The RBA is less worried about a strong Aussie and employment in the land down under is improving. But that’s not all.

The team at SocGen explains why AUD is no longer of their favorite shorts:

Here is their view, courtesy of eFXnews:

Are AUD/USD short positions still attractive at current levels? Credit Suisse believes so, while CitiFX, and SocGen think otherwise.

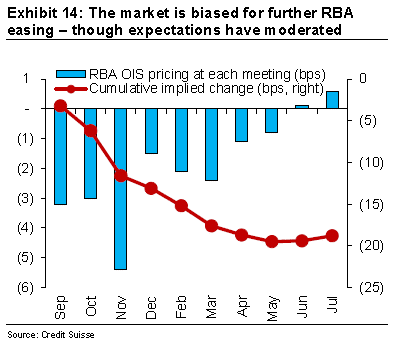

Credit Suisse: The RBA left rates unchanged and toned down its FX language in its August policy statement. While this caused a broad squaring of AUD shorts, we are not ready to throw in the towel on our bearish AUDUSD forecast profile. The bottom line is we see AUD’s jump as a short-covering rally to be faded rather than the start of a meaningful correction.

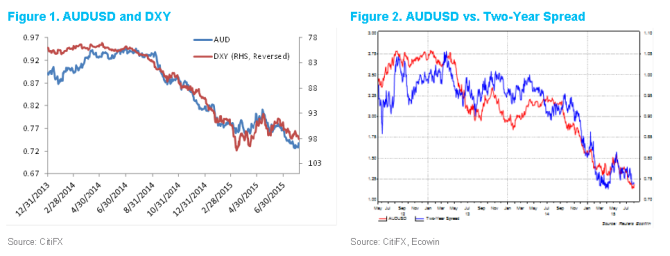

Citi: The recent price action neatly underscores that AUD is increasingly confronted by crosscurrents following the sustained depreciation of the past several years. Should the factors which have supported the dollar and weighed on AUD and other currencies remain in place, it looks reasonable to anticipate further weakening in AUDUSD. AUDUSD should no longer be the poster child for USD bulls and dollar buyers may be better served by looking at currencies such as CAD. Accordingly, there should be some scope for AUD outperformance on the crosses in the short-term if the market continues to move to reduce risk of additional rate cuts this year.

SocGen: The case for being long dollars is now mostly about the US. That is relevant in the case of the Australian dollar. The RBA this week removed the reference to wanting a weaker currency from its monetary policy statement. For months, there has been a reference to expecting further AUD weakness in light of soft commodity prices. The RBA actively promoting a weaker currency won’t prevent it from falling, if the Fed raises rates faster than expected, if the Australian economy weakens further or if commodity prices collapse further, but AUD is no longer one of our favourite shorts.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.