- Ethereum can fly to $245 if it exceeds $223.

- Bitcoin gets stuck at $ 10,600 and provides breathing space for Altcoins.

- XRP fails to react and remains in pause mode.

The upward movement of Bitcoin in recent sessions has consolidated, and the King of Cryptocurrencies continues to move higher in today’s session.

At the time of writing, Ethereum has joined the rally and as I explain in the technical section, has a short-term goal of approximately $250.

The week comes to its end with a battery of news that I consider positive in the medium and long term – and all have one thing in common – regulation.

The Crypto market needs regulation that allows fighting against money laundering and the use of cryptocurrencies in criminal payments – and that is what is happening.

Authorities are seeking to regulate – not forbid – the use of digital coins. And that is excellent news for the market.

On the other hand, some analyses point to the new tariffs announced by President Donald Trump against China as the cause of today’s increases. Without the necessary regulation, few market players can invest significant amounts in crypto assets.

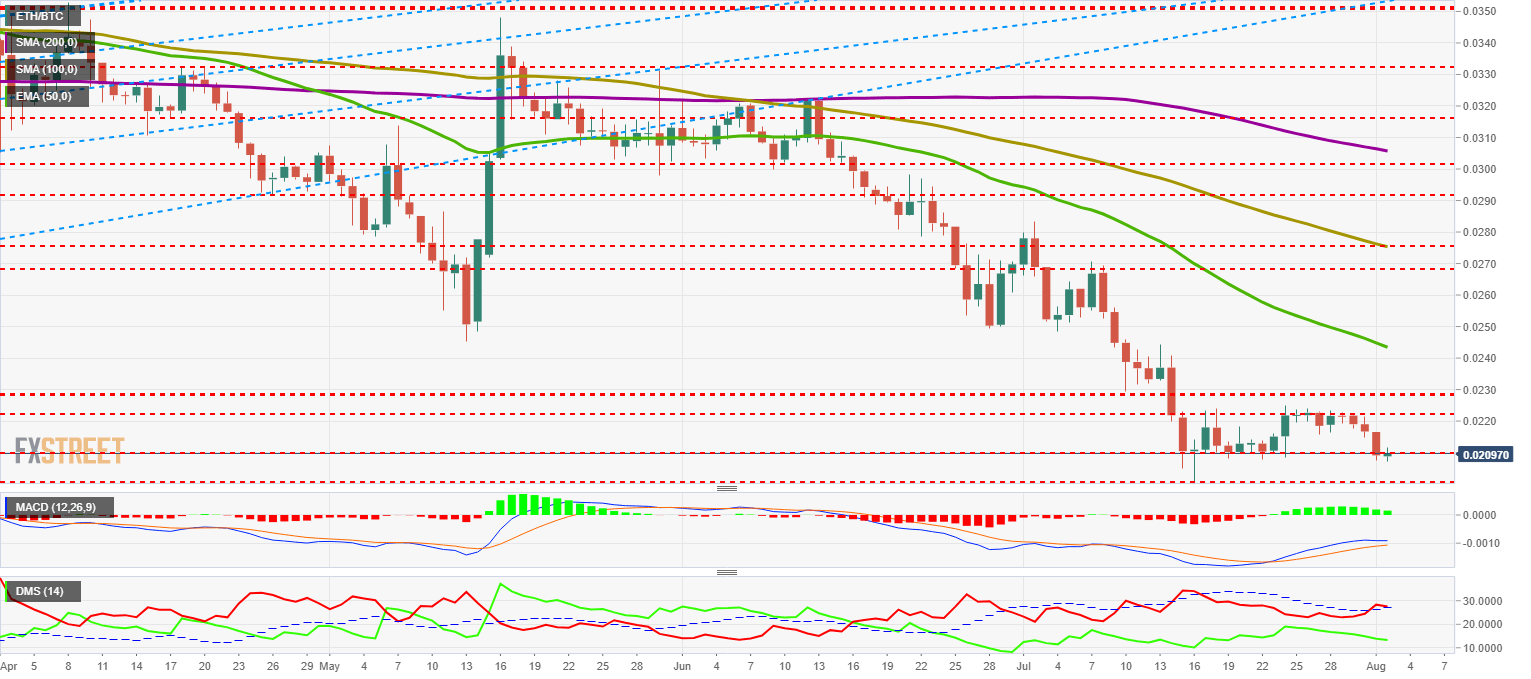

ETH/BTC Daily Chart

The ETH/BTC pair is currently trading at 0.02097 and remains at a level of agony that is a drag on all Altcoins.

The structure of moving averages indicates that the current scenario may still persist for several months. All three are inclined downwards, and if they ever decide to change direction, it will not be a quick process.

Above the current price, the first resistance level is at 0.0221 (price congestion resistance), then the second at 0.023 (price congestion resistance) and the third one at 0.0245 (EMA50).

Below the current price, the first level of support is at 0.021 (price congestion support), then the second at 0.020 (price congestion support), and the third one at 0.0155 (double price congestion support).

The MACD on the daily chart loses both the openness between the lines and the bullish cross. The most likely development is a lateral movement until the lines come closer together – and there is a bullish rejection.

The DMI on the daily chart shows bears ready for another attempt to breach the ADX line, which would resume the bearish trend. The bulls are not convinced of their possibilities and continue to retreat – waiting for better moments.

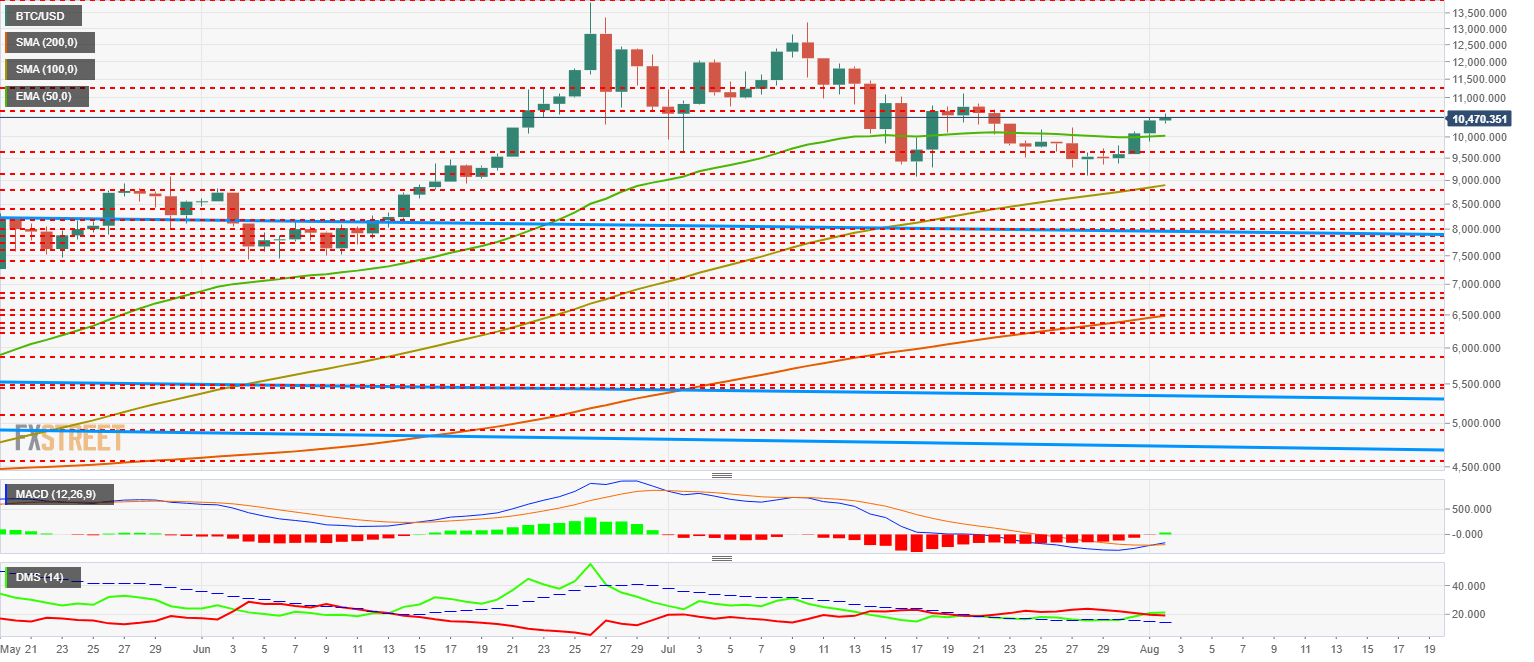

BTC/USD Daily Chart

BTC/USD is trading at $10.470 and has reached the price congestion resistance level of $10.675.

Beyond this first resistance level, the second is at $11,300 (price congestion resistance) and the third one at $14,000 (price congestion resistance and relative highs).

Below the current price, the first level of support is at the EMA50 conquered two days ago at $10,000. The second support level is at $9,635 (price congestion support) and the third one at $9,200 (price congestion support).

The MACD on the daily chart confirms the bullish cross and also confirms that Bitcoin does not usually comply with the pattern called “MACD Cut Failure.” The structure of the bullish cross is still very fragile, but changes the market background and leads us to improve the outlook on Bitcoin from bearish to bullish.

The DMI in the daily chart shows the bulls getting ahead for the first time since mid-July. The bears remain close, which confirms the fragility of the current technical situation.

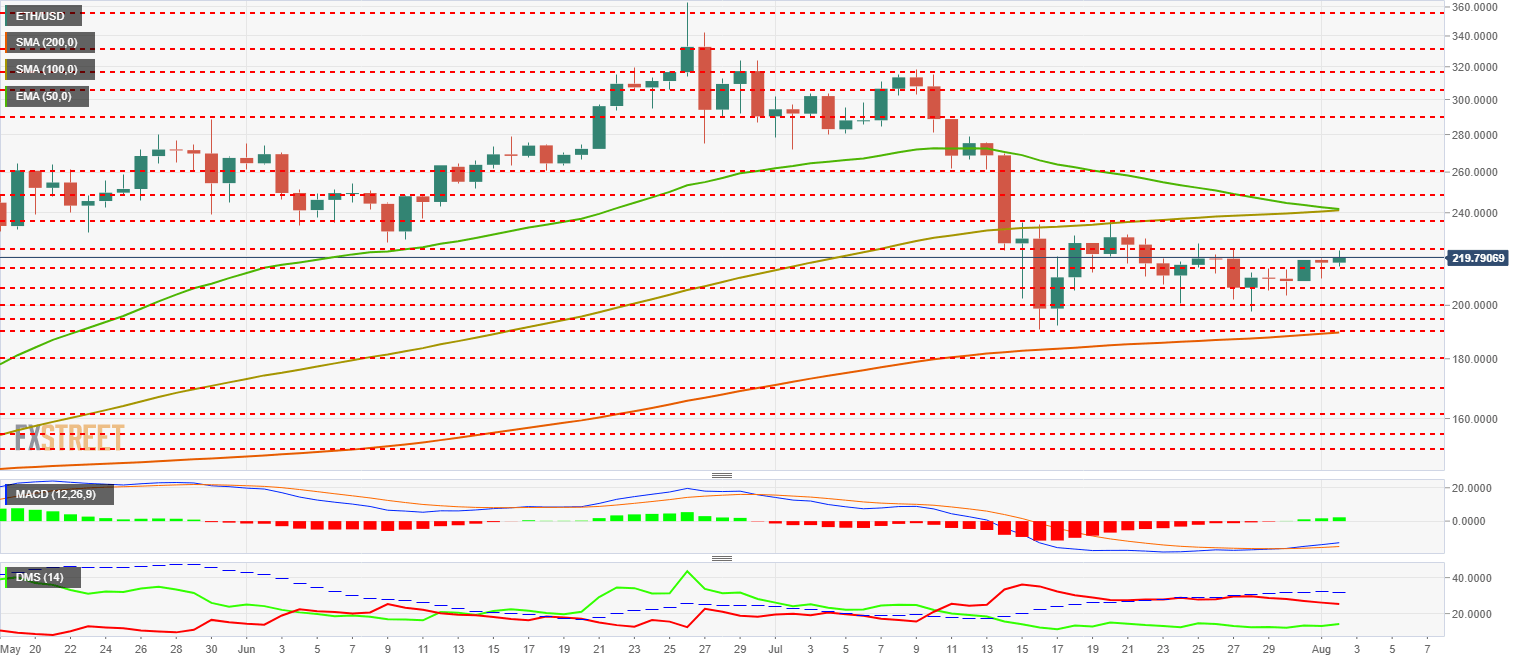

ETH/USD Daily Chart

ETH/USD is trading at $219.7 after its first attempt to cut price congestion resistance at $224 (price congestion resistance).

I note that on the 4-hour chart, Ethereum has surpassed the EMA50 and the SMA100, with the exponential MA close to crossing upward to against the simple MA. Above this price level, the SMA200 moves at $248.2.

Above the current price, the first resistance level is at $224 (price congestion resistance), then the second at $235 (price congestion resistance, EMA50, and SMA100) and the third one at $248 (price congestion resistance).

Below the current price, the first level of support is at $215 (price congestion support), then the second at $207 (price congestion support) and the third one at $200 (price congestion support).

The MACD on the daily chart continues to develop the bullish cross, which is gradually increasing both its slope and the line spacing. This slow start could indicate consistent development over time.

The DMI on the daily chart shows us how the bears continue to lose strength, and today, finally, the bulls begin to show interest in increasing their trend strength.

XRP/USD Daily Chart

XRP/USD remains in the same range it fell to in the mid-July drop. The Ripple Token does not capitalize on the change in the tone of the market.

Above the current price, the first resistance level is at $0.32 (double price congestion resistance), then the second at $0.328 (price congestion resistance) and the third one at $0.335 (price congestion resistance).

Below the current price, the first level of support is at $0.308 (price congestion support), then the second at $0.30 (price congestion support) and the third one at $0.296 (price congestion support).

The MACD in the daily chart continues to cross higher. That the price is not following this technical setup is a clear divergence that must be regulated by one of the two sides. Either the price goes up, or the indicator turns around.

The DMI on the daily chart shows both sides of the market in the same positions as in recent weeks and with no apparent change intention.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel