- Gold bulls are seeking an upside extension.

- EUR/USD, GBP/USD, USD/CHF bears are lurking at critical resistance.

There are a number of opportunities stacking up for the week ahead and the following are a handpicked few to keep an eye on for the opening sessions.

First and foremost, there are prospects of USD/CHF moving lower in the open this week.

USD/CHF hourly chart

The bears are taking the reigns and the focus is on old daily resistance in a 50% mean reversion.

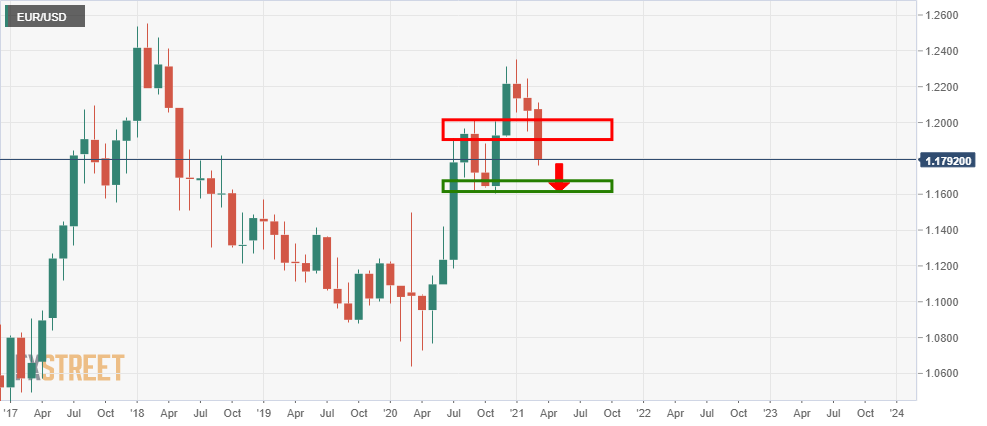

EUR/USD monthly chart

The bears are on track for a strong monthly bearish close below structure which would raise prospects of a downside continuation to test old support.

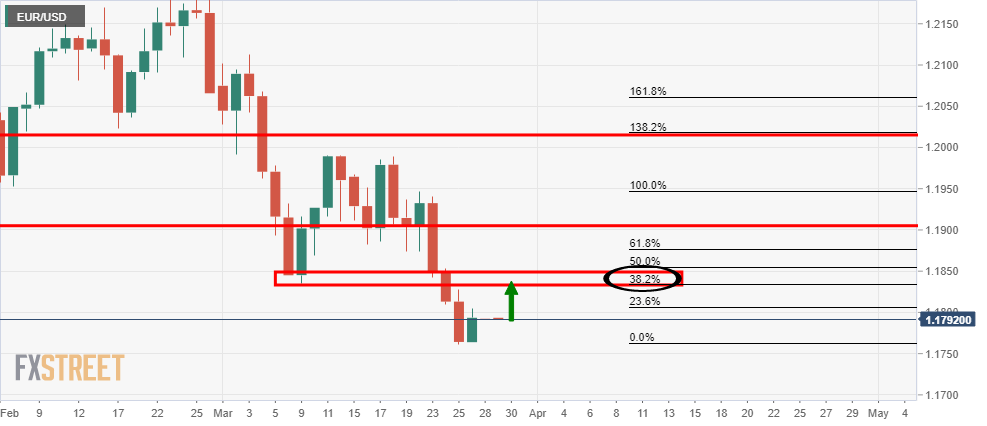

EUR/USD daily chart

Firstly, there are prospects of a significant test of the old support for the week ahead and the 38.2% marks the spot.

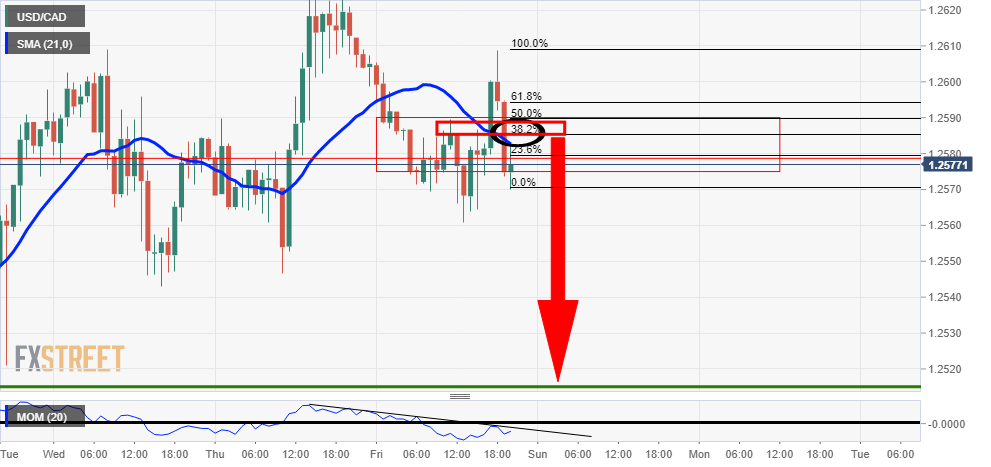

As per this week’s, Chart of the Week: USD/CAD bearish prospects, CAD crosses are in focus.

USD/CAD’s hourly bearish Momentum is compelling and makes a feasible case to the downside arguable, baring a healthy Fibo correction:

Hourly chart

Meanwhile, EUR/CAD is stalling on the downside as bears meet bullish commitments at daily support:

In the open, the hourly chart is following suit with the broadly bearish bias:

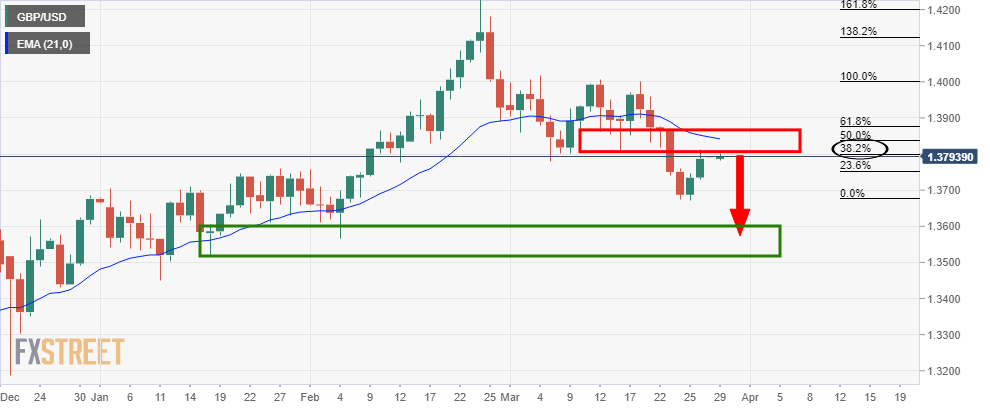

GBP/USD daily chart

The bears about to pounce on the daily chart from a 38.2% Fibonacci and old support structure that would be now expected to act as a firm confluence of resistance.

We have a similar scenario on EUR/AUD from a 50% mean reversion level to the upside where bulls will be looking to engage once the 21-day ema is broken:

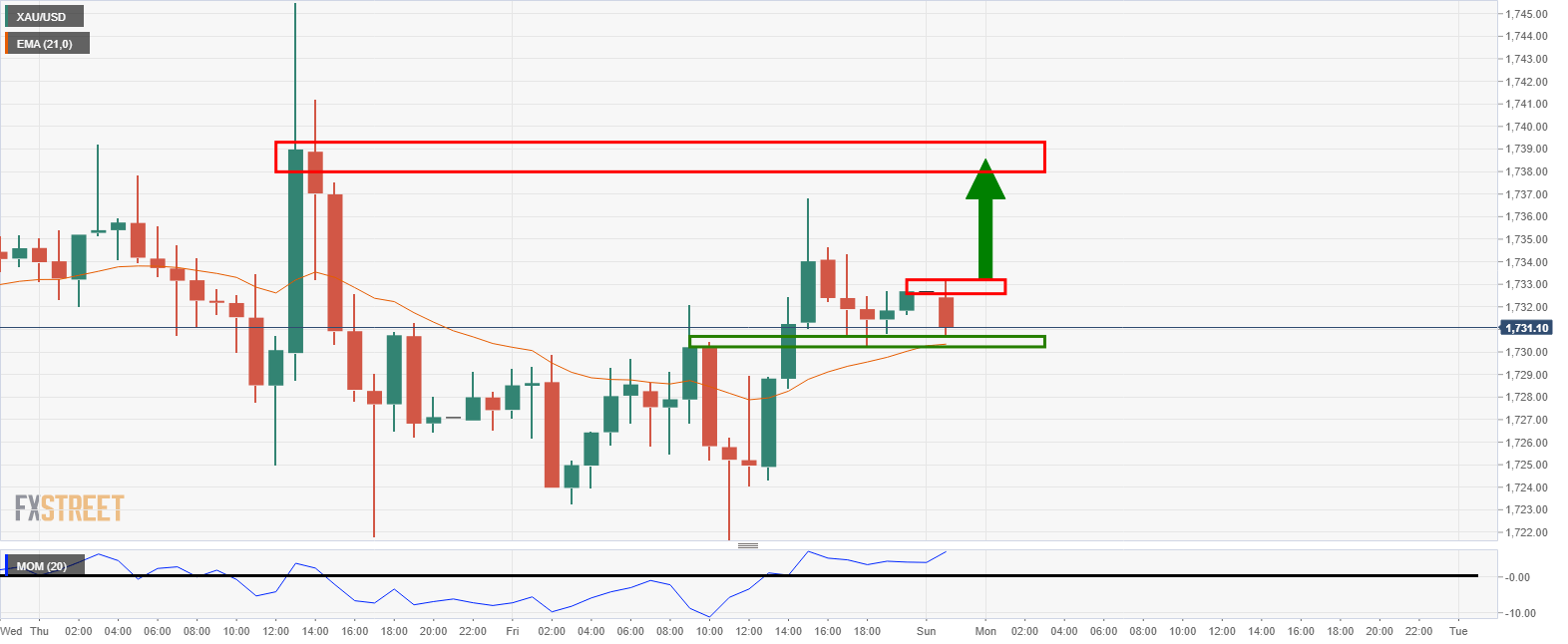

Gold bulls stepping up

As for the price of gold, from a 1-hour perspective, the bulls are in control while above $1,730 old resistance following a sharp bullish impulse:

-637525640989099808.png)

-637525641821165411.png)

-637525645694765733.png)

-637525648857868007.png)

-637525654654932842.png)