- The VIX has fallen 5.16% on Thursday to hit a low of 28.74.

- Equities have moved higher as the risk-sentiment improved once again.

Fundamental Backdrop

In another day if ignoring the negative coronavirus news the US bourses have ticked higher once again. There has been a news story doing the rounds that Pfizer has produced a vaccine that is showing “very promising” results when fighting the coronavirus. There has also been news that the EU is in talks with Gilead about reserving some of the Remdesivir for its citizens.

Around the world, there has also been some encouraging PMI data. China and the US showed improvements with the US ISM reading beating the initial estimates of 49.8 to print at 52.6.

Fed’s Daly also added some dovish comments to the mix by saying he would hesitate to call some of the recent US data “showing recovery”. ECB’s Lane, however, is sounding more optimistic saying he is looking for two steps forward and one step back in regards to the economic recovery with some periodic interruptions.

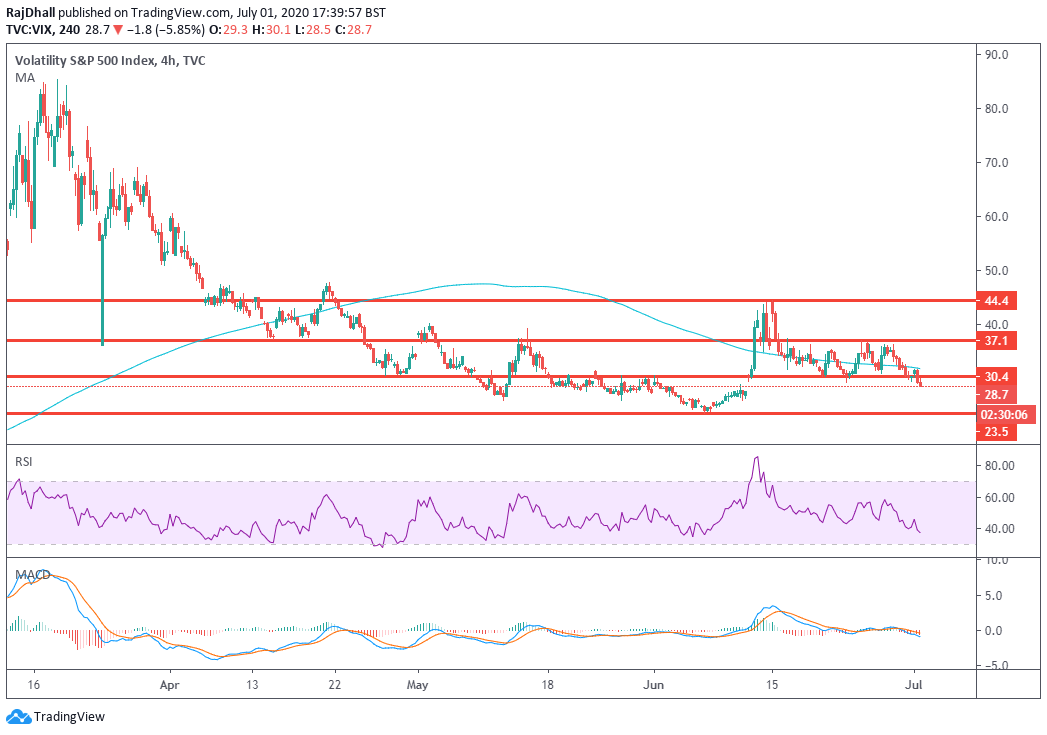

VIX 4-hour chart

Looking at the VIX chart on the 4-hour timeframe and there has been an important break of the 30.00 level. Next up on the support side is 23.6 and a break of this level would take the price of the volatility index to “more normal” levels.

Although the VIX is lower is has not broken through the 200 period Simple Moving Average as it has done on the 4-hour chart below. The Relative Strength Index indicator has broken below the 50 line and the MACD histogram has also broken below zero. The MACD signal lines have touched the zero level but have not breached the zone just yet.