When we look at the majors, the Swiss Franc has been one of the least talked about currencies over the last year. There are a few important reasons for this, as many of the traditional trading tendencies in the CHF have been replaced by central bank watchers looking for new scalping opportunities. But since we are unlikely to see any significant policy changes implemented by the Swiss National Bank (SNB) over the next quarter, it is time for traders to return to the basics and determine the next direction for the currency.

Forex Chart Outlook: USD/CHF

Guest post by By CornerTrader

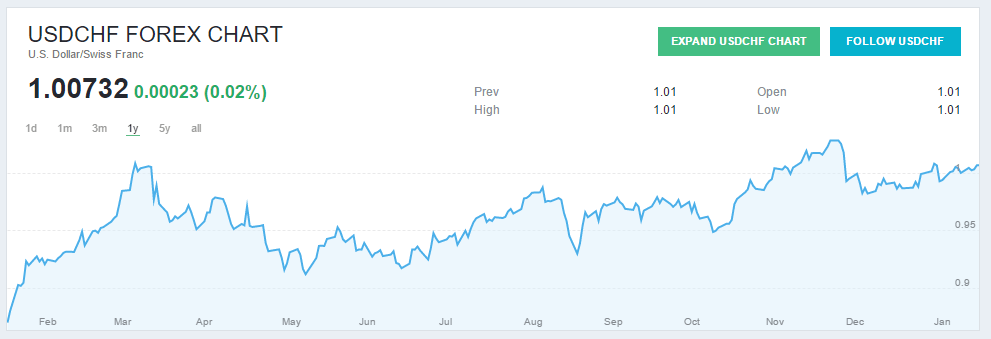

In the chart above, we can see that the USD/CHF has shown a steady increase over the last year as the US Dollar maintained its dominance in the forex markets during that period. This is not entirely surprising because the Swiss Franc has been caught in a multi-year downtrend since the SNB established a price floor relative to the Euro. This price floor has since been removed and this has helped to normalize price activity but we are still seeing generalized weakness in the currency.

This is still a good framework for looking at the major currency pairs denominated in Swiss Francs, and we can see that instruments like the USD/CHF have been a good buy on dips over the last year. In terms of specific price levels, support is currently found at 0.9720 but we would need to see prices break back through parity in order for this to happen. This would likely mean that we see some short-term volatility in the downside direction but the overall momentum on the longer time frames should keep any bearish moves from becoming excessive.

To the topside, we will likely encounter stalling in the 1.0340 area, as this is a critical resistance zone that will more than confirm the downtrend in the CHF if breached. Overall, this is the range that should be viewed when you are looking to implemented range trading strategies. Given the strength of the general uptrend in the USC/CHF, we have the additional option of waiting for buy on dips opportunities to present themselves and these types of opportunities would be found if the Federal Reserve looks to start backtracking on its previous statements to increase interest rates. This is the primary outlook for trading broadly in the CHF and in the USD/CHF in particular over the next 2-3 months