Idea of the Day

The thinking is that this is the year that central banks really start to drive currencies again, with the US Fed having started tapering, whilst the European Central Bank is seen further easing policy and the Bank of Japan also having scope to up the pace of its Quantitative Easing program. On Friday, the outgoing Fed Chairman Bernanke was cautiously optimistic on the US economy going forward. The focus this week is on the UK and ECB, given both have central bank policy meetings. For the UK, don’t expect any fireworks, as statistically the month before the quarterly Inflation Report is the least likely for policy changes, so sterling volatility risks are low. The ECB meanwhile has seen money market rates higher since the cut in rates in November. Some of this has been related to year-end factors, but so far we’ve only seen a partial reversal. The Thursday press conference could well be key in determining if the recent weaker tone to the euro is going to be sustained through January.

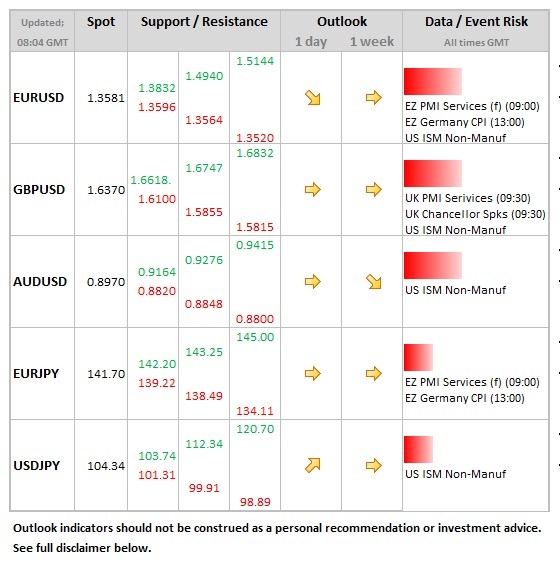

Data/Event Risks

GBP: Sterling held up well last week to the fall in manufacturing PMI data, so today we have a close eye on the services release, which is seen rising marginally to 60.3 (from 60.0). Risk is that we see services data also lower, but overall Q4 is still shaping up well growth wise. Sterling should again be resilient.

USD: The non-manufacturing ISM release is not usually a bit one for the dollar unless it is substantially away from expectations.

Latest FX News

USD: The last major speech as Fed Chairman by Bernanke on Friday was largely reflective, but was also cautiously optimistic on the economy going ahead, which offered some support to the dollar into the Friday close.

EUR: One of the factors that pushed the euro higher last year was the rise in money market rates. These have moved lower, but are still higher vs. where they were when the ECB cut rates early November. EURUSD starts the week below the 1.3600 level and was feeling a little heavy last week, but the interest rate support is still there for now.

Gold: So far, today proving to be the fifth consecutive daily rise for gold. Signs are that sentiment is improving a little after last year’s losses, but the question is how gold copes with a rising dollar, given that this remains the consensus for the year as a whole.

Further reading: