Geopolitical risks are weighing on market sentiment this morning, after the downing of a Malaysian Airlines flight over Ukraine yesterday. With the tragedy likely to raise tensions between Russia and the West, traders are entering the weekend in defensive positions. Stock indices are broadly down, while crude oil and the Japanese yen are seeing aggressive purchases.

The fear response has been limited however, with many market participants reassured by the prospect of further central bank intervention in the event that the conflict takes a toll on the real economy. As a result, the US dollar is trading sideways.

More: EUR/USD < 1.35: 6 reasons and the next levels

The euro is sitting near a five-month low relative to the yen, after a string of policymaker statements suggesting that markets have become too optimistic on the common currency zone’s prospects. European stock markets remain weak, but losses appear to be contained within export-sensitive sectors thus far.

The loonie is treading water, with Wednesday’s dovish Bank of Canada announcement combining with this morning’s higher-than-expected inflation reading to keep the currency tightly rangebound. Prices rose by 2.4% on an annualized basis in June, marginally above market forecasts. While this may help to offset Poloz’s caution on the economy, we don’t expect the effect to last long – over the weekend, the focus will turn back toward the crude price and the domestic housing market, both of which are likely to be more volatile in the months to come.

Flemished Buyers:

Known more for waffles and a pretty solid football team than for its economic prowess, the tiny Kingdom of Belgium has recently become one of the world’s largest owners of US Treasury bills.

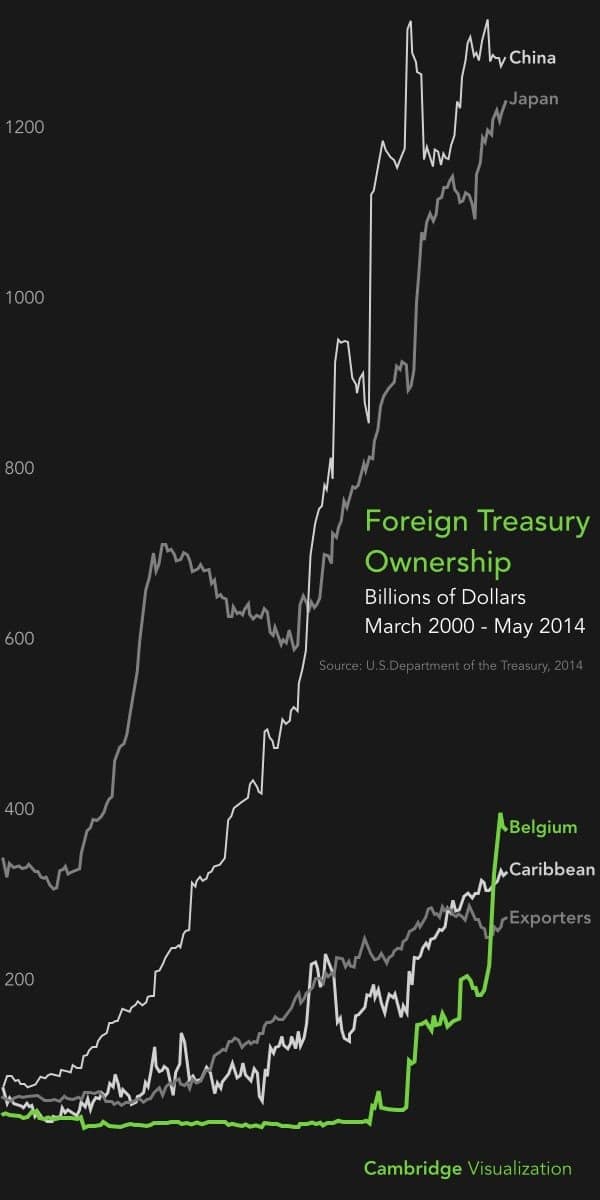

The graphic below illustrates the top five foreign ownership groupings of US Treasury bills, bonds and notes that are reported monthly under the Treasury International Capital (TIC) reporting system. As depicted, Belgian holdings have surged past those from traditional offshore banking centres in the Caribbean, and have outstripped the massive purchases made by the world’s biggest oil exporters.

Various explanations have been discussed in the foreign exchange community over the past few months, with two themes seeming the most significant – on one hand, banks may be increasing usage of Euroclear, the central securities depository that is headquartered in Brussels in response to new regulatory rules, while on the other, sovereign buyers may be using the country’s custodial services to make purchases more secretively.

In particular, it seems likely that China is increasingly routing its purchases through the tiny nation. After appearing to put the country on a path toward sustainability in the last few years, Chinese policymakers appear to be engaging in a massive stimulus programme, accelerating infrastructure investment, creating vast amounts of credit – and intervening in the currency markets to depress the yuan’s external value.

To do so, the country’s reserve managers must enter the world’s deepest and most liquid market – the Treasury market. To do so without political fanfare, they must use a proxy investor.

If this is the case, it would appear that China’s purchases are even larger than previously thought – and that the world could be tipping back into a severely imbalanced state once again. Watch this space.

**Oil Exporters include: Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates, Algeria, Gabon, Libya, and Nigeria.

***Caribbean includes: Bahamas, Bermuda, Cayman Islands, Netherlands Antilles, and Panama. From June 2006, also includes British Virgin Islands.