The Canadian dollar enjoyed another strong week, as USD/CAD dropped 120 points. The pair closed the week at 1.2927.This week’s key event is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

Canadian GDP contracted by 0.2%, a second straight quarter of negative growth. Over in the US, Non-Farm Payrolls shocked the markets with disastrous gain of only 38K jobs. The US dollar was broadly lower on Friday as a result, and USD/CAD posted sharp losses.

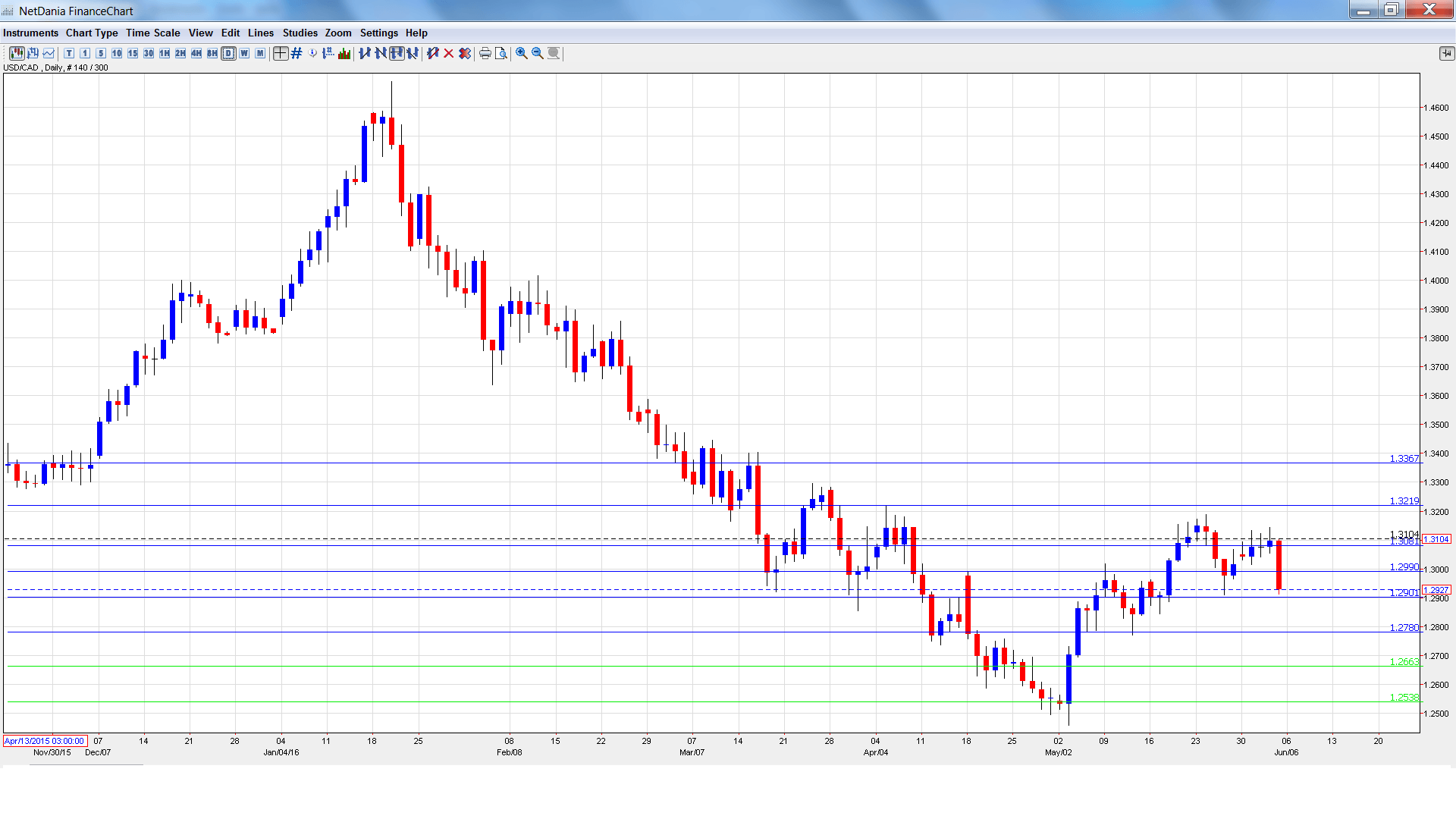

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Ivey PMI: Tuesday, 14:00. The week kicks off with this key event. The index improved in April to 53.1 points, above expectations. The upward trend is expected to continue in May, with an estimate of 54.2 points.

- Housing Starts: Wednesday, 12:15. Housing Starts dipped in April to 192 thousand, shy of the estimate of 195 thousand. The markets are expecting a slight gain in May, with an estimate of 194 thousand.

- Building Permits: Wednesday, 12:30. The indicator has been alternating between gains and declines. In March, the indicator declined 7.0%, worse than the forecast of -4.6%. Will we see an improvement in the April report?

- NHPI: Thursday, 12:30. This housing inflation index provides a snapshot of the level of activity in the housing sector. The index has been steady, posting two consecutive readings of 0.2%. The forecast for the April report stands at 0.3%.

- BOC Financial System Review: Thursday, 14:30. This report is published twice a year, and examines the strengths of the financial system as well as risks to financial stability. A press conference hosted by BOC Governor Stephen Poloz follows.

- Employment Change: Friday, 12:30. This key indicator should be treated as a market-mover. The indicator declined by 2.1 thousand in April, below the estimate. Better news is expected in the May release, with an estimate of 1.1 thousand. The unemployment rate is expected to hold steady at 7.1%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3048 and touched a high of 1.3144. The pair then reversed directions and dropped to a low of 1.2913, as support held firm at 1.2900 for a second straight week (discussed last week). USD/CAD closed the week at 1.2927.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

1.3367 has provided resistance since mid-March.

1.3219 was a cap in April.

1.3081 has some breathing room in resistance as USD/CAD posted sharp losses.

1.2990 has switched to resistance. It is an immediate resistance line.

1.2900 is a weak support line.

1.2780 is next.

1.2663 has held firm in support since early May.

1.2538 is the final support level for now.

I am bullish on USD/CAD

The dust hasn’t yet settled from Friday’s dismal NFP report. This weak release could lead the Fed to remain on the sidelines in June, but a July move remains on the table. Canadian GDP contracted, pointing to an economy in trouble.

Our latest podcast is titled Payroll Problem and Rate Readiness

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.