- Green shoots in the euro-zone economies support the common currency.

- Optimism that the US and China avoid another escalation has been weighing on the dollar.

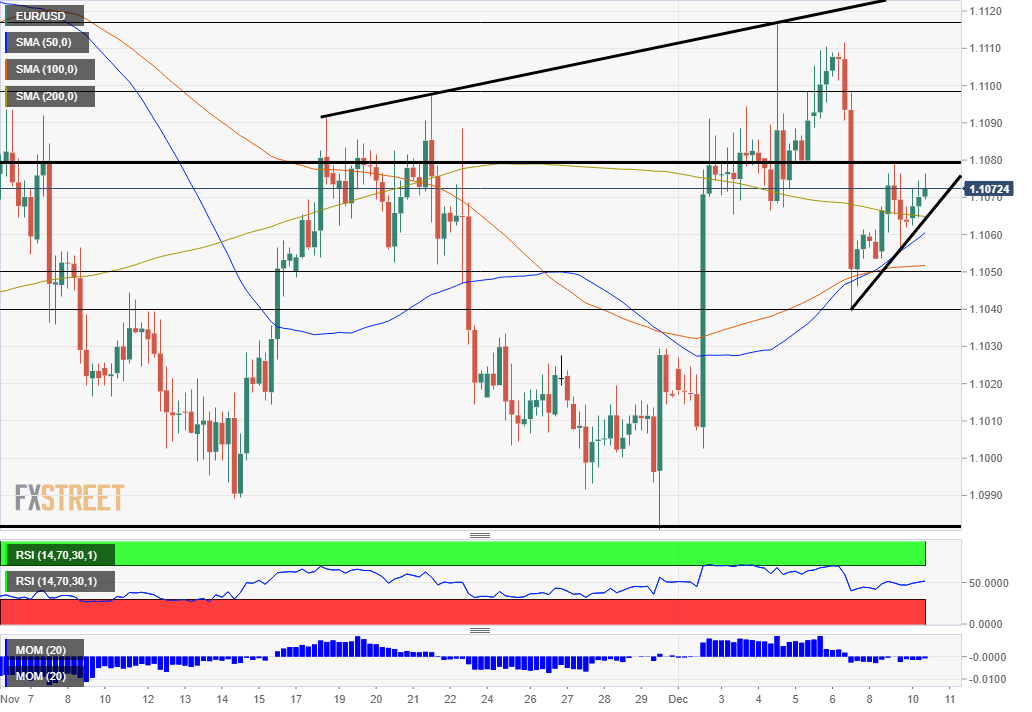

- Tuesday’s four-hour chart is also cautiously supporting the bullish case.

“Don’t contain yourself” – This slogan by a large telephone producer may be what many EUR/USD are feeling. Markets are understandably awaiting for critical decisions by central banks, but may still move the world’s most popular currency pair – to the upside.

Here are three reasons why it could advance:

1) Upbeat euro-zone figures

France, the continent’s second-largest economy, has reported an increase of 0.4% in industrial output in October, beating expectations. The encouraging picture joins an increase in German exports reported on Monday and an unexpected positive Ssentix Investor Confidence figure for December.

Today’s main release is the German ZEW Economic Sentiment for December. It is expected to rise above 0 – switching from pessimism to optimism in the euro zone’s locomotive. All in all, euro area economic data has been positive, supporting the euro.

Tension is already mounting toward Thursday’s European Central Bank decision led by Christine Lagarde, the new President. She is set to leave policy unchanged but perhaps drops hints about future moves. Stay tuned for a preview of the all-important event.

2) Optimism about trade

Sonny Perdue, the US Secretary of Agriculture, said he does not see Washington slapping new tariffs on Beijing on December 15 – this Sunday. Talks between the world’s largest economies continue with the self-imposed American deadline looming.

President Donald Trump has also remained optimistic, saying that negotiations are going on “very well.” Chinese officials have urged the US to drop its “cold war mentality.” but also express hope for an agreement.

Hopes for a resolution of the trade dispute have been weighing on the safe-haven US Dollar.

The greenback also awaits its central bank. The Federal Reserve is projected to refrain from cutting rates after three consecutive slashes. Nevertheless, Fed Chair Jerome Powell and his colleagues will likely rock markets with clues toward policy changes in 2020 – especially through the dot-plot.

See Fed Preview: Is the bar higher for hiking? Powell’s may down the dollar, three things to watch.

3) EUR/USD Technicals have improved

Euro/dollar has topped the 200 Simple Moving Average on the four-hour chart after recapturing the 50 and 100 SMAs beforehand. Downside momentum is waning, and the recent recovery and the currency pair is riding higher alongside uptrend support.

All in all, bulls are in the lead.

Resistance awaits at 1.1080, which was the high point on Monday. It is followed by 1.11, a round level that held it down last week. Further up, 1.1115 was last week’s high, and 1.1130 provided support several weeks ago.

Support awaits at 1.1010, which worked as support in mid-November and converges with the 50 SMA. It is closely followed by 1.1040, Friday’s low, and then by 1.0980 – November’s trough.