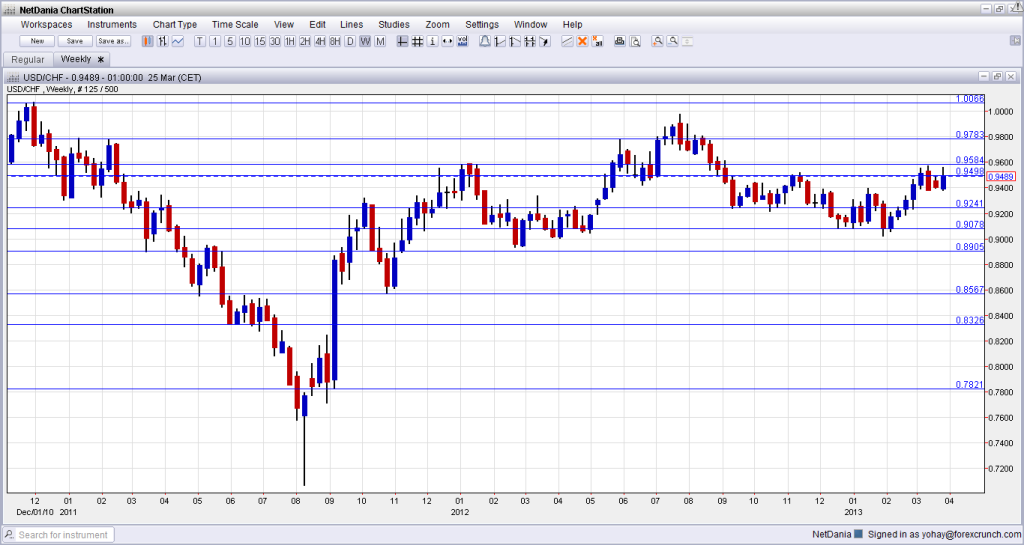

USD/CHF Technical Outlook

After the pair fell early in the year, it managed to recover nicely and finally made a convincing break above 0.9240. Conquering the 0.95 line was already a tougher task.

Lines

1.09 capped the pair during 2010 and provided support beforehand. 1.0435 was support in 2010 and an area of struggle.

The round number of parity returns to the scene. It is backed by 1.0066. 0.9783 was a double top and provides strong resistance. It showed character in August 2012.

The round number of 0.95 worked as support and has psychological importance as well. It successfully capped the pair in late 2012 and was broken recently. However, the pair didn’t go too far.

0.9240 is the bottom of the current range, working quite well in October and November. It also provided some support back in March 2011. 0.9080, which was a trough recently, is also worth watching. The battle around this line is raging. Note that this line defends 0.90.

0.89, is another significant support line that proved its strength early in the year and also back in 2011.

0.8567 is worth mentioning on the downside. It served as support on the way down and then switched to resistance. Further below, 0.8330 was a strong line of support.

0.7820 is the final frontier before the big plunge to the all-time low at 0.7066.