- Peter Brandt claims that Coinbase is going bankrupt, lists several reasons why.

- Coinbase accused of delayed response to customer inquiries and complaints.

- The US-based firm waits for direct IPO review and approval by the SEC.

Coinbase has, over the years, grown to become one of the leading cryptocurrency exchange platforms in the world. It is by far the most prominent digital exchange firm in the United States. However, poor customer service, imposed withdrawal limits and delay in execution of withdrawal requests, among other complaints, have seen renowned trader Peter Brandt believe that it is heading fast to bankruptcy.

Is Coinbase growth on an uptrend or downtrend?

Brandt has been a trader since 1975, mainly in the futures and forex markets. He claims to have “been involved in three bankruptcies of brokerage firms (Mann, Refco and Peregrine). According to him, he has the privilege of knowing the clues that are likely to lead a firm like Coinbase to bankruptcy.

Some of the signs of doom Brandt highlighted include “impossible customer service, limits on withdrawals and outrageous fees.” The veteran traders added that Coinbase is fond of taking the “other side of customer sell orders way below its posted daily low (above listed high),” something that he says is unheard of in the futures market.

Despite Brandt’s authority in the financial markets, some people responded, saying that he is mistaken with the claims. According to another renowned trader, @NebraskanGooner (as seen on Twitter), Coinbase has a reputation for not responding to inquiries fast, but is not anywhere near bankruptcy, especially with the high fees the exchange charges.

On the other hand, Coinbase has applied for an initial public offering (IPO) that had been scheduled to take place in March, but according to a report by Bloomberg, it was pushed to April. Coinbase hopes to have a direct listing to the public following approval by the Securities and Exchange Commission (SEC).

In line with the impending public listing, it is unlikely that Coinbase is going bankrupt. However, many agree that the company takes too long to address customer inquiries, something that could be tinting its image.

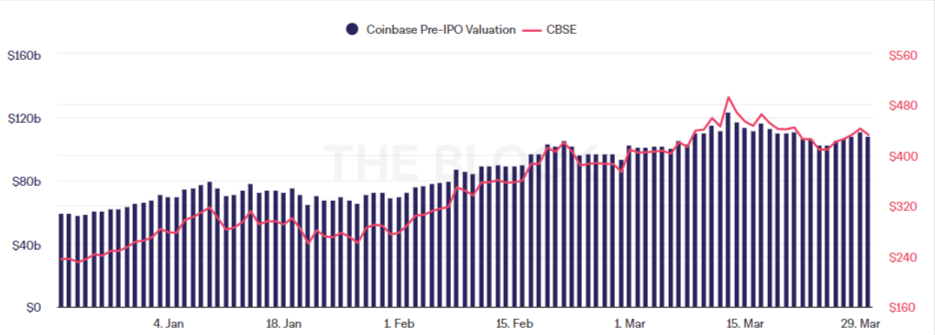

Coinbase pre-IPO stock price

Data provided by Coinbase shows that Coinbase pre-IPO stock price stands at $421.55. The stock is expected to trade under the symbol CBSE. The cryptocurrency exchange platform has more than 43 million registered users, who continue to grow with each passing year. Besides that, Coinbase has over 2.8 million monthly transaction users.