- Uniswap price spikes over 20% to trade above $22, leading crypto assets in recovery.

- Investors shift attention to Defi tokens such as UNI and Compound.

Uniswap price has extended the action upward since the decline to $14 toward the end of June. However, the upswing has not been unique to UNI but impacted other decentralized finance (Defi) tokens in the market.

Compound price also spiked massively to trade slightly above $500. Moreover, Maker had broken out last week, accruing incredible gains. At the time of writing, Uniswap teeters at $22, following a majestic upswing from support at $14.

A break above $20 triggered many buy Uniswap orders as investors speculate gains to $30. A monthly high seems to have formed at $22.68, with Uniswap teetering around $22.20.

What is Behind Uniswap Price Rally?

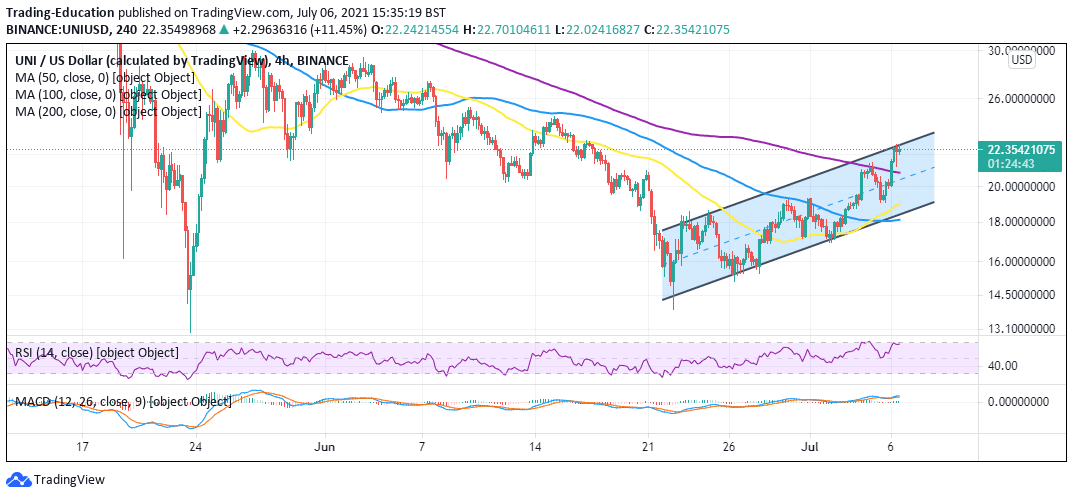

The four-hour chart brings to light a recently flashed bullish signal. Following the robust support at $14, the Moving Average Convergence Divergence (MACD) indicator lifted from the negative region.

In addition, the 12-day exponential moving average (EMA) crossed above the 26-day EMA, adding credence to the bullish outlook. If the technical picture remains intact, we are likely to see Uniswap gain ground toward $30.

Uniswap Four-Hour Chart Flashes More Buy Signals

The Relative Strength Index (RSI) has been on an upward move since Monday while closing the gap toward the overbought areas allowed bulls to tighten their grip on UNI. Besides, a break above 70 could trigger more buy orders as the tailwind on Uniswap intensifies.

It is essential to keep in mind that the ongoing uptrend maybe long-term based on the golden cross pattern appearing on the four-hour chart. As the 50 Simple Moving Average (SMA) crossed above the 100 SMA, a call to buy came into the picture. This technical pattern hints at the token making significant strides north before a barrier slows down the momentum.

Uniswap Price IOMAP validates the uptrend

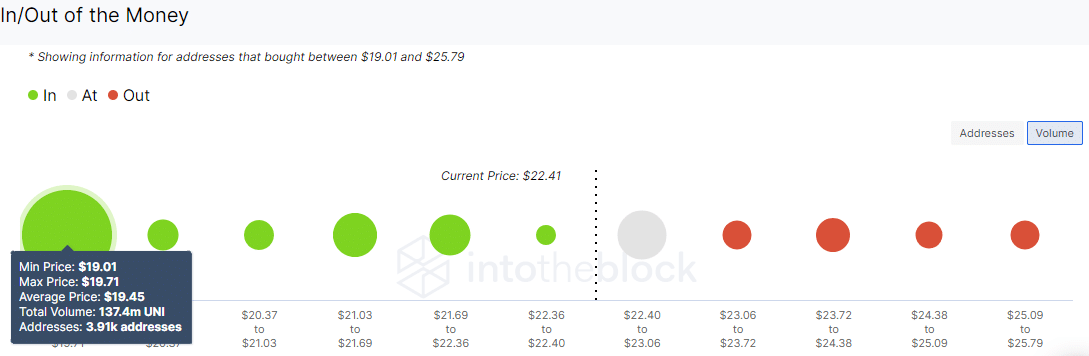

The In/Out of the Money Around Price (IOMAP) by IntoTheBlock adds credence to the bullish outlook by revealing robust support between $19 and $19.7. In this range, around 3,900 addresses previously bundled up 137 million UNI. As these addresses profit from the tokens, selling pressure is absorbed, allowing Uniswap to hit higher levels.

On the upside, the on-chain model shows that the recovery to $25 is relatively smooth. However, the region from $23.4 to $24.7 may absorb some of the buying pressure. Nonetheless, if bulls triumph, we expect the bullish leg to stretch toward $30.

Looking to buy or trade Ethereum now? Invest at eToro!

Capital at risk