Idea of the Day

It’s been interesting to note the tighter correlation between the dollar bloc currencies, more specifically the Aussie, kiwi and Canadian dollar. These three stand out as the leading performers over the past week, suggesting commodity based currencies as a whole are on a good standing at present. This certainly remains true in the case of the Aussie, which so far has corrected 3.7% from the early September low, which means it’s not that far off surpassing the 4.35% corrected seen early to mid-August. The Aussie is moving from a bear market interspersed with corrections to a bullish trend. To this end, the August high of 0.9233 remains in focus today, as a break here would likely give further confidence to those turning more bullish on the Australian currency.

Data/Event Risks

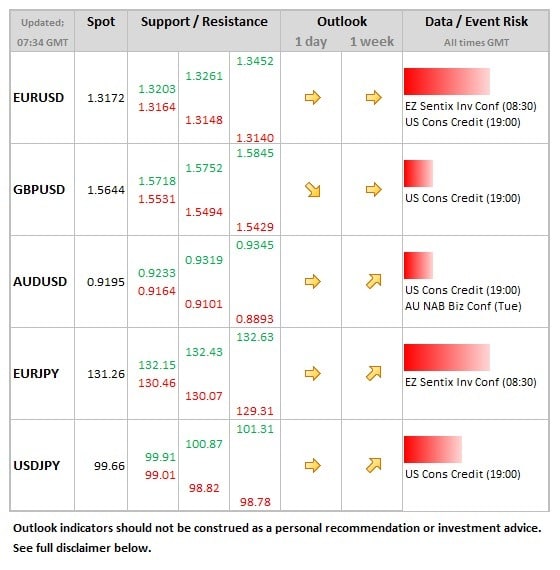

USD: Light data calendar with just consumer credit data released later in the day, but not an event risk for the dollar

EUR: Sentix consumer confidence data this morning of modest interest to the single currency. Data expected to show further small improvement, taking headline balance to -3.5.

AUD: NAB business confidence data is released tomorrow, with the Aussie likely to have an increased focus on domestic data in a bid to support a continuation of the recent recovery.

Latest FX News

JPY: An opening gap of around 0.6% on USDJPY with another brief move through the 100 level. Believe it or not, renewed optimism on the economy in light of Japan’s successful bid for the 2020 Olympics cited as a factor. Certainly it could well give more impetus to Abenomics and infrastructure spending.

EUR: A relatively choppy few days for EURUSD, since the middle of last week, it stands in the middle of the currency leader-board, with the dollar-bloc of the Aussie, kiwi and CAD having outperformed in recent sessions.

AUD: Not that far away from breaking the August high of 0.9233, with no surprise in the weekend election results, which returned the Liberal-National coalition back to power. As such, there was no immediate impact on the Aussie, but the underlying tone remains buoyant. Home loans data firmer than expected at 2.4%.

Further reading:

Non-Farm Payrolls only 169K – dollar lower – taper train probably on track