- The UK is expected to report a relatively modest 0.5% growth rate in the last quarter of 2020.

- Investors likely anticipate a more robust figure following upbeat comments by the BOE.

- Elevated real estimates and a recent GBP/USD rally point to a downside scenario.

Another Friday, another “buy the rumor, sell the fact” awaits GBP/USD traders – but this time to the downside. Investors raised their expectations for US Nonfarm Payrolls following a string of upbeat leading indicators – and they fled the dollar when the figure dropped and only met original estimates. The same scenario is on the cards for GBP/USD and the UK’s Gross Domestic Product statistics for the fourth quarter of 2020.

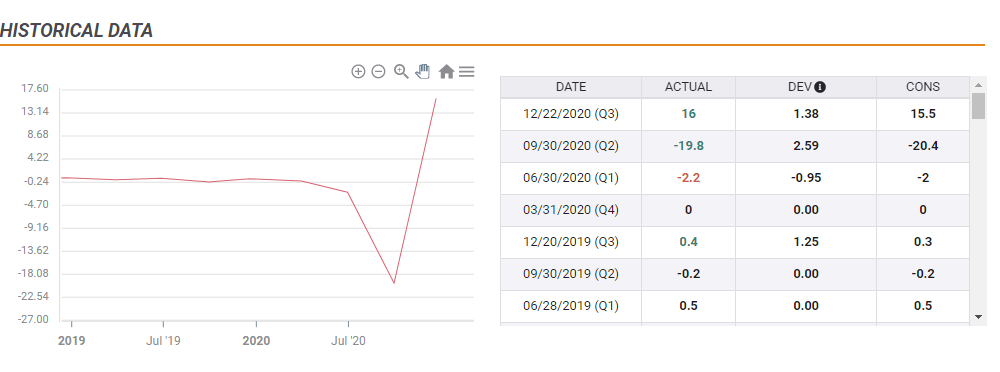

FXStreet’s Economic Calendar is pointing to a quarterly increase of 0.5% in GDP – a decent growth rate in pre-pandemic times, but only a modest change in output as the economy struggles to catch up. These estimates are likely based on the UK’s on/off lockdowns during the turbulent autumn months and uncertainty about Brexit.

On the other hand, the Bank of England provided a more upbeat estimate. While the headlines focused on lower projections for 2021, the BOE said that it is content with how the economy held up in the last three months of 2020 – setting the stage for more robust growth moving forward.

GBP/USD Reaction

Are the bank’s comment on resilience worth only 0.5% quarterly growth? Probably not, especially after the second quarter’s comeback – no less than 16% between July and September. Traders are well aware of the comparison and the BOE’s words and have likely priced in a better figure. What kind of surprise is pried in? An increase of 1% seems reasonable.

There is a good chance that GDP beats the estimates on the calendar but fails to exceed real, higher ones, and that may lead to a sell-off in the pound.

Moreover, sterling may suffer selling pressure after a rally that may have gone too far, too fast. Several indicators such as the Relative Strength Index on the four-hour chart are pointing to overbought conditions. While some of the rises is related to dollar weakness rather than high-expectations for UK GDP, the result will likely be similar.

Conclusion

The BOE hinted that the UK economy probably grew at a stronger rate than 0.5% expected – yet that may already be in the price and could trigger a “buy the rumor, sell the fact” response.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits