Idea of the Day

All eyes and ears were on the Fed Chair nominee Yellen yesterday as she appeared in front of the Senate Banking Committee. The interesting thing was the dis-connect between the stocks markets and the dollar. The S&P500 was up nearly 0.5% on the day and at another high for the year as markets were left with the perception that tapering next month was very unlikely. Meanwhile, the dollar was weaker, but only marginally so as the inverse relationship between the dollar and stocks remains weak. However, if the data falls to the soft side, then there is scope for the dollar to catch up and weaken.

Data/Event Risks

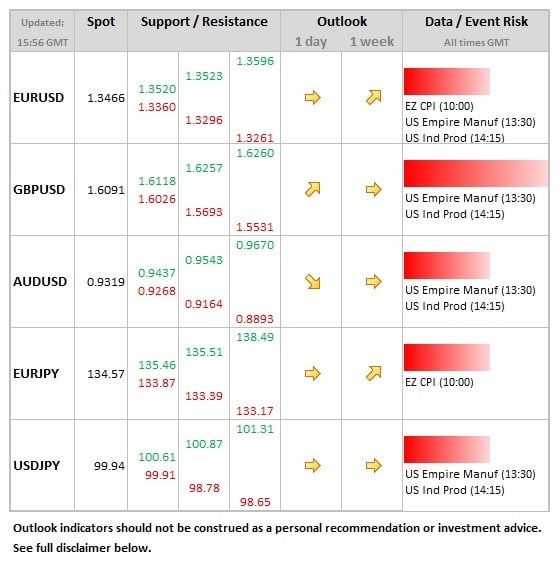

USD: Just industrial production data released today which is a relatively low risk release for the dollar. The market looks for a 0.2% increase after the 0.6% gain seen in September.

EUR: It was the early estimate of October inflation that instigated the easing expectations from the ECB, which were duly delivered upon last week. The market will be sensitive to any revisions from that initial 0.7% reading.

Latest FX News

GBP: The weaker than expected retail sales data send cable back below the 1.60 level, but the weaker dollar seen later on allowed for a push back towards 1.61. A sustained break higher still remains elusive for the time being.

AUD: There was a heavy feel to the Aussie through most of the Thursday, as the dollar weakness took hold there was a squeeze higher towards the end of the European day, back towards the 0.9350 level.

JPY: USDJPY moving back above the 100 level in overnight trade on the back of the better tone to stocks. The is the first move above this level for 2 months and the yen has been the weakest performer on the majors over the past two weeks.

Further reading: