The manufacturing sector in the U.S. strengthens in 2016, indicating that inflationary pressures will firm, pushing consumer prices closer to, or overshooting the Fed’s 2% target rate.

The manufacturing sector in the U.S. measured by Markit and the Institute of Supply Management showed one of the strongest yearly performances in recent times. Latest data released earlier last week showed both gauges of the manufacturing sector rising strongly, finishing the year with a bang.

Markit’s measure of manufacturing showed that the PMI accelerated to 54.3 in December, recording a 21-month high. The data was also underpinned by the fastest increase in payroll numbers since June 2015. Business conditions were also seen improving at the fastest pace since March 2015.

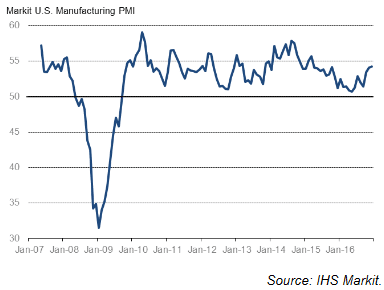

Markit’s manufacturing PMI has been broadly stable since early 2011 as the manufacturing PMI gauge has been hovering between the 60 and 50 levels, indicating expansion. But since early 2014, Markit’s gauge of manufacturing has been trending weaker after a steady increase towards 57. This decline has shifted with the U.S. manufacturing PMI showing a steady increase since late 2015 – early 2016.

December’s reading of 54.3 was the highest and was seen increasing from November’s headline print of 54.1. The effects of a stronger U.S. dollar were missing as the manufacturing PMI advanced on all fronts. Experts were of the opinion that a stronger exchange rate for the U.S. dollar could make exports less competitive and was seen as one of the headwinds for the manufacturing sector. This was evident from the comments from Chris Williamson, Chief Business Economist at IHS Markit who hinted that most of the demand was coming from domestic customers. But he sounded optimistic noting that the underlying pressures show that manufacturing strength was likely to persist into 2017.

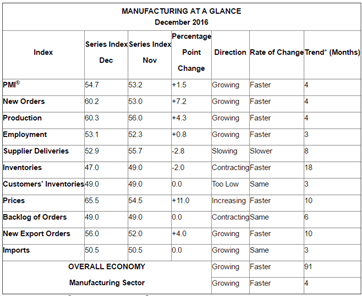

In a separate report released by the Institute of Supply Management (ISM), the manufacturing PMI rose 1.5 points from November’s print to record 54.7 in December. Looking into the details, the ISM’s manufacturing PMI showed a similar story to that of Markit’s findings with new orders rising to the highest levels since 2014. December’s ISM manufacturing PMI was 0.9 points higher than the forecasts and 1.5 points higher from November’s 53.2. The ISM prices paid rose 11 points to 65.5 in December indicating that the underlying economy was gaining momentum. New orders jumped 7.2 points to reach the highest levels since 2014.

With both the new orders and production index hitting multi-year highs, the data suggests that 2017 is likely to continue on a bullish note with factories seen gearing up to meet demand.

The recent uptick in optimism was seen coming after the U.S. elections in November last year. Trump’s focus on manufacturing jobs alongside tax and regulatory reforms were seen as some of the key elements boosting confidence across several industries that are seen to benefit from the proposals.

ISM’s employment index was also stronger, rising to a one year high in December, recovering from the declines posted a month ago. Still, experts warn that despite the robust data, manufacturing remains just part of the puzzle. But elsewhere, the signs are stronger that inflation could strengthen in the near term.

With the prices paid index surging to 65.5 in December and eighteen commodities rising in price against just three declines, indicates that inflation is firming and not just on the backdrop of higher oil prices. Although the energy prices have contributed to inflation, the rising economy activity is seen putting pressure on a variety of input costs which underlines the risks that inflation could potentially overshoot the Fed’s 2% target sometime this year.