The US dollar leans towards the safe haven camp, but it’s not always the currency of choice in times of trouble.

What’s next for dollar? A lot depends on the Fed. Here is the view from Nordea:

Here is their view, courtesy of eFXnews:

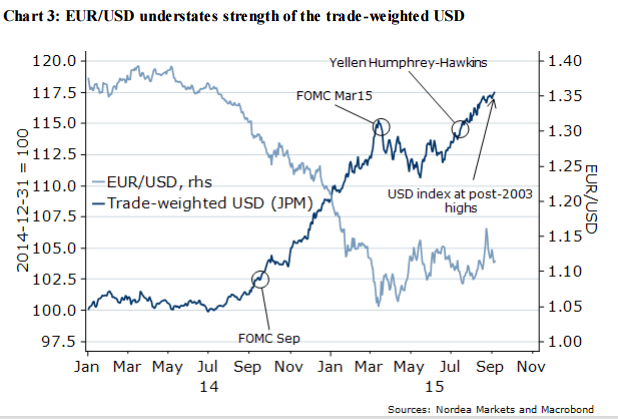

The first Fed rate hike has been awaited for quite some time. The pattern of the past three major rate hiking cycles is that the USD weakens by several percent after liftoff, consistent with both QE experiences as well as with Dornbusch’s exchange rate overshooting model. This may not be welcomed by the Fed or by other central banks. How financial conditions develop will be crucial for the Fed and thus for the dollar.

The USD “normally” weakens after the first Fed rate hike,

A weaker USD would imply easier financial conditions,

This may not be welcomed by the Fed or by other central banks.

…To summarize, while the USD may well weaken after the first rate hike, this could be a trigger for further Fed hawkishness or ECB dovishness, at which point the market would start to question the then-actual dollar weakness.

For now – ahead of the Fed’s September meeting, the US central bank will have to decide in how to deal with EM FX weakness triggering tighter financial conditions. The nominal tradeweighted USD is currently at its strongest level since 2003.

[1] Expanding the analysis to cover all major Fed hiking cycles since 1973 yield no directional conclusions at all; with EUR/USD (synthetic or not) a coin-toss over the next 3, 6 or 12 months.

[2] NY Fed’s Dudley speech The 2015 Economic Outlook and the Implications for Monetary Policy is a must-read for those interested in the Fed’s thoughts on the issue.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.