- The US 10-year yield fell to one-week low despite easing US-China tensions.

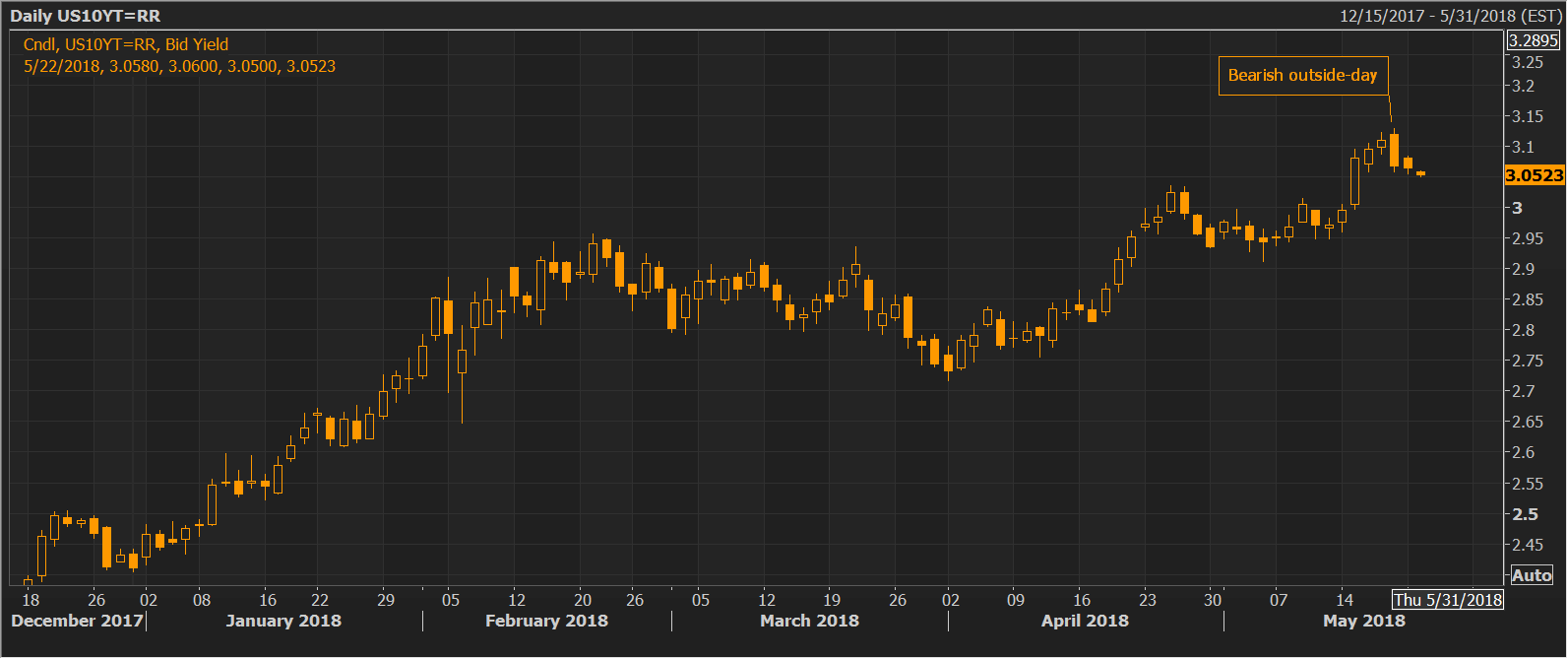

- Short-term top in place, the Friday’s bearish outside-day candle indicates.

The yield on the benchmark 10-year treasury note fell to 3.05 percent in Asia – the lowest level since May 15 and down 7.8 basis points from the recent 7-year high of 3.128 percent.

The US and China decided not to impose punitive tariffs and thus put a bid under the risky assets. The Dow Jones Industrial Average (DJIA) rallied almost 300 points yesterday. However, the risk-on action has not had a positive impact on the yields. Treasury prices usually dip and yields rally during risk-on and vice versa.

The drop in the yield amid risk-on action only adds credence to the bearish outside-day candle seen in the 10-year yield’s daily chart and indicates scope for a deeper pullback, possibly below the 3 percent mark.