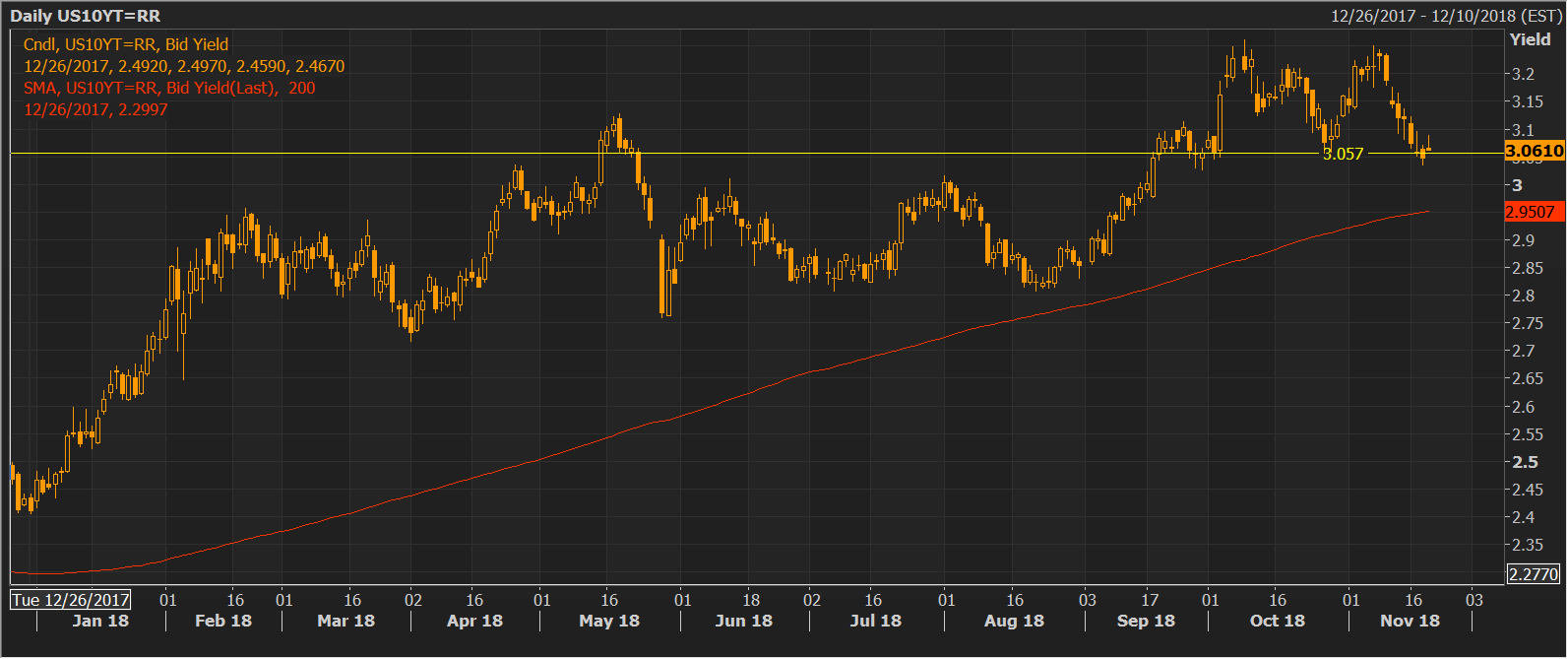

- The US 10-year closed just below 3.057 percent, confirming a double top bearish reversal pattern.

- As of writing, the yield is seen at 3.06 percent, meaning it has moved back above the neckline. That is hardly surprising as most markets tend to crowd out the weak hands before capitalizing on the major bearish or bullish pattern.

- All-in-all, the path of least resistance is now on the downside. The immediate support is seen at 2.95 percent, which is the 200-day simple moving average (SMA) line. The long-term average, if breached, would open the doors to 2.86 percent (double top breakdown target as per the measured height method).

- It is worth noting that the double top breakdown on the Treasury yield could be considered an indication that markets are pricing in fewer Fed rate hikes in 2019.

Daily chart

Trend: bearish