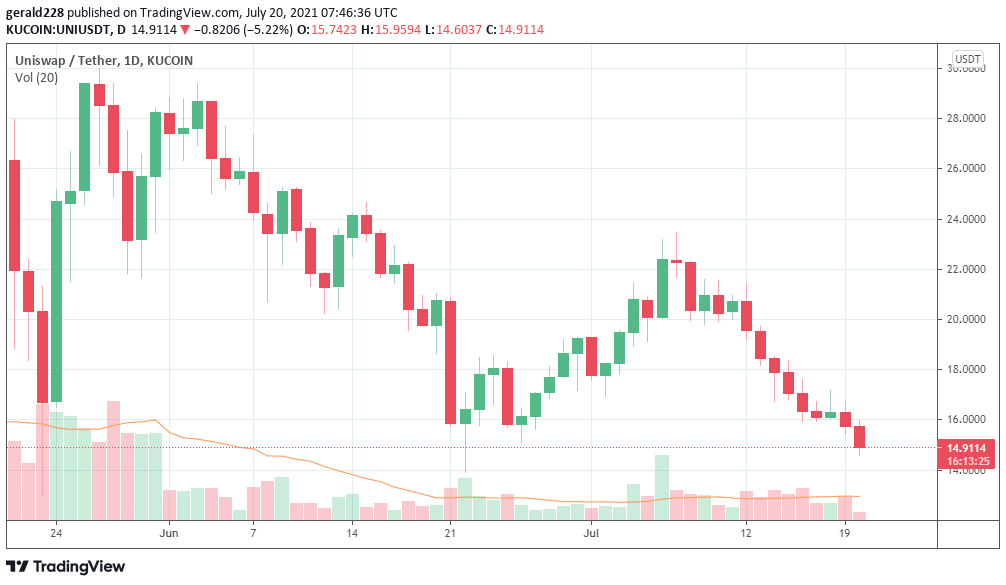

The much-vaunted DeFi exchange Uniswap, has seen a considerable decline of late. The Uniswap price has descended from highs of around $45 in early May to lows of around $15 recently. That is a 65% from its all-time high and a further drop of 30% from its July 6 high of $22.

There has been considerable positive news regarding Uniswap recently with a number of partnerships and agreements hitting the news. Unfortunately, these did not have much of an effect on the UNI price with a steep drop starting just after July 6 and showing no real signs of stopping soon.

If you haven’t yet bought Uniswap, the low price seems right so check out our How To Buy Cryptocurrency Beginners Guide.

Short Term Forecast For Uniswap Price: Still Bearish For Now

The Uniswap price has broken through the critical support of $15 and is expected to continue falling further. As already mentioned, the Uniswap price has fallen around 30% from its July 7 price which incidentally was also the 200-day Simple Moving Average (SMA).

The DeFi cryptocurrency is now sitting at the edge of a symmetrical triangle that harks back to the May 23 low. At present, it is difficult to predict what will happen on a short-term level but the Uniswap price could drop to $11 where there is the next level of support in a continuously bearish scenario.

It looks very likely that Uniswap has now careened off the bullish forecast that had been going on since the June 22 low and is in strong bearish territory. The next lows to be revisited should be the May 23rd and June 22nd levels before an uptrend commences.

If you are interested in getting your hands on some crypto, then it would be useful to check out these Best Cryptocurrency Brokers.

Long Term Prediction For UNI: New Lows To Be Retested

The Uniswap price has veered off the bullish forecast since the June 22 low and is in strong bearish territory. This is in stark contrast to the considerable interest in the DeFi space of which Uniswap is a prime mover with its exchange.

There seems to be a big move either way once the uncertainty in the market is resolved. If the bears continue to growl and selling pressure increase, we may see a 78% decline from the all time high to the $6.90 level.

This would take the Uniswap price to levels last seen in September 2020 which would be unlikely at this stage unless a complete crypto meltdown occurs.

At present, a more realistic drop would be to the $11 level which would be a 25% loss from current prices. If UNI closes below the $14.70 mark then it would likely retest the June 22 low of $13.90 and the May 23 low of $13. Bearish sentiment would continue pushing the price down to the $11 mark.

Looking to buy or trade [coin name here] now? Invest at eToro!

Capital at risk