Idea of the Day

The first half of January saw FX markets move against the conventional wisdom for the year as whole. The dollar was not universally stronger because of the Fed tapering story. Furthermore, the currencies widely seen as weaken further this year (the yen and Aussie) were actually firmer against the dollar in the first two weeks. We’ve seen a reversal of that overnight, with the Aussie weakening later in the European session and the euro during Asian trade. In part this has been down to hawkish Fed speaker last night reminding markets of the further tapering to come. All in all though, the price action reminds us that it is not going to be a one way street higher for the dollar this year.

Data/Event Risks

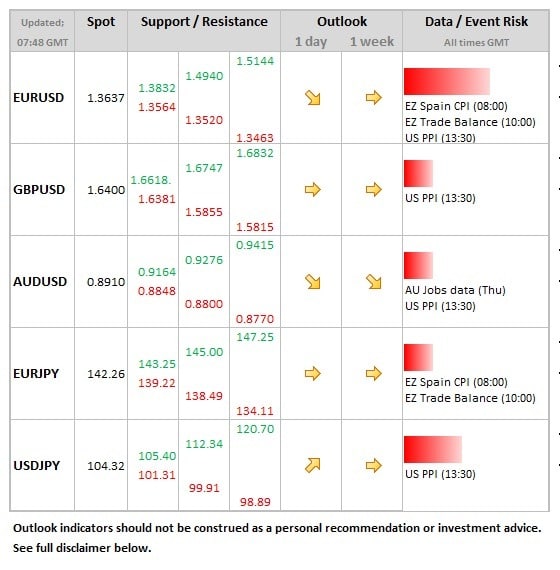

USD: The data is second tier today, with PPI released at 13:30 together with the Empire manufacturing survey. Note that Chicago Fed’s Evans speaker later. Firmer data should put a floor under the better dollar tone.

Latest FX News

EUR: Some selling noted early during Asian trade, taking EURUSD towards the 1.3630 level, where it settled for the rest of the session. A reminder that money market rates remain elevated, still higher than when rates were cut back in November. This continues to act as a support for the single currency.

GBP: There was no lasting impact from the weaker than expected inflation data yesterday, with the headline number hitting the 2% target for the first time in over 4 years. Cable was initially lower, but recovered the losses by midday.

AUD: Weaker overnight with push to the 0.8900 level. Some nervousness ahead of jobs data due tomorrow, where unemployment rate seen steady at 5.8% with some risks of move higher.

Further reading:

AUD/USD: Trading the Australian Employment Change

Markets are concerned the Fed will continue to scale back its asset purchases