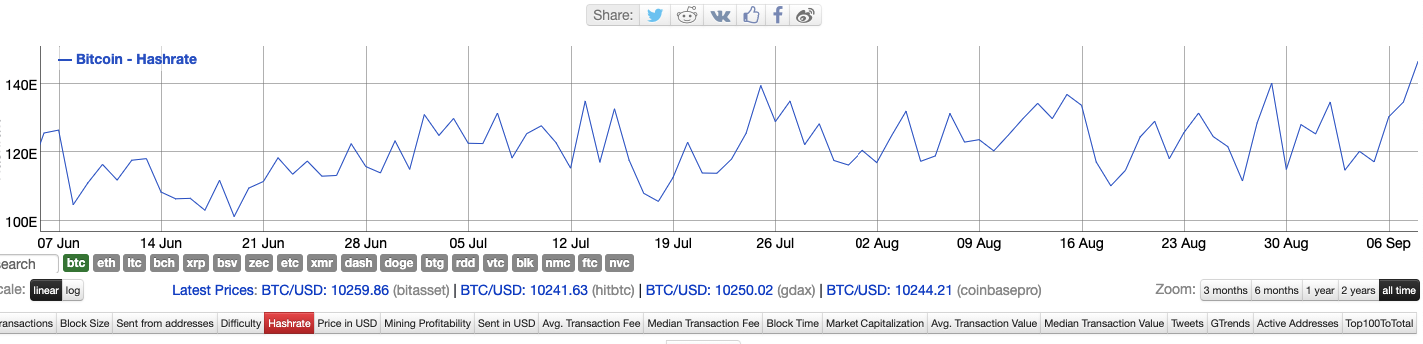

- Bitcoin’s hashrate has broken the 150 TH/s plateau for the very first time.

- A Crypto Compare survey shows that many believe Ethereum will continue to dominate the DeFi sector.

Bitcoin network hits a new hashrate record

Although Bitcoin’s price has been on a notable decline, the network’s hashrate has hit a new all-time high, breaking the 150 TH/s plateau for the very first time. Hashrate is used to measure the health of the Bitcoin network. It represents the amount of global hashpower dedicated to mining BTC.

Miners are one of the key players in the Bitcoin ecosystem. Their ongoing allocation of resources despite the recent turmoil in price appears to be a positive long-term indicator. However, industrial mining typically does not get affected by short-term price volatility and the business planning in it involves medium to long-term time horizons.

The overall economic uncertainty may also be another factor that is forcing more firms and individuals to allocate resources to BTC mining. This activity is often perceived as a hedge against traditional markets.

The young and adventurous prefer BTC over gold – Morgan Stanley

In a recent interview with CNN, Ruchir Sharma, Morgan Stanley’s head of emerging markets and chief global strategist, discussed the generational divide when it comes to investments. He said that while the older population is sticking with traditional finance, millennials are increasingly opting for cryptocurrencies.

Sharma has predicted inflation to come as early as 2021 in the US. He cited several monetary and fiscal measures that officials have taken to deal with the economic fallout of the COVID-19 pandemic.

There is this lingering feeling out there that given what central banks are doing in terms of printing so much money, there is a search for alternative assets.

He said that having around 5% of one’s portfolio in gold is “not a bad idea.” Sharma added that it’s wise to choose investments in Bitcoin and other cryptocurrencies.

In related news, Peter Schiff, a popular Bitcoin critic, took to Twitter to conduct a poll. He asked people to decide who was more trustworthy when it came to financial advice: a 57-year-old, experienced investor/business owner with 30 years of professional experience or an 18-year-old college freshman ((his son Spencer Schiff)) who’s never even had a job. Of the 82,906 surveyed, 81.3% chose “the kid.”

BTC/USD daily chart

BTC/USD has gone past $10,300 as the bulls regained control of the market this Thursday. crept back in following a bearish Tuesday. The RSI has gone up a little bit and is trending near 40.25 following this bullish price action. The buyers must have enough momentum to break past the $10,473.65 resistance level. Speaking of which, let’s check out the IOMAP from IntoTheBlock.

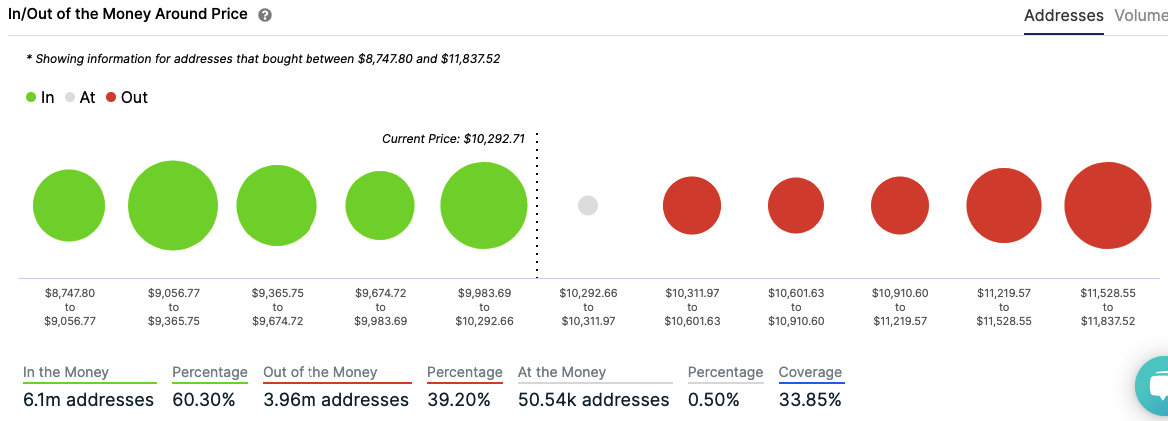

Bitcoin IOMAP

BTC is currently sitting on top of a healthy support level which prevents its drop below the $10,000-level. On the upside, the bulls have the space to go up to $11,200 before they encounter the closest strong resistance level. While we don’t believe that the buyers currently have the momentum to make that jump, BTC definitely has plenty of upside potential.

Ethereum

According to a Crypto Compare survey, over 60% of the respondents from Ethereum-based DeFi projects believe that Ethereum will remain the top DeFi network in the next three years. This is a counterpoint to the idea that rival blockchains with improved transaction throughput and lower costs will build out their own DeFi offerings before ETH 2.0 arrives.

The survey included participants from the token swap and pooling protocol Balancer, DeFi insurance provider Nexus Mutual and Kyber Network. Some of the other respondents included representatives from Augur, Argent, DDEX, Loopring and Staked. Crypto Compare has not specified the number of DeFi projects involved in the survey.

The survey participants also weighed in on the importance of security for the growth of the DeFi sector. About 50% of the surveyed believe that security is a 10-out-of-10 concern for the DeFi industry. Notably, no participant gave it a priority below 8.

Discussing the means to protect the expanding DeFi user base, 75% of respondents said that outside regulation is not necessary for the industry to reach mainstream adoption. Additionally, around 40% thought it was crucial for DeFi protocols to offer insurance protection for potential loss of user funds. However, others ranked it a 3 (out of 10) in terms of priority.

A majority of the respondents estimated that between 10% and 30% of the value within DeFi protocols comes from everyday users, compared to those looking to get in on speculative income.

ETH/USD daily chart

ETH/USD has gone up from $336.85 to $357.20 since yesterday as the bulls regained control. The MACD (moving average convergence/divergence) shows decreasing bearish momentum as the buyers aim for the $372.10 resistance level.

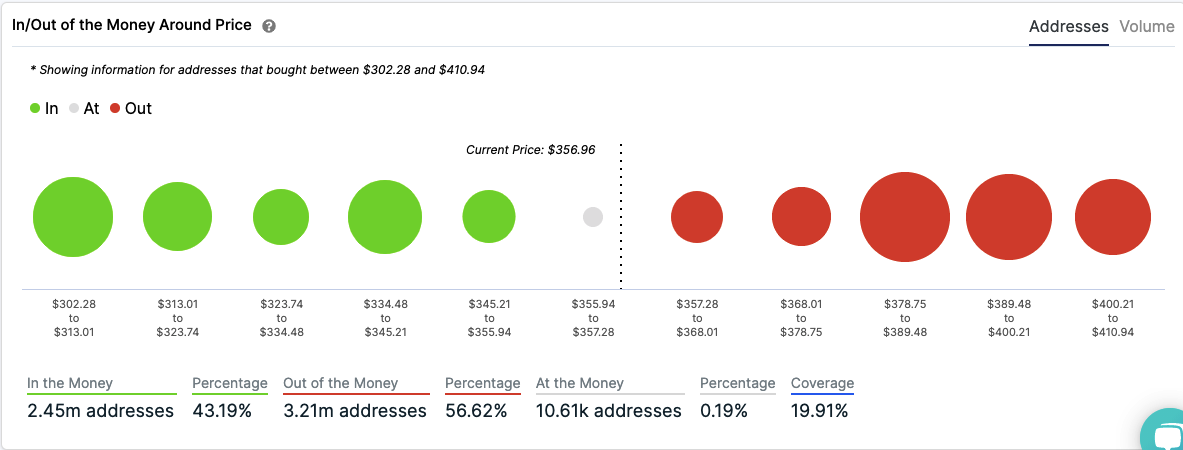

Ethereum IOMAP

Unlike BTC, ETH’s position is a lot less secure, as per the IOMAP. If the bears take back control, then the price can drop to $345.20 before it encounters the nearest healthy support level. On the upside, ETH/USD can go up to $378.75 before hitting the nearest strong resistance level

Ripple

XRP/USD daily chart

XRP/USD hasn’t enjoyed the same tearaway bullish sessions as BTC or ETH. XRP is presently priced at $0.24 as it bounced up from the $0.238 support level. The William’s %R indicates that the price is still undervalued so more bullish action is expected. While it will be unrealistic to hope that the price will reach anywhere close to the $0.2585 resistance level, we can safely assume for it to creep nearer the $0.25 psychological level.

-637352953719243622.png)

-637352960116929477.png)

-637352962277079495.png)