- Uniswap, one of the leading DeFi applications in the industry, introduces new features in its latest version to be launched today.

- The leading decentralized exchange introduces two new concepts in v3, concentrated liquidity and multiple fee tiers.

- Liquidity providers will receive more options and achieve up to 4000x capital efficiency compared to v2.

Top decentralized exchange (DEX) Uniswap is coming out with new products and features for the multi-billion dollar decentralized finance (DeFi) industry. The Ethereum-based DEX will give users more control over liquidity with its version 3 launch today.

How Uniswap became the leading DEX

Leveraging blockchain technology, DeFi aims to remove intermediaries between parties in a financial transaction. Most DeFi services and apps are built on public blockchains like Ethereum, replacing traditional financial institutions like banks. Services in the industry include loans, earning interest, swapping tokens and derivatives.

While DEXs may solve many problems of their centralized counterparts, including arbitrary fees, the dangers of hacking, and mismanagement, many decentralized exchanges lack liquidity. Without counterparties, liquidity is needed to supply the market. Uniswap aims to solve the DEXs liquidity problem by removing the need for buyers and sellers to provide the liquidity.

As one of the most popular DEXs, Uniswap allows people to swap tokens that run on the Ethereum network. Unlike centralized exchanges, Uniswap is also an automated market maker (AMM), which relies on an algorithm to price assets instead of an order book. AMMs are a staple of the DeFi space, allowing trades to execute without having a counterparty on the other side to make a trade. Instead, the user would interact with a smart contract.

Uniswap uses the x * y = k pricing formula for assets, where x and y each represent the amount of one token in the liquidity pool, and k is a fixed constant. With this formula, the pool’s total liquidity always has to remain the same. The supply of tokens in the smart contract would be provided by liquidity providers (LPs).

Liquidity providers provide funds to liquidity pools, and in return, LPs earn fees from the trades that occur in their pool. Uniswap v2 charges traders 0.3%, which directly goes to LPs. With the way that AMMs function, more liquidity is needed to prevent slippage from large orders, attracting more volume on the platform.

Uniswap v1 was launched in late 2018 as a proof of concept for automated market makers, where users can pool assets into shared market-making strategies. In May 2020, Uniswap v2 was launched, introducing new features such as ERC20 to ERC20 pairs and price oracles. According to the leading DEX, the platform has facilitated over $135 billion in trading volume, ranking as one of the largest cryptocurrency spot exchanges worldwide.

Uniswap to provide more flexibility for liquidity providers

Taking the decentralized platform to the next level, Uniswap v3 is introducing two main features, including concentrated liquidity and multiple fee tiers. The DEX aims to become more flexible and efficient by giving LPs granular control over what price ranges their capital is allocated to. Depending on the degree of risks users are willing to take, Uniswap will adjust the compensation for LPs.

While LPs only earn fees on a small portion of their capital, they may not be fully compensated for the impermanent loss they take by holding capital in both tokens. To solve this issue, the new version of Uniswap will allow LPs to customize the price ranges of their assets instead of distributing them evenly in v2.

Each provider can create its own price curve, which generates concentrated liquidity compared to the formula used in the previous version, with assets reserved for all prices between 0 and infinity. Users can trade against the combined liquidity of the price curves provided by LPs. Trading fees will then be split proportionally between token liquidity providers to contribute to the price range.

Stepping into V3, LPs can provide the same liquidity depth as v2 within specified price ranges with the concentration of their liquidity while reducing risks. Uniswap would enable 100% of assets deposited to be used for yield farming.

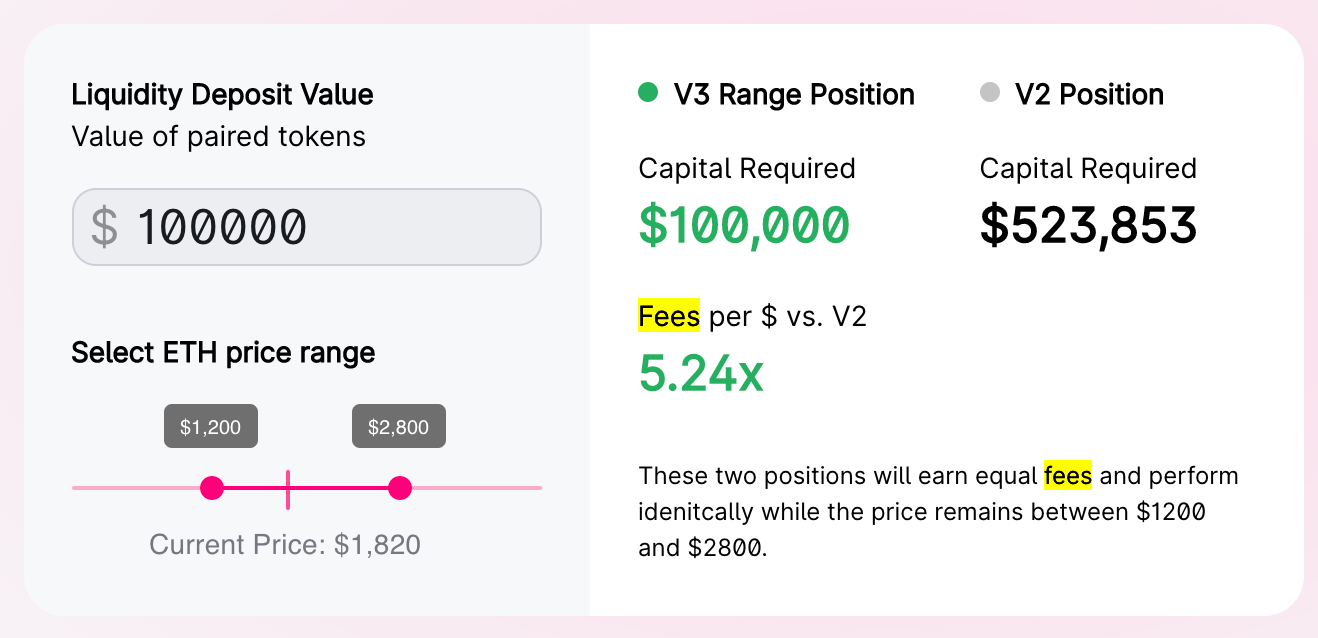

Uniswap claims that the maximum capital efficiency could reach 4000x in a 0.10% price range. The DEX also provided a tool to calculate the capital efficiency gains of a concentrated liquidity position for v3.

Uniswap capital efficiency gains

With high Ethereum transaction costs, Uniswap aims to lower the gas cost of v3 swaps, along with “easier and cheaper” oracles. Competition continues to grow in the DeFi space, as Binance Smart Chain-based PancakeSwap has cut into Uniswap’s market share, given the lower transaction costs.

The leading DEX will continue to introduce new features, with an L2 deployment on Optimism set to follow shortly after.