- The Graph price recently broke out of a descending parallel channel indicating a 30% bull rally on the horizon.

- Transactional data shows that $1.80 holds a massive concentration of underwater investors that could hamper the upswing.

- A decisive daily candlestick close below $1.50 will invalidate the bullish thesis.

The Graph price shows a positive outlook after recently breaking out of a downward sloping technical formation.

The Graph price eyes higher high

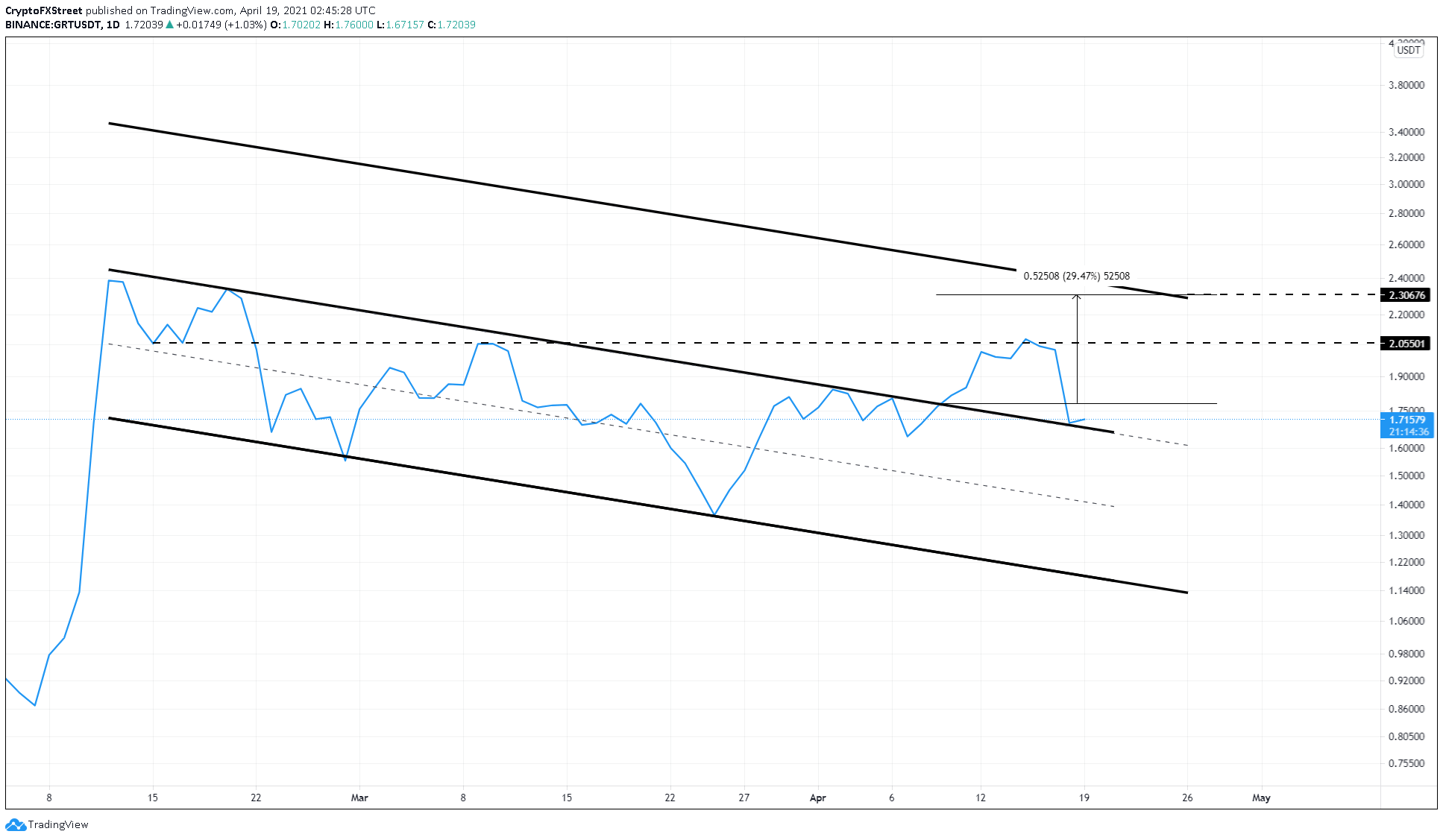

The Graph price has consistently set up lower highs and lower lows since February 12. When these swing points are connected using trend lines, it results in a descending parallel channel.

This setup has a bullish bias and forecasts a 30% upswing, which is determined by adding the channel’s height to the breakout point at $1.71. In GRT’s case, the target is $2.30

The Graph price broke out of this consolidation on April 9 but faced immense selling pressure, which led to a collapse and is currently retesting the upper trend line of the descending channel. A successful bounce from this level will signify that the bullish momentum and hence the target are still intact.

Under such conditions, investors can expect GRT to rally toward the target at $2.30 after surpassing a crucial resistance level at $2.05.

GRT/USDT 1-day chart

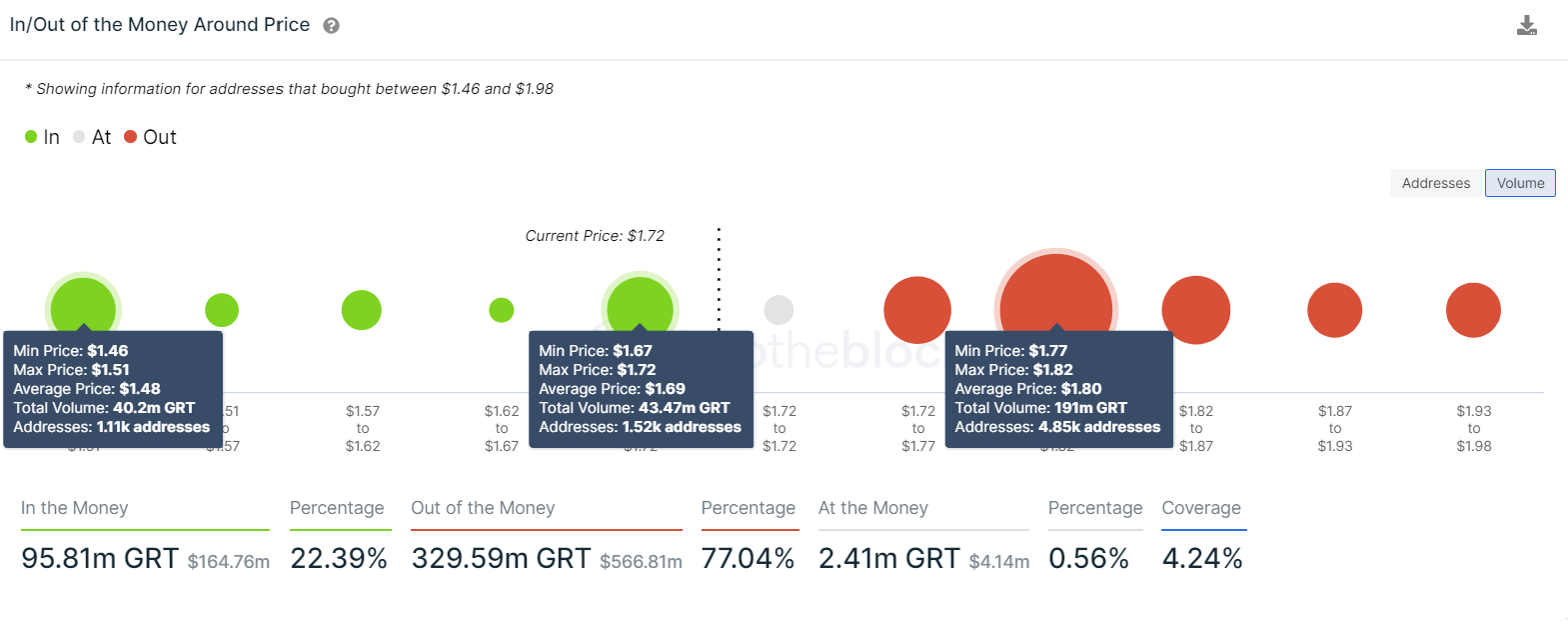

Based on IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, the Graph price will have to embark on an arduous journey to reach its target due to a cluster of underwater investors present at $1.80.

Here, roughly 4,900 addresses that purchased 191 million GRT are “Out of the Money.” Hence, a short-term bullish momentum will be absorbed by investors who might break even. Therefore, the buyers must shatter this level to surge higher.

GRT IOMAP chart

While things seem bullish for the Graph price from a technical point of view, IOMAP shows that support levels are relatively scarce. Therefore a potential spike in selling pressure that produces a daily candlestick close below $1.50 in a convincing fashion will invalidate the bullish outlook.

If this were to happen, GRT might head to $1.45 and $1.40.