Among our 4 scenarios for the Fed decision (and others’ as well) there is a scenario of a “dovish hike” – the Fed raising rates but signalling a big pause towards the next move.

The team at Deutsche argues there is no such thing, and outlines 3 scenarios for the big day:

Here is their view, courtesy of eFXnews:

In theory there are four main FOMC scenarios for the market to consider: a ‘dovish hike’; a ‘hawkish hold’; a ‘dovish hold’, or a ‘hawkish hike’, says Deutsche Bank.

“If one was putting a probability on the above four scenarios: 70% chance of a ‘hawkish hold’; ~20% of a ‘dovish hold’ (no overt attempt to make it clear that October is ‘live’); 10% of a so called ‘dovish hike’ – that as emphasized below, won’t prove dovish at all; and, close to zero (call it less than 1%) chance of a ‘hawkish hike’ signaling more than a gradual path for rate hikes going forward,” DB adds

“There is no such thing as a ‘dovish hike’– a surprise hike would be a huge (hawkish) change in Fed regime, showing the Yellen Fed is no longer willing to ‘baby-sit’ long risk exposure,” DB argues.

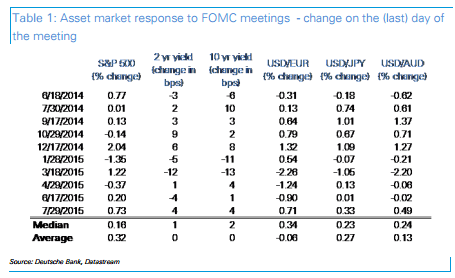

Market Impact:

1- A ‘hawkish hold’ reaction: We will know about the hold part immediately with the first headlines, and that should be helpful for risk and a small negative for the USD, given there is still a modest (~20% probability) of a 25bp hike priced in for this meeting. Thereafter we could hear from Yellen that October is ‘live’, which will undercut the response to the hold marginally. The more sustained reaction will likely include, some stale USD longs and risk shorts getting squeeze perhaps for a few weeks because both the US and China stories are going off the boil. Thereafter strategic mediumterm books will buy USD dips before the October FOMC meeting.

2- A ‘dovish hike’ and a ‘hawkish hike’ reaction should very quickly turn into close to the same thing: a rout of risk appetite that is very USD positive.

3- A ‘dovish hold’ that does not overt make October ‘live’. This will temporarily give risk parameters a nice lift, and further aid the selective positioning squeeze we have seen in some currencies notably AUD and ZAR. However beware, this trade probably has only a few weeks window,” DB projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.