Brad Jones, Head of Economic Analysis at the Reserve Bank of Australia said in a keynote address at the minerals week Australia-Asia investment outlook, ” in Australia, it would seem premature to completely rule out the possibility of an overhang of cautious behaviour by households and firms, as seen internationally following previous shocks like the Great Depression and the GFC.”

”However, the unusual origins of the COVID-19 shock, and the fact that in Australia at least, many household and business balance sheets are in better condition today than before the pandemic, suggests the domestic economy could follow a quite different trajectory compared to past rare disasters experienced abroad. This is consistent with our central scenario for the Australian economy and the surprising strength in the domestic recovery to date.”

Full speech

AUD implications

There was no reaction in the market as it awaits the result of the first quarter Gross Domestic Produce later in the shift.

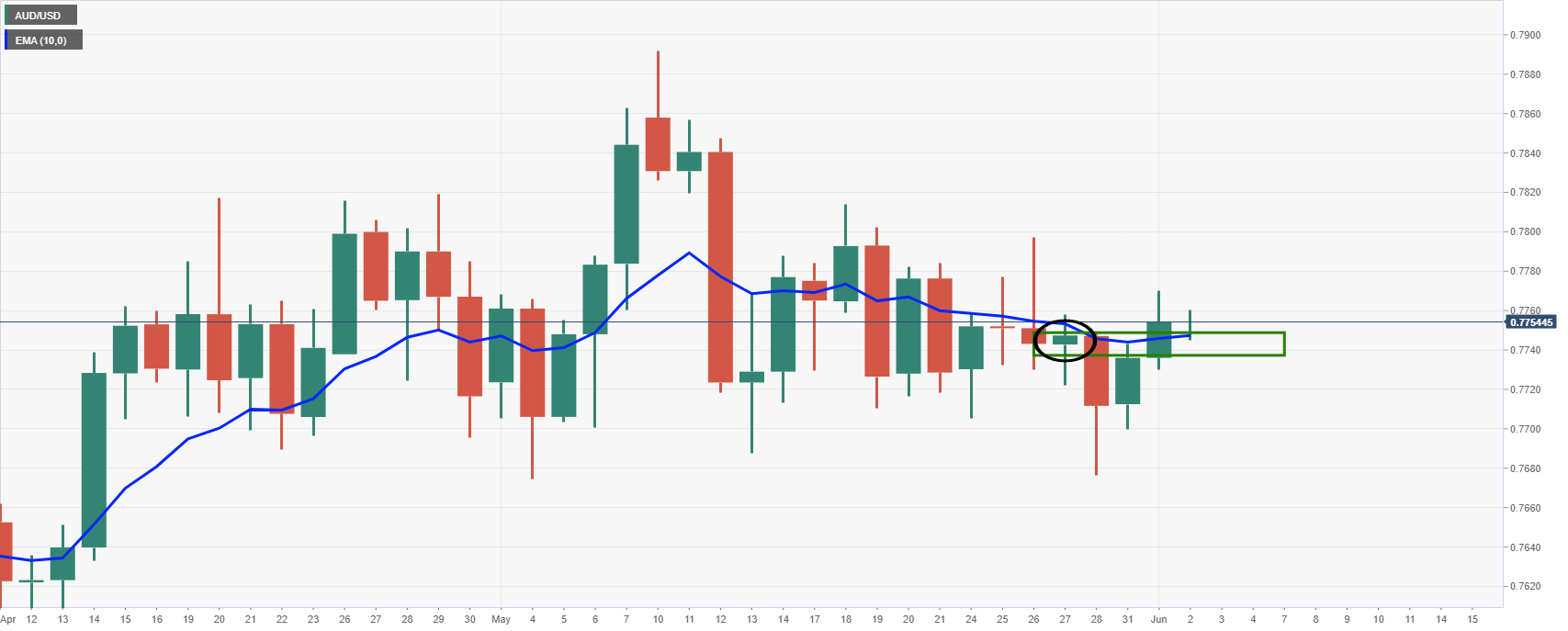

Meanwhile, yesterday’s RBA Board Meeting was uneventful and the Aussie remained above a key daily support structure and has done little since but hold in a tight range at the 10-day EMA.

Analysts at Westpac noted, however, that from within the RBA statement, there was the absence of the sentence: “The Bank is prepared to undertake further bond purchases to assist with progress towards full employment”.

The analysts said that this could be interpreted as a hawkish signal.