- Cryptocurrencies are giving up gains earned on Tuesday.

- Bitcoin is doing relatively well as compared to altcoins.

- Here are the levels to watch according to the Confluence Detector.

Cryptocurrency market shifted back into the red zone as Binance news weighted on the market sentiments. The world’s largest cryptocurrency exchange experienced a severe security breach that cost it over $40 million. The head of the exchange Zhao said that only the hot wallet was compromised, though the case is another reminder of the vulnerabilities of the nascent industry.

The total capitalization of all digital assets in circulation dropped to $184 billion from the recent peak of $189. Bitcoin, the most popular digital asset, is hovering around $5,800, mostly unchanged on a day-on-day basis. Meanwhile, major altcoins experience much deeper drawdowns, which is consistent with the theory of Bitcoin divergence form the rest of the pack.

So, what levels should we watch?

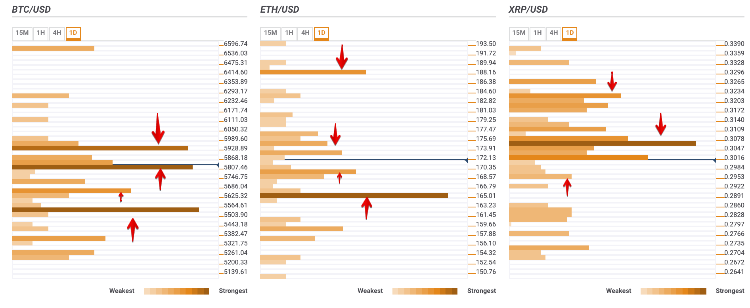

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD dances around $5,800

A strong support located right below the current price consists of SMA50 1-hour, SMA200 15-min and 61.8% Fibo retracement daily. Once it is out of the way, the sell-off ma be extended towards $5,630 (April’s high and Pivot Point 1-day Support 1).

The key support awaits us on approach to $5,550, created by 161.8% Fibo projection daily, and 38.2% Fibo retracement weekly.

On the upside, 23.6% Fibo retracement daily and the upper boundary of 4-hour Bollinger Band create a formidable resistance on approach to $5,930. It separates us from psychological $6,000 with Pivot Point Week R1, the previous daily high and Pivot Point day R3 located below this barrier.

ETH/USD gives back gains

Ethereum is hovering above $170.00, which is a strong local support created by SMA100 1-hour, 38.2% Fibo retracement daily and the middle line of 4-hour Bollinger Band. However, the critical barrier is seen on approach to $165.00, strengthened byy a confluence of SMA100 4-hour, DMA10 and 38.2% Fibo retracement weekly.

There are few strong hurdles above the current price, though $172.50 may create a local barrier strengthened by previous 4-hour high and 23.6% Fibo retracement daily. The ultimate resistance is seen on approach to $188.00 (previous month high and Pilot Point 1-day R1).

XRP/USD is about to break below $0.30

Ripple, currently at $0.2997, is vulnerable to further losses as there are no strong support levels below the current price. Once the breakthrough is confirmed, the sell-off may be extended towards $0.2930 (Pivot Point 1-day Support 2 and the previous week low).

On the upside, a strong resistance is created on approach to the psychological $0.3100 with several technical levels clustered there. They include SMA100 and SMA50 4-hour, 61.8% Fibo retracement daily, DMA5 and DMA10.

Once it is out of the way, the recovery may be extended towards the next upside barrier on approach to $0.3200. It is protected by the previous week high and the Pivot Point 1-week R3.