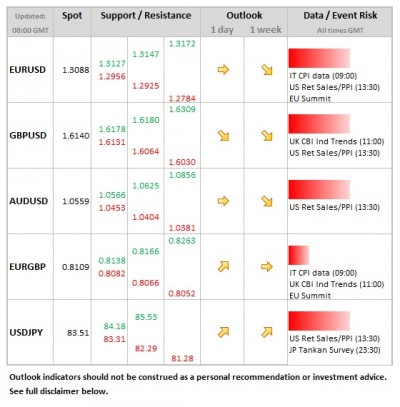

- EUR: Leaders gather today for two-day summit, but expectations have been managed downwards ahead of the event and agreement on banking supervision by finance ministers last night may be held up as the main big win of the week, reducing pressure on heads of state to come up with something to appease markets.

- GBP: CBI trends data of modest interest, showing how the industrial sector is fairing. But sterling has been less sensitive to data of late, so would need strong figure – must stronger or weaker vs. expectations – to impact.

- CHF: The SNB Quarterly Policy Review takes place today with news conference taking place at 09:00. The focus is on negative deposit rates, now that some retail banks are charging these on customer deposits and ECB was discussing the possibility last week, so some potential for weaker CHF if idea is aired.

Idea of the Day

EUR/JPY is squaring up for an attack on the 110.00 level before year-end, close to the peak that the pair failed to sustain seen in late March/early April. The high for the year is at 111.44. The cross has moved 8.5% over the past month, so once again a move could struggle to be sustained above 110. Fundamentally, the yen is naturally focused on the election mid-month. For the euro, last night’s agreement to centralise banking supervision in the eurozone is key in that it represents one of the biggest shifts of power away from domestic institutions since the start of the eurozone (leaving aside those which have happened through bailouts). If more follow, it could show that Europe is willing to make the tough choices needed to shore up the foundations of the single currency.

Latest FX News

- JPY: Weaker overnight and not that far from 84.18 high for the year (0.6% away). Focus on Tankan survey released early Friday which could prompt highs for year on USD/JPY if on the weak side.

- GBP: There was a brief bid on the back of the labour market data yesterday, but sense is that sterling is struggling to sustain gains on better data, knowing that growth is set to remain low, inflation will creep higher and for now there is little that BoE can do on the policy front.

- USD: The US central bank decided to buy an additional USD 45bn of government bonds per month after its meeting yesterday, this on top of the USD 40bn per month of mortgage-backed securities. Perhaps more importantly, it tied its future commitment of policy to both a level for both the unemployment rate (6.5%) and for inflation (2.5%), pledging to keep rates low until these levels are achieved.