- US 10-year Treasury yield has plunged dramatically from 1.776 (high placed on March 28) to 1.2520.

- Benchmark 10-year Treasury Yield rose and reached 4.63% on Friday.

- What’s tumbling US 10-year treasury yield & boosting global stocks? – Find out below.

Lately, global investors have sought shelter in safe-haven assets such as gold and bond funds amid coronavirus concerns. The fast-spreading Delta variant of COVID-19 dampened optimism for speedier recovery from the pandemic. In fact, some economic figures are already exhibiting signs of a slowdown. This week, the US 10-year treasury yield tumbled to 1.252 amid covid fears.

US 10-year Treasury yield Vs. Global Stocks – Positive Correlation

Typically, the US 10-year Treasury yield (bond yield) has a positive correlation with global stocks. US 10-year Treasury yield plunges when investors start investing in US bonds. The increased demand for US bonds triggers a premium on its price while lowering the yields.

Investors prefer to buy US bonds during high-interest rate periods, as it offers higher risk-free returns on their investments. The increased demand for US bonds starts diminishing the treasury yield.

At the same time, the increased cost of equity makes stock market investment less attractive. Thus, the US 10-year Treasury yield shares a positive correlation with the investment in global stocks.

Thomson Reuters Lipper Reports Inflows of $36.68 Billion.

The US 10-year Treasury yield has plunged dramatically from 1.776 (high placed on March 28) to 1.2520 today. The corona fear boosts safe-haven demand, and investors are shifting their investments to the US bond markets.

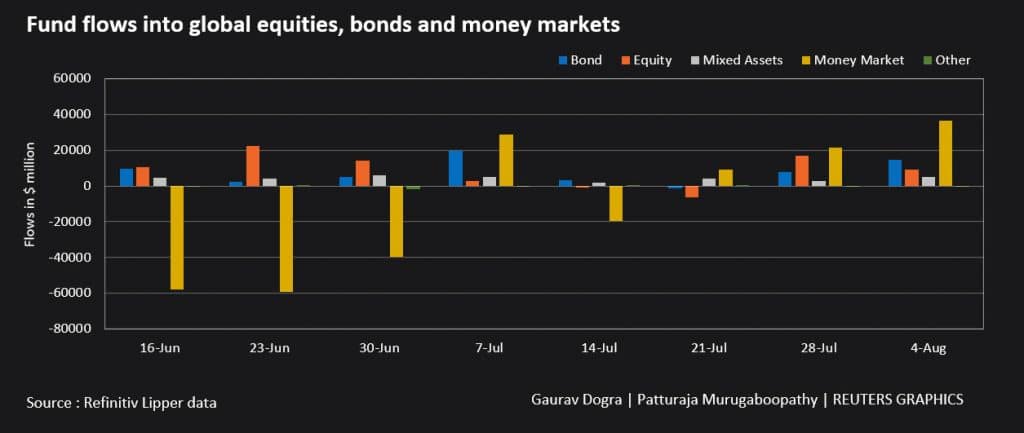

The figures from Thomson Reuters Lipper recorded that global money market funds brought inflows of $36.68 billion, the most in 10 weeks. Moreover, the global bond funds collected $14.6 billion in the week; it’s twice the inflows in the preceding week. Therefore, the US Treasury Yields on a 10-year kept trading on a bearish mode.

However, there’s been a slight bullish correction in Bond yields lately. After declining for 4-consecutive sessions, the benchmark US Treasury Yields on a 10-year note turned green on Thursday. It moved higher as the risk sentiment in the market improved as the jobless claims from the previous week remained flat.

On Thursday, the US Labor Department showed that initial claims for unemployment benefits dropped last week. At the same time, the layoffs declined to their lowest level in 21 years in July as companies were more towards holding workers amid a labor shortage.

After the report was released about the unemployment claim that suggested an expected decline to 385K during last week, the stock indexes rose, and bond yields moved along with them. While the 2-year Treasury yield that follows the interest rates expectations moved up with 2-basis points and reached 0.202%.

US Job Data Comes out Better than Expected

The US job data is a crucial indicator for the US Federal Reserve officials to decide about tapering the bond-buying program to $120 billion per month. This asset purchase program has been supporting the financial markets throughout the coronavirus pandemic, and with the higher prices and inflation above the target level, investors are betting that Fed will soon start reducing the support to the economy.

The latest US job data is also out…

According to the Bureau of Labor Statistics, the US economy added 943K new jobs in July, compared to analysts’ forecast of 850K jobs. The unemployment rate slipped by 0.5 percentage points to 5.4%, leaving the optimistic view of the US economy.

The benchmark 10-year Treasury Yield rose and reached 4.63% on Friday as investors are hopeful following better-than-expected US job data. On the other hand, the central bank of the United States has set a goal of full employment and inflation above 2% to start tapering. For starting tapering asset purchases later this year, Fed might want to see the employers adding jobs about 500,000 to 10,000,000 a month.

Global Stocks Rally amid Dovish Fed Remarks

On the flip side, the dovish Fed has triggered the risk-on market sentiment. Since there’s no update on tapering and the interested rate is still near zero, the cost of borrowing will be minimal. Thus, the chances of increased EPS (earning per share) on the global stock attract more investments.

Global stocks are trading with a solid bullish trend amid dovish remarks from the US Fed officials. The S&P 500 ended the day at record levels the day before, following a series of strong corporate earnings.

Investors were watching for another shot of confidence from US July employment figures scheduled 1230 GMT. The US job data was expected to show sturdy gains, albeit due to seasonal technical factors and underlying growth. That’s exactly how the labor market data has responded.

The US economy added 943K new jobs in July, compared to analysts’ forecast of 850K jobs. The unemployment rate fell by 0.5 percentage points to 5.4%. The decline in US unemployment claims on Thursday and optimistic US job data (NFP & Unemployment) on Friday will likely trigger another round of buying in global stocks.

What’s Tumbling US 10-year Treasury Yield & Boosting Global Stocks?

If you have made so far in this article, you must know we are experiencing an unconventional scenario here. US 10-year treasury yields are tumbling due to boosted safe-haven appeal. Despite more robust US economic data, the Fed isn’t tapering its QE program amid covid fears. Thus, the low cost of capital and increased financing by the Fed is keeping global stocks bullish. At the same time, investors are still finding the bond market attractive because of its safe-haven appeal.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.