Significantly worse than expected data in the UK: the manufacturing purchasing managers’ index dropped to 49.2 points, under the 50 point threshold separating growth and contraction.

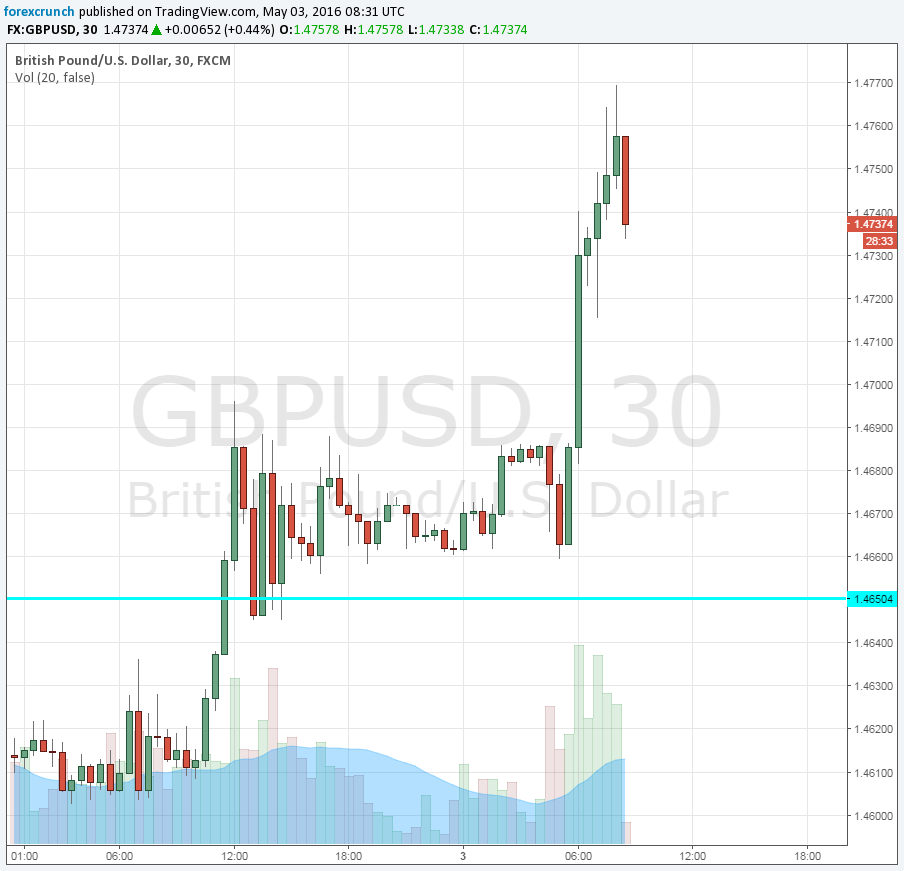

GBP/USD falls from the sky high levels of to 1.4740. Update: the drop extends. In many cases, the effect of UK data is strong but relatively short-lived. Will this release be different?

Here is how it looks on the 30 minute chart, which reflects the turnaround in price:

Markit’s UK manufacturing PMI was expected to edge up from 51 to 51.2 points, stil showing relatively poor growth in the weakest sector of the British economy.

GBP/USD was surging ahead of the publication, taking advantage of the weakness of the greenback. The US dollar was on the fall, extending its losses across the board.

Resistance awaits at 1.48 and support at 1.4650.

More: GBP/USD: En-Route To 1.46-1.48 – Nordea

Another factor helping the pound is that markets are now less fearful of a British exit of the EU.

Later this week we will also hear the construction and services PMIs. The most important publication is for the services sector, as it is the largest in Britain.