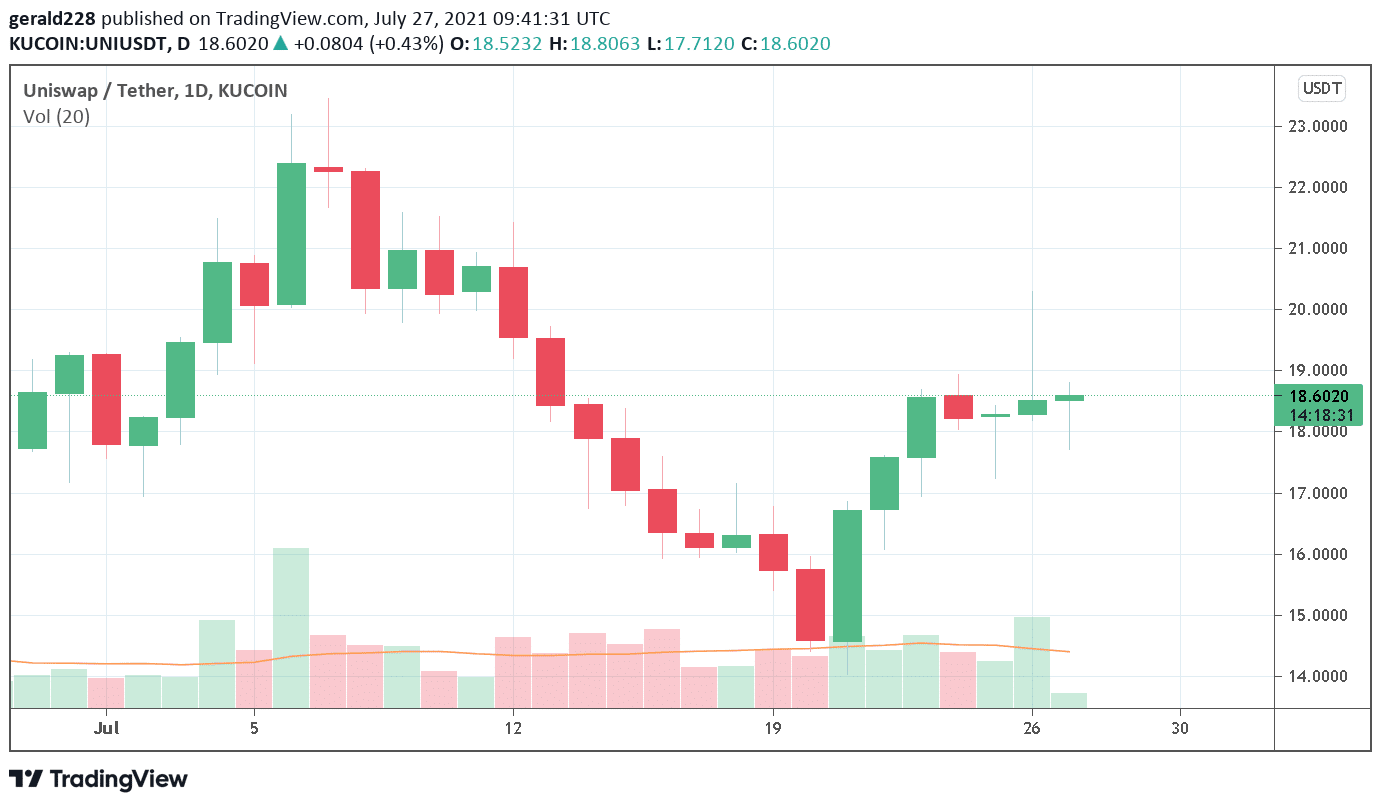

The Uniswap price has been on a consistent rise since sinking to the July 21 low of $14.59. The DeFi exchange’s coin price rose by at least 20% to the $19 level on July 26 but has since retraced slightly as bulls take a breather. There is bullish sentiment on the whole however with Uniswap expecting to continue accelerating.

Positive news on partnerships as well as a renewed interest in DeFi has continued to put Uniswap on the map. However, after reaching a high of $22 in early July, the Uniswap price has had a disappointing run as selling pressure continued to dominate the market. Bears pushed the price down considerably by around 30% from the July 6 high of $22 to the July 20 low of $14.70.

However, it seems that the recent jump in the Uniswap price has confirmed that bears are once again back in town. If you haven’t yet bought some Uniswap, take a look at this How To Buy Cryptocurrency Beginner’s Guide.

Short Term Forecast For Uniswap Price: A Beeline For $22

Although the Uniswap price has seen a slight retracement over the past 24 hours, the outlook is still bullish. At the current price of $18.50, UNI has gained around 20% from the July 21 low. The next move is expected to rise to the $20 level and it will then meet the next resistance level of $22. If that is broken, then the price could go all the way back up to $25.

It seems that the Uniswap price has once again found a bottom at the support of a rising trend line. Although there has been a rally of approximately 35%, it seems that the price has stalled for now. A bearish thesis would present a decline to the $14.50 level again where there seems to be strong support. This does look unlikely at this stage though.

If you are toying with the idea of buying some cryptocurrency then take a look at these Best Cryptocurrency Brokers.

Long Term Forecast For UNI: The $20 level Remains a Crucial Point

Although Uniswap seems to have retreated slightly over the past 24 hours, the DeFi exchange seems to be gearing up for a big move upwards. There remain important resistance levels however. The descending trend line from 26 May at $20.51 has been rejected several times.

The 50-day moving average at $20 shows that the trend line resistance is strong. The 50 DMA also remains below the 100- and 200-day averages indicating weak investor sentiment. Positive price action has not been accompanied by an increase in volume either.

If the Uniswap price manages to stay above the $20.50 level, then sentiment will turn bullish. Long term prices till end of year are seeing Uniswap at the $45 level yet again.

Looking to buy or trade Uniswap now? Invest at eToro!

Capital at risk