- Tesla shares recover as Bitcoin bounces toward $40,000.

- TSLA breaks above the 200-day moving average in a strong move.

- TSLA aiming for $625 as the next target, resistance.

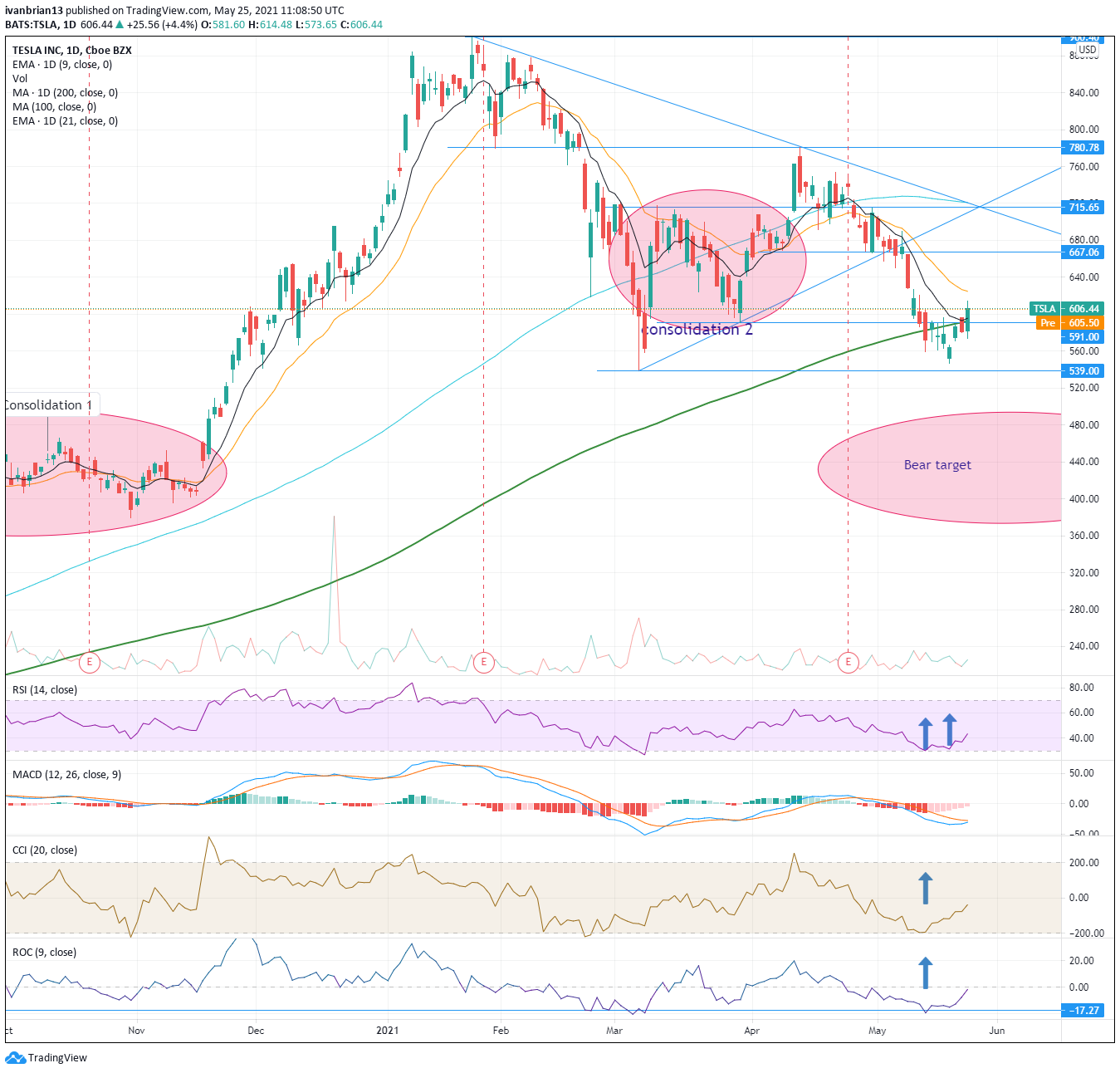

Tesla shares have continued to prove the oscillators can prove useful in predicting turning points as the shares registered for a neat 4.4% gain on Monday to close at $606.44. Tesla shares have found support from a confluence of indicators, with the 200-day moving average and the shorter term 9-day moving average being a pivot point for the shares on Monday. Tesla pushed through these levels and now finds itself aiming for $625. FXStreet analysis has pointed to a break of $591 being key on Monday saying “Any break above $591 could accelerate to $625 as there is not much volume despite the steep fall – a form of vacuum”.

Tesla stock forecast

The earlier failure to break $539 on May 19 can also be taken as a small victory for bulls on the longer-term horizon, as it will result in a higher low, albeit only marginally. Now Tesla has done the hard part, recapturing the 200-day moving average and retracing back to the consolidation 2 zone. $667 is now the next target for bulls and the trendline at $715 beyond that. Tesla, with its Bitcoin investment, has tied itself to the whims of a volatile asset for now and so Bitcoin will have to be watched closely for guidance toward TSLA shares. It was reported at the weekend that Tesla is now suffering a mark to market loss on its Bitcoin investment but that may no longer be the case as Bitcoin retraces to $40,000. Tesla is still in a classic downtrend with a series of lower lows and lower highs. Holding above $539 ends the series of lower lowes and breaking $667 with end the series of lower highs. These are the pivot points.

Breaking this $539 level probably sees Tesla slip further to the bear target in the $440 region. Hold and Tesla can stabilize.

| Support | 539 | 500 | 465 | 430 | ||

| Resistance | 625 | 667 | 715 | 781 | 900.40 |