- Bank of England governor Mark Carney last Friday proposed the creation of a new global currency (preferably a digital currency).

- It is only after Bitcoin clears $10,281 hurdle that it will have the energy to assault the major resistance at $10,702.

- Ripple price has been lethargic since the drop under $0.3 with recovery movements pre-maturely cut short.

The trade war between China and the United States continues to escalate. The situation is having a blowback on the global economy. Besides, the United States economy is on the verge of a recession. The United States President Donald Trump keeps reacting to China’s advances, in turn, is making the situation worse. According to the Washington Post Trump now regrets the China trade dispute which has culminated in severe economic disputes.

“Yeah, sure, why not. Might as well. Might as well. I have second thoughts about everything,” Trump responds to a G7 reporter.

With that in mind, the Bank of England governor Mark Carney last Friday proposed the creation of a new global currency (preferably a digital currency). According to Carney, the dominance of the US dollar is hurting the global economy. There is always a negative blowback on the global economy when the US economy is suffering. However, a digital currency backed by central banks would greatly lower the dominance of the US dollar.

Amid the full-blown trade war between the two giant economies, the cryptocurrency market is relatively quiet. It is almost like the love the weekends had for the market is long gone. Most of the gains accrued on Friday have been slashed following minor dumping across the board.

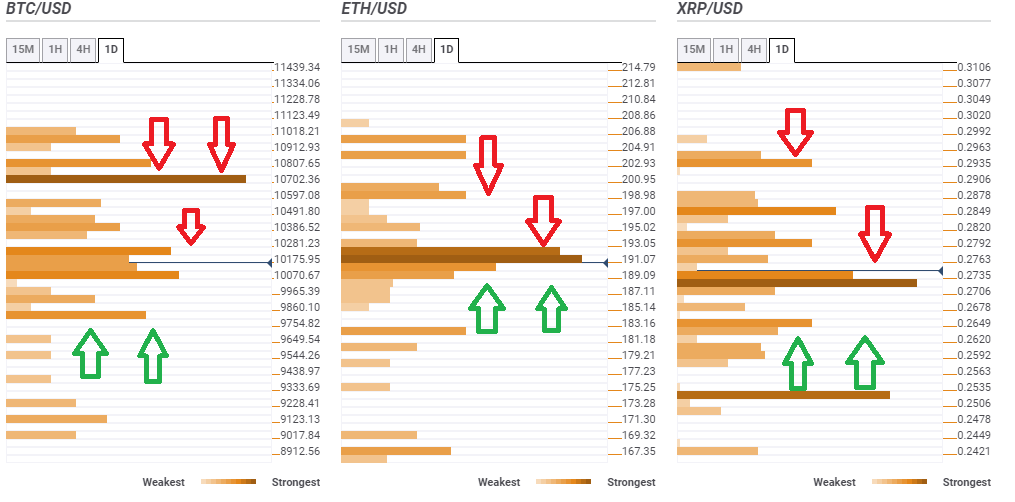

Confluence levels

Bitcoin price lethargic between key support and key resistance

Bitcoin price is in the middle of a retreat from the recent weekly high close to $10,500. The correction from $10,500 briefly dived under $10,000 before bouncing back up. At press time, Bitcoin is trading at $10,106 while the immediate upside is capped by $10,175. Forming the confluence at this zone include the Previous High 15-mins, SMA 100 1-h, Bollinger Band 15-mins upper, previous high 1-hour, previous high 4-hour and Bollinger Band 4-hour.

Glancing further north, the confluence tool highlights $10,281 as the next hurdle to be tackled. Here the price will encounter the BB 1-hour upper, SMA200 15-mins, SMA 4-h, SMA 50 1-h, Fibonacci 61.8% 1-week, and the Fib 61.8% 1-day.

It is only after Bitcoin clears this bump that it will have the energy to assault the major resistance at $10,702. The few indicators converging here range from Fib 38.2% 1-mins, SMA 100 4-h, 23.6% Fib 1-week and the pivot point 1-day R2. Beyond this zone, the remaining journey to $11,000 will be relatively smooth.

Ethereum needs one gigantic push to rise above $200

Ethereum price has in the past one week been confined under $200. There was an attempt to break above $200 on Friday last week, however, the bullish momentum lost steam at $196.87. The correction from the failed attempt sent Ether $190 once again. At press time, ETH/USD is exchanging hands at $189. The biggest task for Ethereum buyers is to propel the price past the key resistance zone at $191.01-193.05.

Various indicators meet here to form the confluence. Some of them include the previous high 15-mins, BB 15-mins upper, previous high 1-hour, previous 4-hour, SMA 200 15-mins, SMA 50 1-hour, Fib 61.8% 1-day the SMA 5 1-day among others. Once cleared, correction above $200 will be a walk in the park especially if a catalyst comes into play.

It is also very important that the buyers ensure that there are no price dips towards $180 due to the lack of formidable support areas. Despite the lack of strong support areas, losses could try to find refuge at $183 and $167.35.

Ripple conquers the biggest hurdle at $0.2735

Ripple price has been lethargic since the drop under $0.3. The recovery from the major support at $0.24 encountered resistance at $0.28 culminating yet another dive towards $0.26. However, at press time, a shallow recovery just stepped above the strongest resistance at $0.2735. The remaining hurdles are relatively weak starting at $0.2763, $0.2849 and $0.2935 according to the confluence tool.

On the downside, the initial support is observed at $0.2649. Hosted here are the Bollinger Band 4-hour lower, previous low 1-day and pivot 1-day S1. A new major support has been established at $0.2535. The Pivot Point Daily S3 and the previous year low form the confluence.

More confluence levels