Idea of the Day

At the present moment in time, EURJPY is where the action is proving to be. The cross, already at levels last seen 4.5 years ago, is close to break through the mid 2009 highs to stand at levels last seen in the depths of the Lehman crisis in late 2008 when the yen was dominating for save haven reasons. Although today is Thanksgiving in the US, lower volumes could still elicit some choppy price action, especially we do look to threaten the 140 level. Bigger macro players are keen to push for a weaker yen and there is a case for saying that EURJPY is the better way to avoid the “will they/won’t they” tapering debate on the dollar.

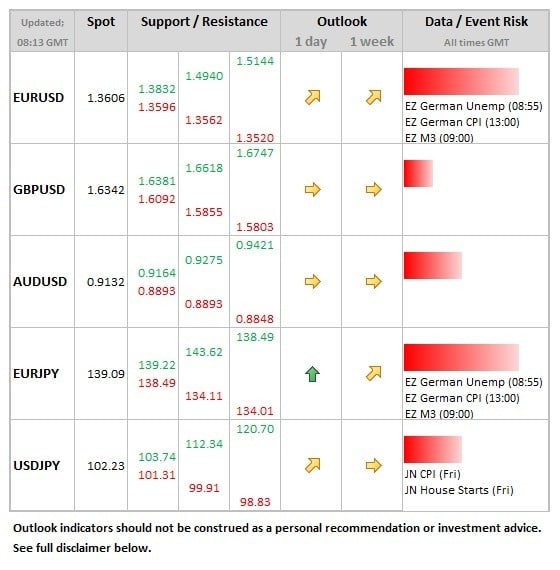

Data/Event Risks

EUR: Never forget that money supply remains a key pillar of ECB policy, although they have more often than not tended to turn a blind eye both to overshoots and undershoots of the 4.5% reference value. Data today is expected to show 3-mth average falling to 2.0% (from 2.2%), The lending data, showing credit to households and businesses, will be of modest interest. The euro at present though still more sensitive to ECB speakers.

USD: Thanksgiving holiday today which for most also rolls over into Friday, which should make for a relatively subdued end to the week, with no US data.

Latest FX News

AUD: Strong capex data allowed an opening jump higher on the Aussie, but steady thereafter above 0.9100.

EUR: Pushing through the 1.36 level to 1.3613 on Wednesday. There was some impetus from the formation of a coalition in Germany, but it was marginal at best. Instead, the relatively positive underlying fundamentals remain a factor, but market nerves could increase going into the ECB meeting next week.

GBP: Key levels being blown away on cable on Wednesday, taking it back to levels last seen on the first trading day of the month.

Further reading: