- Bitcoin (BTC) breaks to new multi-month lows in Asia.

- Altcoins retain downside bias, following the lead of the first digital currency.

The cryptocurrency market has resumed the sell-off during early Asian hours after a short consolidation on the weekends. Bitcoin and all major altcoins are nursing losses on a day-to-day basis. The total cryptocurrency market capitalization crashed to $2180 billion; an average daily trading volume is increased to $113 billion. Bitcoin’s market share settled at 66.3%.

Top-3 coins price overview

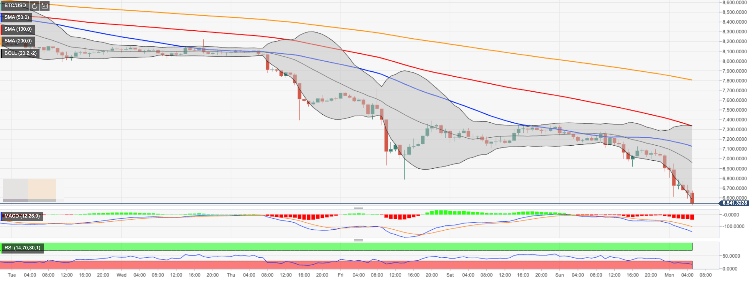

BTC/USD dropped below $6,600 to trade at $6,570 at the time of writing. The first digital asset has lost over 9% on a day-to-day basis and 5% since the beginning of Monday. The next important support is located on the approach to $6,500. A sustainable move below this barrier will trigger the sell-off towards $6,000.

BTC/USD, 1-hour chart

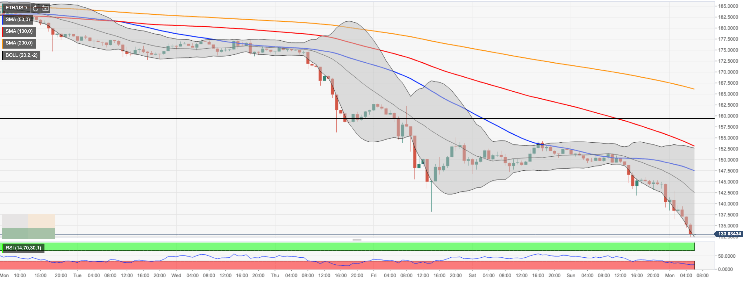

Ethereum’s bearish trend is gaining speed. The second-largest digital asset with the current market capitalization of $14.5 billion, has settled at $133.00 after a recovery attempt towards $143.00 during early Asian hours. At the time of writing, ETH/USD down 11% on a day-to-day basis and 5% since the beginning of the day.

ETH/USD, 1-hour chart

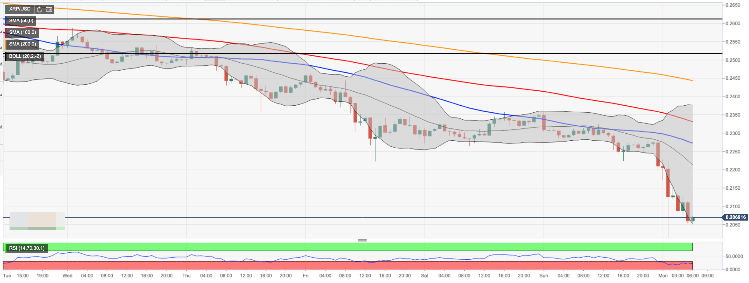

Ripple’s XRP has come dangerously close to $0.2000 during early Asian hours. At the time of writing, XRP/USD is trading at $0.269, down 10% in recent 24 hours. The recovery above $0.22 (the middle line of 1-hour Bollinger Band) will mitigate the initial bearish pressure. The critical support is created by a psychological $0.2000.

XRP/USD, 1-hour chart