- A tug of war between the bulls and bears persists across the crypto market.

- Ethereum set to book 2% weekly gains while Ripple lags.

- Bitcoin unable to sustain the move higher above $9700.

The most dominantly traded crypto coin, Bitcoin, is side-lined below 9700 heading into the weekly closing. Ethereum and Ripple follow suit amid a lackluster trading activity seen across the crypto space on Sunday. Ethereum, however, outperforms the rest two on a weekly basis, as it remains on track for 2% weekly gains. The total market capitalization of the top 20 cryptocurrencies now stands at $274.88 billion, as cited by CoinMarketCap.

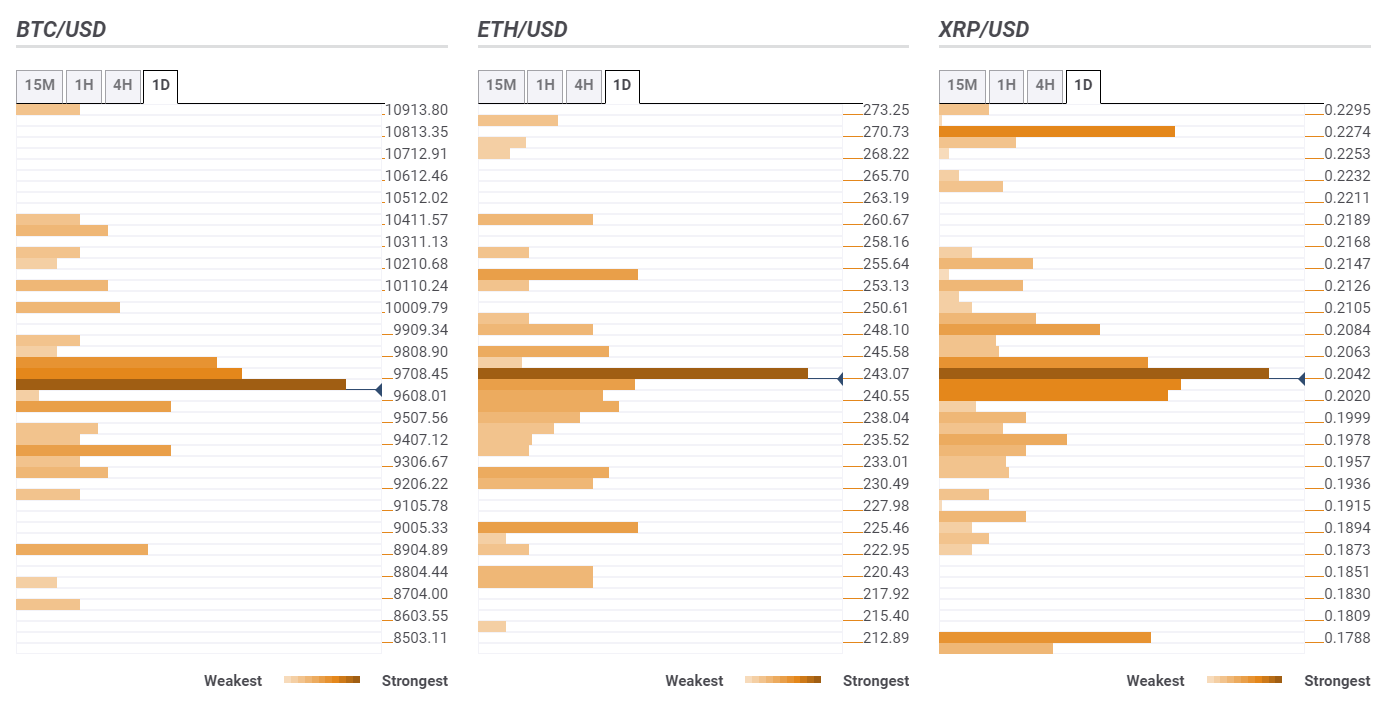

The top three coins are awaiting fresh impetus/ catalyst, with FXStreet’s Confluence Detector indicating key support and resistance levels to consider ahead of a new trading week.

BTC/USD: Path of least resistance appears to the downside

Amid broader market indecision, Bitcoin is likely to face stiff resistance at 9708, the confluence of Fib 61.8% 1D, Fib 23.6% 1M and SMA 200 1H, on a convincing upside break.

The immediate hurdle above the latter is aligned at 9758, where SMA 10 1D, SMA 100 1H and Bollinger Band 1H Middle intersect. Next up, the bulls aim for 9808 (Fib 38.2% 1W and Previous Day High).

To the downside, the immediate downside should find minor support at 9558, Fib 23.6% 1W and Previous Day Low.

Should the bulls fail to defend the aforesaid support, the selling pressure will likely accelerate towards 9500 amid a lack of significant supports.

ETH/USD: 243.07 is the level to beat for the bulls

According to Ethereum’s near-term technical view, the ETH bulls are struggling to extend the recent recovery mode, as the 243.07 level remains a tough nut to crack. That level is the confluence of Fib 38.2% 1D, SMA50 1H and SMA5 4H.

The bullish pressure will likely intensify above that level, triggering an extensive rally towards 255.64 (Previous Week High and Pivot Point 1W R1), in absence of strong resistance levels.

Alternatively, a cluster of supports is seen around 240-238, which could likely limit the losses. A breach of the latter could open floors towards the next relevant support at 225.46, the Previous Week Low and Pivot Point 1W S1.

XRP/USD: 0.2000 is critical to hold the upside

Ripple is trapped in an extremely tight range just above the 0.20 handle, with the immediate upside capped around 0.2050, the major confluence zone of Fib 38.2% 1D, SMA200 4H and SMA5 1D.

A sustained breakthrough above the last could test the 0.2063 level (Previous Day High). A bullish break to the upside is likely to fuel a rally in the spot towards the next significant resistance, now located at 0.2274 – Previous Month High and Pivot Point 1M R1.

The coin lacks a clear directional bias, at the moment, as the bears challenge the 0.2020 support, the intersection of Fib 61.8% 1D and SMA50 1D.

A break below the last would call for a test of the psychological 0.2000 level, which is critical to hold the near-term recovery momentum.

See all the cryptocurrency technical levels.